- United States

- /

- Chemicals

- /

- NYSE:DOW

A Look at Dow’s Valuation Following Expanded AI Partnership With Kyndryl

Reviewed by Simply Wall St

Dow (NYSE:DOW) just expanded its long-running partnership with Kyndryl, focusing on integrating AI and automation into its technology infrastructure. This move continues Dow's digital transformation journey. The company aims to strengthen operational efficiency and drive innovation.

See our latest analysis for Dow.

Despite Dow’s push to modernize through AI partnerships and digital transformation, its 1-year total shareholder return sits at -49.7%. Momentum continues to fade, with the share price now at $20.95. Recent sharp declines suggest investor sentiment remains cautious, despite operational initiatives.

If you’re tracking how innovation can impact performance, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Dow's shares trading well below analyst targets and future growth initiatives underway, investors are left to wonder: is this current weakness a buying opportunity, or has the market already accounted for any rebound?

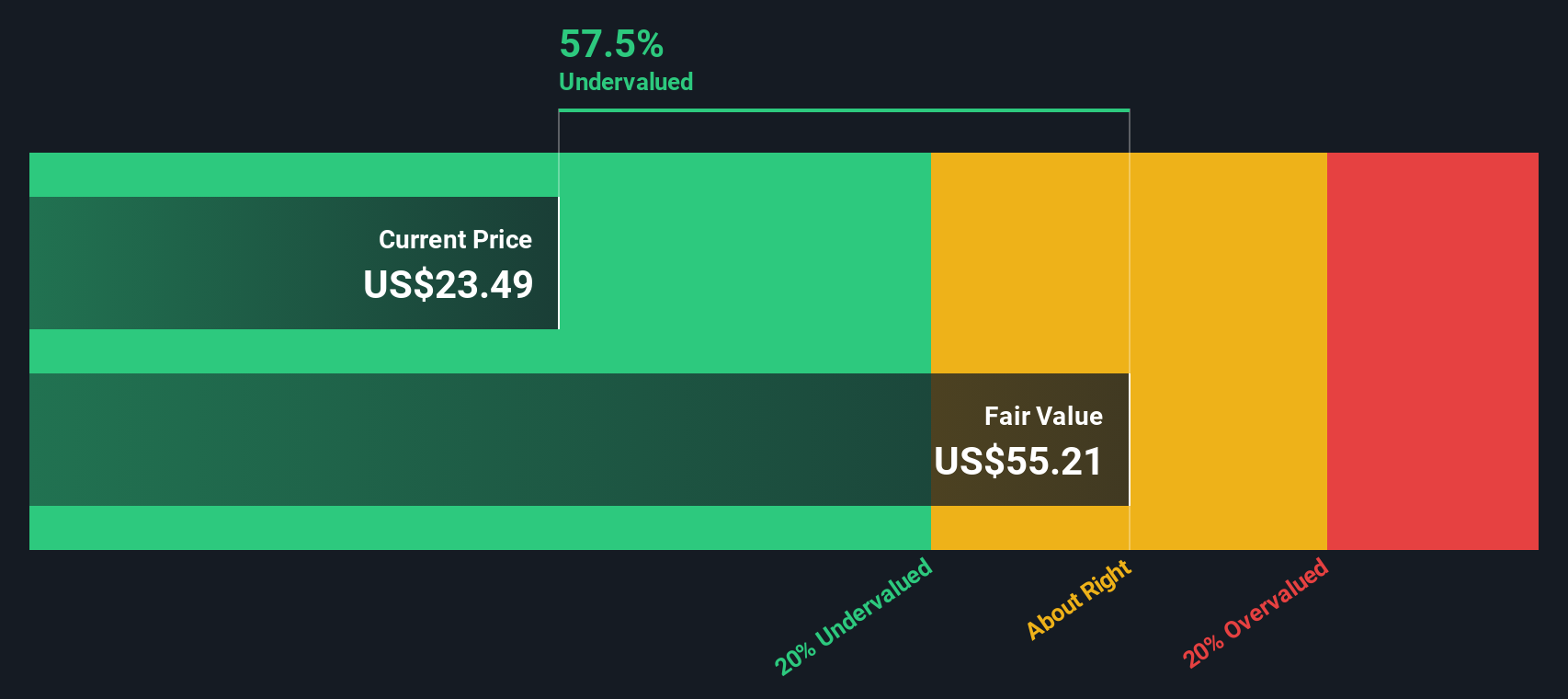

Most Popular Narrative: 24.7% Undervalued

The prevailing narrative values Dow at $27.82, nearly $7 above the last close. This gap highlights expectations for a significant rebound, grounded in the company's cost-cutting and asset optimization strategies.

Adjusted capital spending and asset optimization strategies aim to enhance cash flow, improve margins, and focus on high-margin operations.

What’s fueling such bullish sentiment? The narrative is built around bold improvements to profits, margins, and cash flows. The framework depends on a turnaround, but what numbers make it so compelling? Uncover the exact projections that shape this price target.

Result: Fair Value of $27.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressures from elevated costs and persistent global demand uncertainty could easily disrupt these optimistic expectations, potentially delaying any meaningful rebound.

Find out about the key risks to this Dow narrative.

Another View: Discounted Cash Flow Perspective

Taking a second look through the SWS DCF model lens tells a very different story. On this basis, Dow's estimated fair value comes out to $13.87, which is well below the current share price of $20.95. While analysts see upside, our DCF approach suggests the market may be overestimating recovery potential. Which outlook will prove more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dow Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own perspective on Dow in just minutes, and Do it your way

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your horizon and get ahead of the market by checking out stocks with standout potential in different themes and emerging sectors on Simply Wall St.

- Boost your search for superior yield by tracking income plays among these 16 dividend stocks with yields > 3% with robust payouts. These can strengthen your portfolio’s earning power.

- Spot tomorrow’s tech leaders by uncovering innovation-driven companies through these 26 AI penny stocks as they transform the world with practical artificial intelligence advancements.

- Seize timely opportunities by finding quality businesses undervalued by the market. Use these 919 undervalued stocks based on cash flows to identify those trading below their intrinsic cash flow worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives