- United States

- /

- Chemicals

- /

- NYSE:ECL

A Look at Ecolab’s (ECL) Valuation Following Its Data Center Cooling as a Service Launch

Reviewed by Simply Wall St

Ecolab (ECL) has just rolled out its fully integrated Cooling as a Service program. The initiative aims to address the rising demand for energy-efficient cooling across the AI-powered data center sector. This move highlights the company’s drive to capture growth in a fast-evolving market.

See our latest analysis for Ecolab.

Ecolab’s launch of its cutting-edge Cooling as a Service program comes amid a solid year for the stock, with a year-to-date share price return of 13.3%. The company’s recent showcase at the Baird Global Industrial Conference and the rollout of new AI-powered cooling solutions have sharpened investor focus on Ecolab’s long-term growth story. Total shareholder returns have been impressive over longer periods, with an 8.6% one-year return and a standout 80.3% over three years. This signals steady momentum for both growth and innovation in a changing market.

If innovations like Ecolab’s data center initiatives have you looking for what's next, this is a great moment to discover fast growing stocks with high insider ownership

The question now is whether Ecolab’s gains reflect its real value or if market enthusiasm for AI infrastructure means all this future growth is already priced in. Is there still a buying opportunity here?

Most Popular Narrative: 10% Undervalued

With Ecolab’s last close price of $261.74 sitting nearly 10% below the narrative's fair value estimate of $291.75, the numbers suggest the market might be discounting the company’s margin expansion story. This sets the stage for why many see untapped upside in Ecolab’s future trajectory.

Investments in digital technologies have led to improved productivity, resulting in a 190-basis-point increase in operating income margin. Continued investment in these technologies is anticipated to enhance earnings and operating margins further.

Want to know the growth blueprint behind this high valuation? The main driver is an ambitious margin leap, powered by digital upgrades and a science-led operating strategy. The analysts’ math points to a future where profit multiples rival high-growth industries. Curious about which bold projections underpin this price target? Dive deeper to reveal the calculations behind this call.

Result: Fair Value of $291.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer demand in key industries and the challenge of passing on trade surcharges remain potential hurdles that could disrupt Ecolab’s bullish outlook.

Find out about the key risks to this Ecolab narrative.

Another View: Is Ecolab Priced Too High?

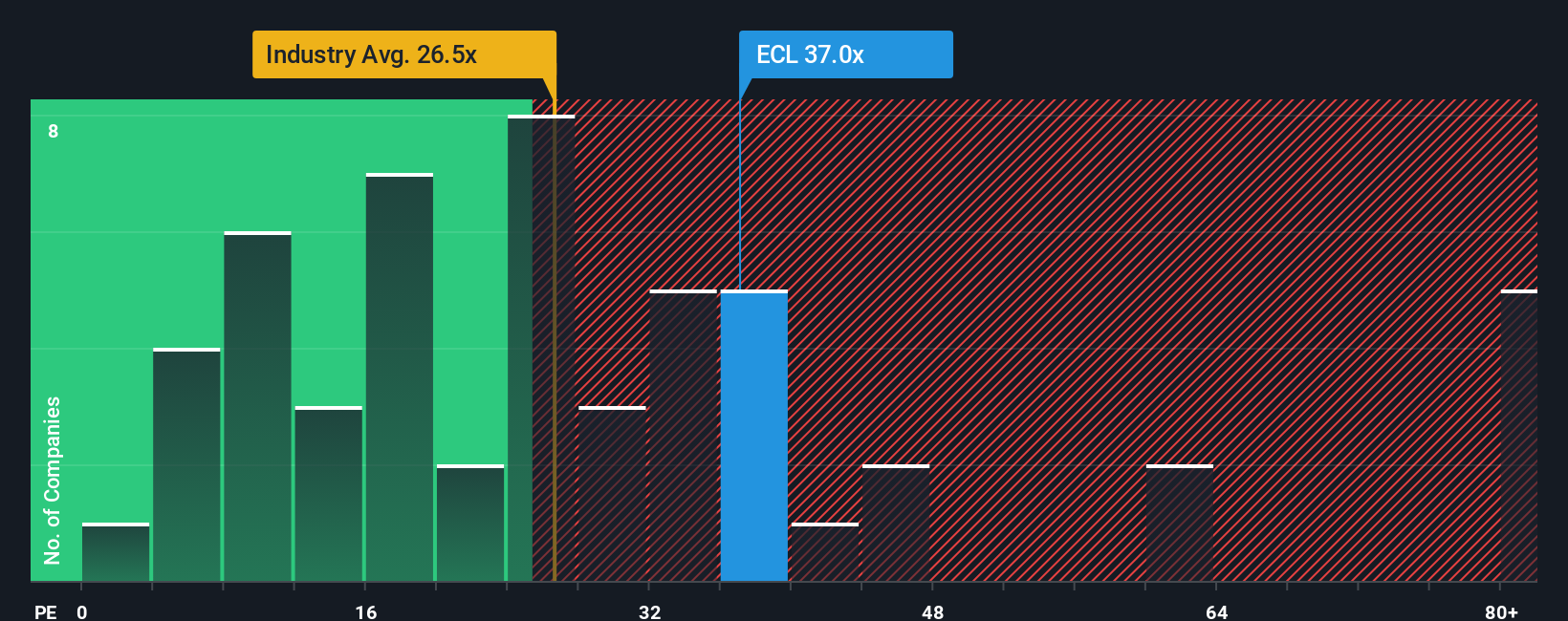

While growth narratives and fair value estimates look compelling, a glance at Ecolab’s market valuation raises a flag. The company trades at a price-to-earnings ratio of 37.4x, significantly higher than both its industry average (21.9x) and the peer average (22.2x). Even compared to its fair ratio of 25.1x, the current premium suggests investors are paying up for future gains that may already be priced in. This could leave less room for upside if profit targets fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

If you see the story differently or would rather run the numbers your way, you can build your own view in just a few minutes. Do it your way

A great starting point for your Ecolab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let lucrative opportunities pass you by. Expand your watchlist with market picks you might have overlooked and get ahead of shifting investment trends.

- Unlock potential high-yield returns when you scan these 3592 penny stocks with strong financials with solid fundamentals in overlooked market segments.

- Tap into the future of healthcare innovation through these 30 healthcare AI stocks that are redefining disease detection, patient care, and medical technology.

- Amplify your cash flow with these 16 dividend stocks with yields > 3% featuring companies delivering reliable income through above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives