- United States

- /

- Chemicals

- /

- NYSE:DD

DuPont (DD): Evaluating Valuation Following Major SK hynix Deal in Next-Gen Semiconductor Materials

Reviewed by Kshitija Bhandaru

DuPont de Nemours (DD) just made headlines as its Electronics segment, Qnity, entered a Memorandum of Understanding with SK hynix to supply advanced polishing pads for semiconductor fabrication. This new agreement positions DuPont as a key partner in supporting next-generation chip and AI production.

See our latest analysis for DuPont de Nemours.

DuPont de Nemours’ recent momentum has been encouraged by growth in its Electronics segment and new product launches, but the share price tells a nuanced story. After a solid 5.5% year-to-date share price return, total shareholder return over the past 12 months is still down 4.3%, while its three- and five-year total returns above 49% reflect resilience over the long run.

If DuPont’s role in next-gen tech caught your attention, it could be a great moment to see the full list of leading innovators shaping the future — See the full list for free.

With DuPont shares still trading nearly 18% below the average analyst price target, investors may be wondering if this discount signals an overlooked upside or if the market is already factoring in all future growth prospects.

Most Popular Narrative: 15.2% Undervalued

With DuPont de Nemours recently closing at $79.57 versus a narrative fair value of $93.81, the prevailing view points to meaningful upside, supported by forward-looking financial projections and strategic growth bets.

DuPont's accelerated growth in Electronics, particularly from AI-driven applications, advanced packaging, and high-performance computing, positions the company to capture outsized revenue expansion as node migrations and broader electronics market recovery unfold through 2025 and beyond.

What big bets are powering this price target? There is a bold case here: future profitability leaps, climbing operating margins, and bullish long-term earnings assumptions lie at the story’s core. Want to know which financial dominoes have to fall in DuPont’s favor to unlock that premium value? The narrative holds the answers.

Result: Fair Value of $93.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal exposure from PFAS litigation and heavy reliance on electronics demand, especially in China, could dampen the bullish narrative if conditions worsen.

Find out about the key risks to this DuPont de Nemours narrative.

Another View: Multiples Tell a Different Story

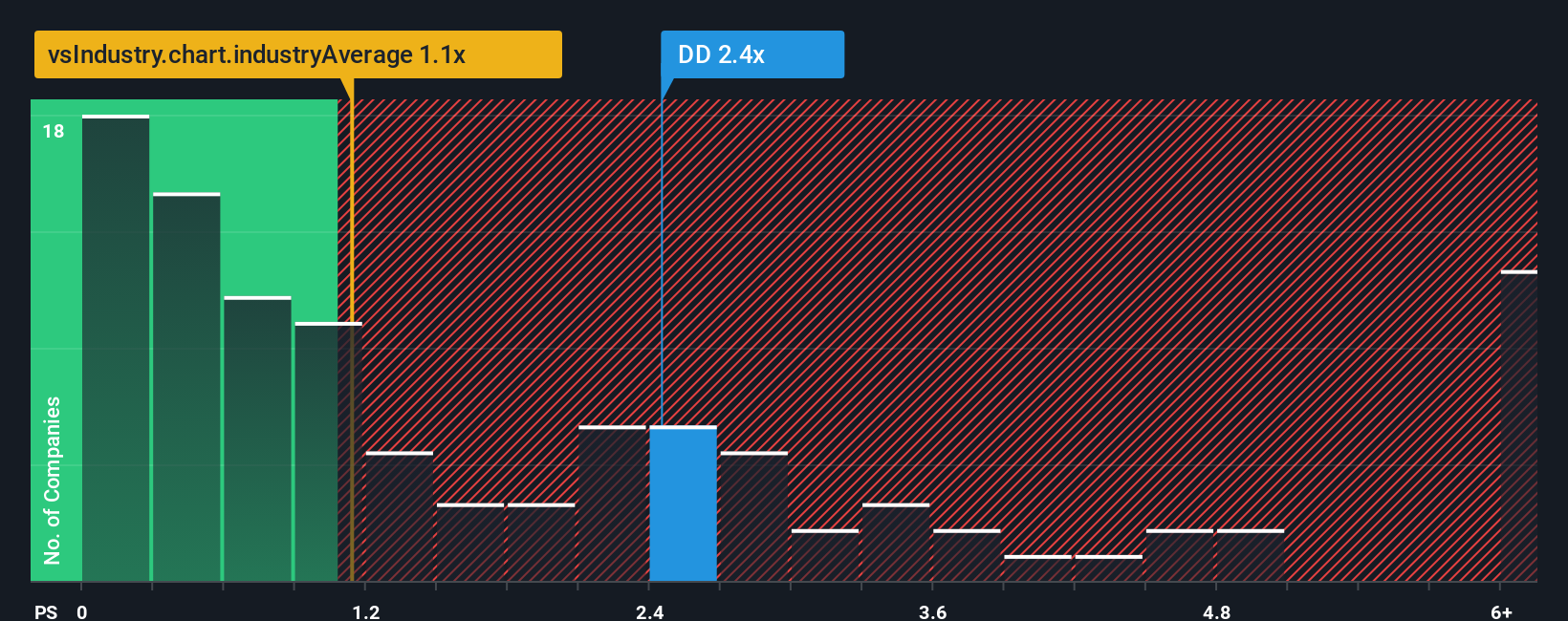

Looking at DuPont de Nemours through its price-to-sales ratio paints a less optimistic picture. The company trades at 2.6 times sales, making it pricier than both the US Chemicals industry average of 1.2x, the peer average of 2.5x, and even its fair ratio of 2.4x. This signals investors are paying a premium, raising questions about whether the upside is already included or if there is hidden value yet to be seen.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DuPont de Nemours Narrative

If you think there’s more to the story or want to investigate the data firsthand, you can build your own unique perspective in just a few minutes. Do it your way

A great starting point for your DuPont de Nemours research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next winning idea pass you by. Use Simply Wall Street’s powerful screener to spot compelling investments before everyone else.

- Boost your income potential and see which companies offer impressive yields through these 18 dividend stocks with yields > 3% you can rely on for steady returns.

- Tap into the future of computing by checking out these 26 quantum computing stocks set to benefit from breakthroughs in speed, security, and innovation.

- Catch a glimpse of tomorrow's market leaders and be among the first to find potential gems with these 868 undervalued stocks based on cash flows flying under the radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion