- United States

- /

- Metals and Mining

- /

- NYSE:DRD

Can DRDGOLD's Leadership Transition Reinforce Its Longstanding Commitment to Dividends and Growth Ambitions (DRD)?

Reviewed by Sasha Jovanovic

- DRDGOLD recently announced a leadership transition, with Ms. Henriette Hooijer set to succeed Mr. Riaan Davel as Chief Financial Officer in February 2026, alongside updates on board composition and committee roles.

- The company’s reaffirmed goal to reach 200,000 ounces of annual gold production from tailings by 2029, while maintaining an 18-year dividend streak and prioritizing debt-free growth, signals a commitment to operational expansion and financial discipline.

- We’ll explore how DRDGOLD’s production milestone ambitions and sustained dividend track record shape its investment narrative going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is DRDGOLD's Investment Narrative?

Being a DRDGOLD shareholder means believing in the company’s ability to sustainably lift gold production from South African tailings, hit ambitious targets, and maintain financial discipline even during transitions. The recent CFO succession and upcoming board changes appear well-planned, thanks to long tenures and internal promotions, so I don’t see material impact on short-term catalysts like production or earnings momentum. However, any leadership handover does bring an element of execution risk, particularly with DRDGOLD’s 200,000 ounce annual production goal by 2029 still ahead. Risks right now center on operational delivery and maintaining its 18-year dividend streak, especially after a small drop in production and yield last year. That said, DRDGOLD’s earnings, strong returns, and share price performance all signal that financial and operational discipline are still at the core, even as new hands take the wheel.

But as we consider these strengths, supply reliability remains a risk you shouldn’t overlook.

Exploring Other Perspectives

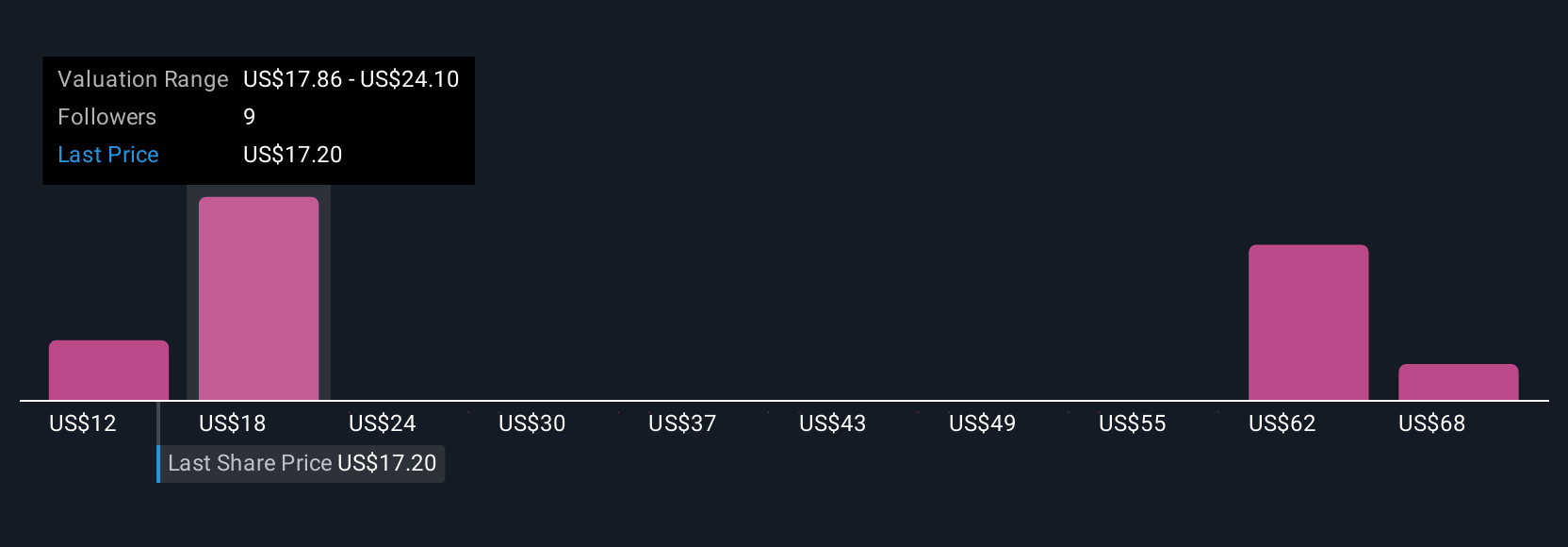

Explore 7 other fair value estimates on DRDGOLD - why the stock might be worth less than half the current price!

Build Your Own DRDGOLD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DRDGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DRDGOLD's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives