- United States

- /

- Life Sciences

- /

- NYSE:DNA

Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

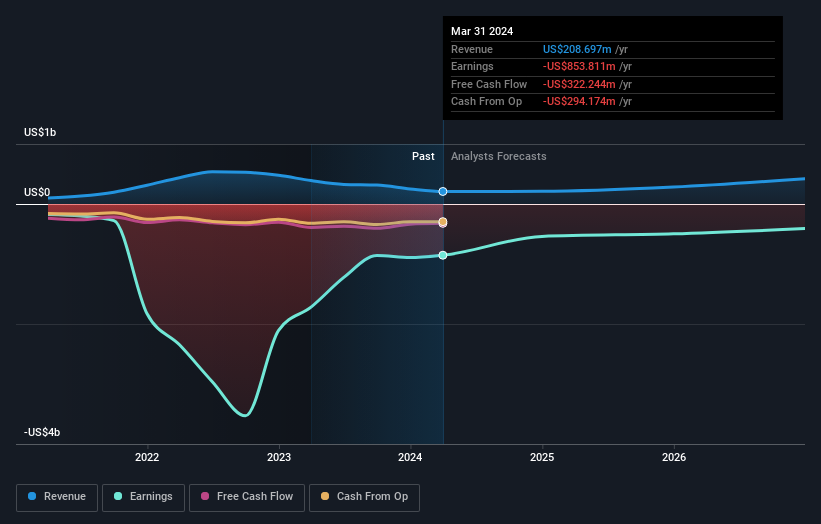

There's been a major selloff in Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) shares in the week since it released its first-quarter report, with the stock down 20% to US$0.76. It wasn't the greatest result, with ongoing losses and revenues of US$38m falling short of analyst predictions. The losses were a relative bright spot though, with a per-share statutory loss of US$0.08 being moderately smaller than the analysts forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Ginkgo Bioworks Holdings after the latest results.

See our latest analysis for Ginkgo Bioworks Holdings

Taking into account the latest results, Ginkgo Bioworks Holdings' seven analysts currently expect revenues in 2024 to be US$210.5m, approximately in line with the last 12 months. Losses are expected to be contained, narrowing 19% from last year to US$0.32. Before this earnings announcement, the analysts had been modelling revenues of US$223.2m and losses of US$0.32 per share in 2024.

The consensus price target was broadly unchanged at US$1.88, implying that the business is performing roughly in line with expectations, despite a downwards adjustment to forecast revenue next year. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Ginkgo Bioworks Holdings, with the most bullish analyst valuing it at US$3.00 and the most bearish at US$0.80 per share. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Ginkgo Bioworks Holdings' revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 1.2% growth on an annualised basis. This is compared to a historical growth rate of 11% over the past three years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 4.9% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Ginkgo Bioworks Holdings.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Ginkgo Bioworks Holdings analysts - going out to 2026, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 3 warning signs for Ginkgo Bioworks Holdings that you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNA

Ginkgo Bioworks Holdings

Develops a platform for cell programming in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives