- United States

- /

- Metals and Mining

- /

- NYSE:DRD

We Take A Look At Whether DRDGOLD Limited's (NYSE:DRD) CEO May Be Underpaid

The impressive results at DRDGOLD Limited (NYSE:DRD) recently will be great news for shareholders. At the upcoming AGM on 29 November 2022, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

Check out our latest analysis for DRDGOLD

How Does Total Compensation For Niel Pretorius Compare With Other Companies In The Industry?

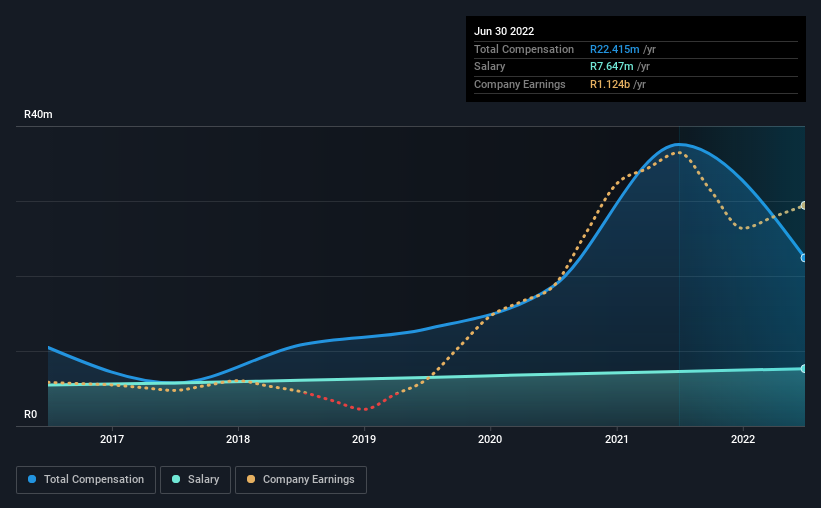

Our data indicates that DRDGOLD Limited has a market capitalization of US$536m, and total annual CEO compensation was reported as R22m for the year to June 2022. Notably, that's a decrease of 40% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at R7.6m.

For comparison, other companies in the same industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of R43m. In other words, DRDGOLD pays its CEO lower than the industry median. What's more, Niel Pretorius holds US$503k worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | R7.6m | R7.3m | 34% |

| Other | R15m | R30m | 66% |

| Total Compensation | R22m | R38m | 100% |

Talking in terms of the industry, salary represented approximately 21% of total compensation out of all the companies we analyzed, while other remuneration made up 79% of the pie. It's interesting to note that DRDGOLD pays out a greater portion of remuneration through salary, compared to the industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at DRDGOLD Limited's Growth Numbers

Over the past three years, DRDGOLD Limited has seen its earnings per share (EPS) grow by 123% per year. Its revenue is down 2.9% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has DRDGOLD Limited Been A Good Investment?

Most shareholders would probably be pleased with DRDGOLD Limited for providing a total return of 78% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for DRDGOLD you should be aware of, and 1 of them is a bit unpleasant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success