- United States

- /

- Chemicals

- /

- NYSE:DOW

Should Investors Reassess Dow After 49% Drop and Dividend Concerns?

Reviewed by Bailey Pemberton

- Ever wondered if Dow is a bargain or just looks cheap? Let's dig into what's really behind the numbers.

- The stock has been anything but quiet lately, down 11.0% in the past week and 49.3% over the last year, with broader market shifts playing a big role.

- Recent headlines around the global materials sector, including demand fluctuations and sustainability initiatives, have weighed heavily on Dow's share price. Ongoing industry shifts and higher input costs are also adding extra pressure on the company's valuation.

- Dow earns a 3 out of 6 valuation score based on our standard checks, but traditional approaches only reveal part of the story. Stick around for a deeper look at valuation methods and a new way to see real value.

Find out why Dow's -49.3% return over the last year is lagging behind its peers.

Approach 1: Dow Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company’s value by projecting its future dividend payments and discounting them back to today’s money. This model is especially relevant for companies that pay reliable dividends, such as Dow.

For Dow, the DDM assumes an annual dividend per share (DPS) of $1.63 and a return on equity (ROE) of 6.41%. Notably, Dow’s payout ratio is extremely high at 151.19%, which means it is paying out more in dividends than it earns in profits. Based on this, the expected dividend growth rate is actually slightly negative, calculated as -3.3%. This suggests dividends may not be sustainable over the long term if current trends persist.

According to the DDM, Dow’s intrinsic value per share is estimated at $14.88. When we compare this to the current market price, the model indicates Dow is trading at a 51.8% premium over its fair value. In other words, it appears significantly overvalued through the lens of dividend sustainability and growth.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Dow may be overvalued by 51.8%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Dow Price vs Sales

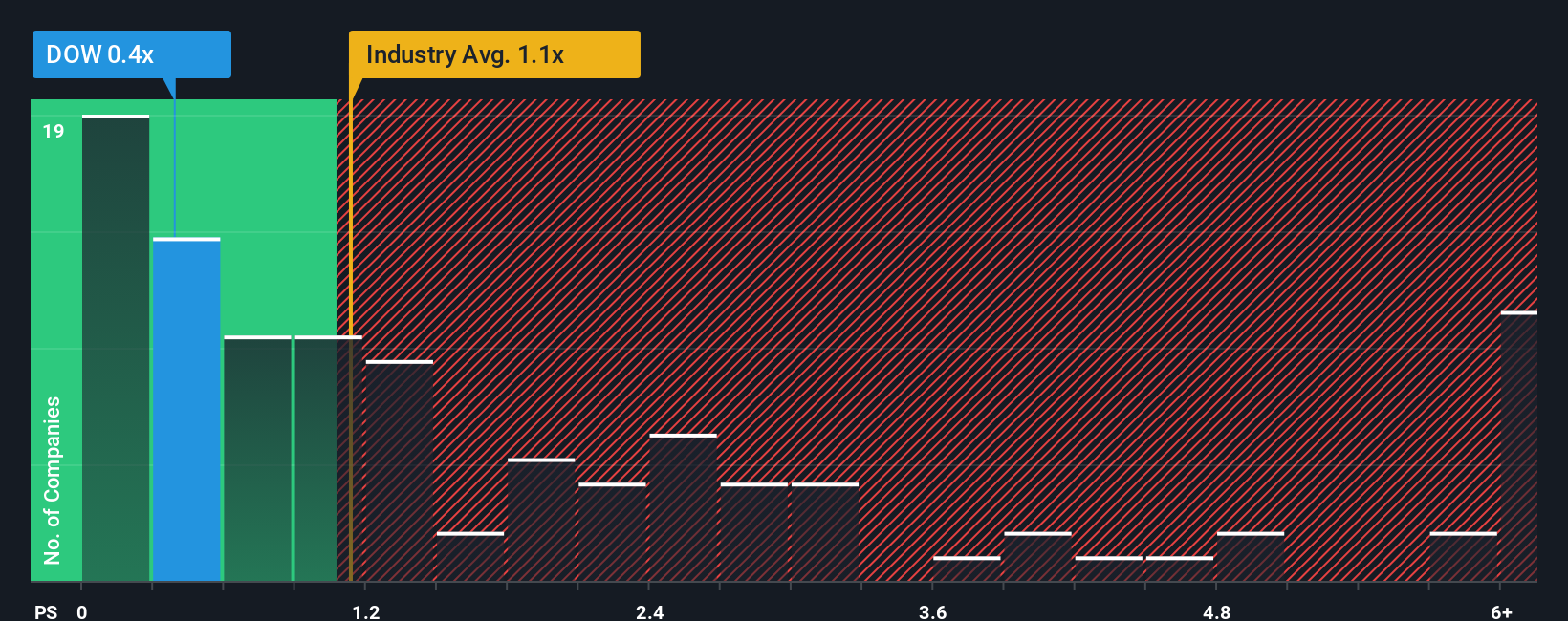

The Price-to-Sales (P/S) ratio is often the go-to valuation metric for companies where profits fluctuate or losses are present but sales remain steady. Since Dow’s recent earnings have turned negative, the P/S multiple offers a clearer view of how the market values its core business activity: revenue generation, relative to its peers and the broader industry. It’s a useful lens when earnings-based measures like PE aren’t as meaningful.

Generally, higher growth expectations and lower risk justify a higher P/S ratio. In sectors with modest growth or higher uncertainty, investors tend to pay less for each dollar of sales. For Dow, the current P/S sits at 0.39x. This is below both the Chemicals industry average of 1.14x and the peer average of 0.58x, suggesting traders have priced in expectations of slower growth or higher risk for Dow compared to competitors.

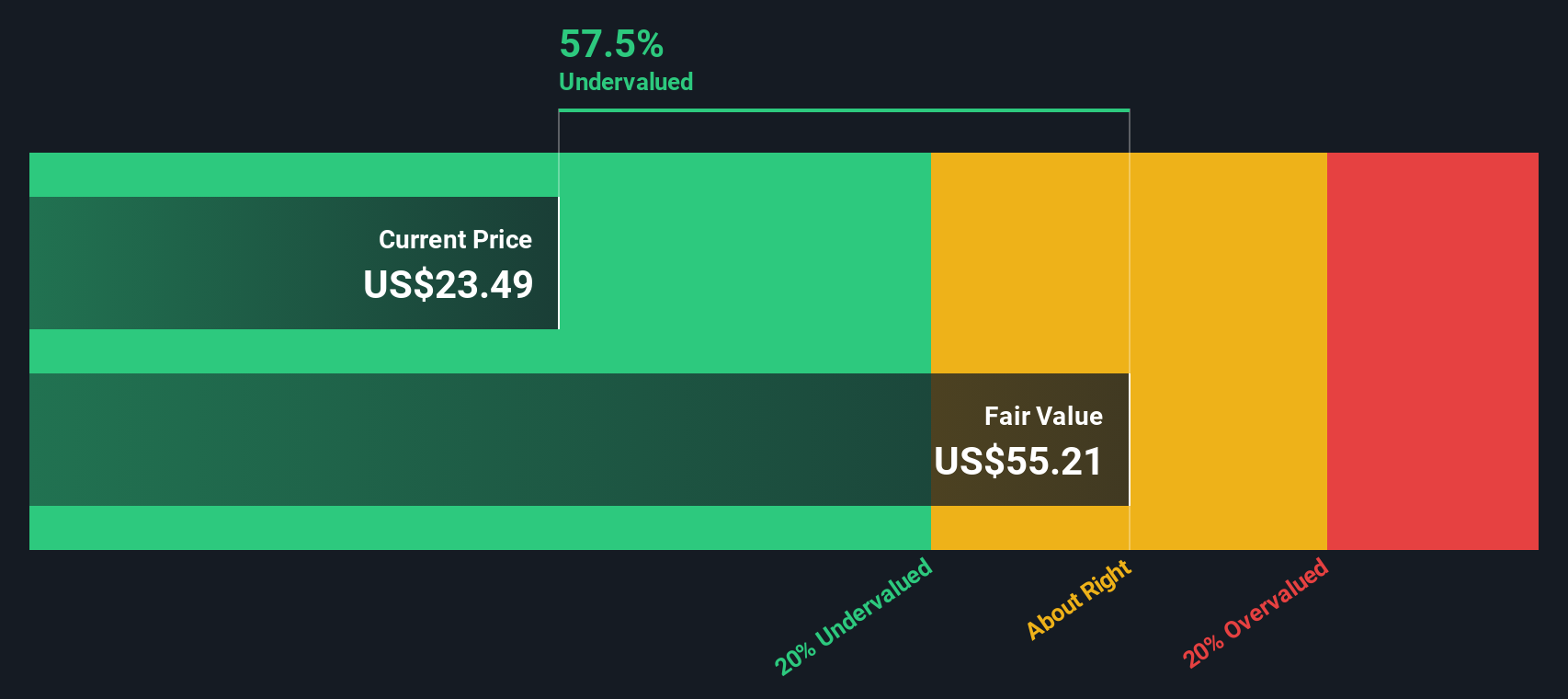

To give better context than a straight peer or industry comparison, Simply Wall St’s proprietary Fair Ratio steps in. This tailored benchmark weighs up factors like Dow’s projected growth, risks, profit margins, industry landscape and size, producing a “fair” P/S multiple specific to the company. For Dow, the Fair Ratio is 0.81x, noticeably higher than its current ratio.

Because Dow’s actual P/S multiple of 0.39x is well below its Fair Ratio, the data points to the stock being undervalued by this measure. Market sentiment looks especially cautious compared to what the fundamentals suggest Dow should be worth.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dow Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

Narratives blend your view of a company's story, including its industry position, management decisions, and future direction, with your fair value estimate, revenue forecasts, and margin assumptions. Rather than relying solely on static numbers, Narratives let you map your personal perspective on what matters most, linking the company’s journey directly to financial predictions and a specific valuation.

Available on Simply Wall St’s Community page, millions of investors use Narratives to simplify their investing process. With Narratives, you can compare your calculated Fair Value with the current Price in an intuitive way and see when the story changes based on the latest news, earnings, or industry developments.

For example, with Dow, some investors might see the potential for a rebound and assign a fair value as high as $45.00, while others may focus on macro uncertainty and set their value closer to $20.00. Narratives make these viewpoints visible and trackable as new facts emerge.

Do you think there's more to the story for Dow? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives