- United States

- /

- Chemicals

- /

- NYSE:DD

A Look at DuPont (DD) Valuation After Renewed Optimism From High‑Profile Analyst Endorsement

Reviewed by Simply Wall St

Recent upbeat commentary from Jim Cramer on DuPont de Nemours (DD) has put fresh attention on the stock, as he praised management, the new electronics spinoff, and the company’s focus on higher margin water and materials businesses.

See our latest analysis for DuPont de Nemours.

That upbeat narrative is landing just as DuPont’s 1 month share price return of about 9 percent contrasts sharply with a roughly 45 percent year to date decline, while multi year total shareholder returns remain solid. This suggests sentiment may be turning after a painful reset.

If Cramer’s comments have you thinking about where else capital could work harder, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover under the radar compounders.

With shares rebounding from steep year to date losses, trading modestly below analyst targets and near estimates of intrinsic value, investors now face a key question: Is DuPont still mispriced, or is future growth already reflected in the stock?

Most Popular Narrative Narrative: 13% Undervalued

With DuPont de Nemours trading at $41.26 against a most popular narrative fair value of $47.25, the storyline leans toward upside from here.

DuPont's accelerated growth in Electronics, particularly from AI driven applications, advanced packaging, and high performance computing, positions the company to capture outsized revenue expansion as node migrations and broader electronics market recovery unfold through 2025 and beyond.

Curious how modest top line expectations, rising margins and a richer future earnings multiple can still add up to upside potential? Unpack the full narrative drivers next.

Result: Fair Value of $47.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sizable PFAS legal liabilities and DuPont’s heavy electronics exposure to China could pressure free cash flow and undermine the upside case.

Find out about the key risks to this DuPont de Nemours narrative.

Another Angle on Valuation

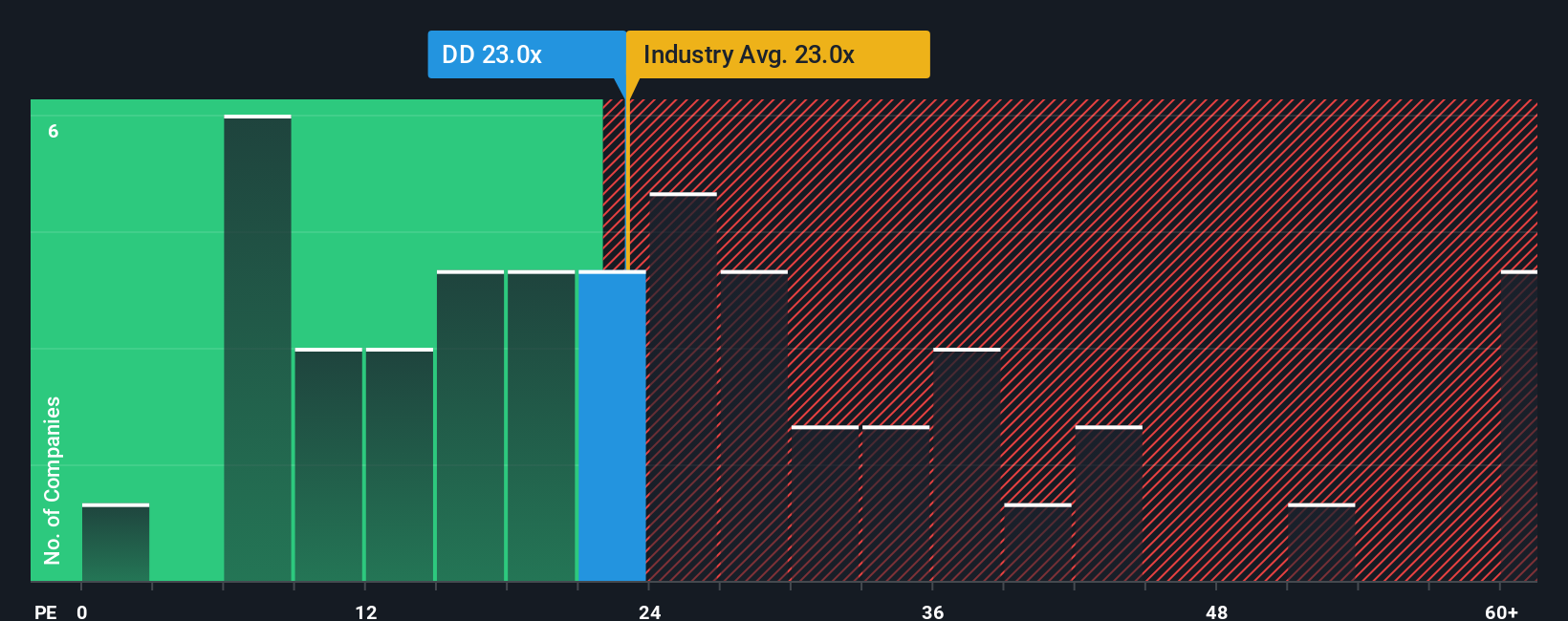

On earnings based valuation, DuPont looks more fully priced. Its price to earnings ratio of 23.8 times is roughly in line with the US Chemicals industry at 23.9 times and just below peers at 24.9 times, but still above its own fair ratio of 22.6 times.

That small gap may not sound like much. However, it means the market is already paying a premium to what our fair ratio suggests the multiple could drift toward, leaving less room for error if growth or margins disappoint from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DuPont de Nemours Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your DuPont de Nemours research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at DuPont when smarter opportunities might be waiting next in line. Use the Simply Wall Street Screener to target the themes that fit you.

- Explore early stage potential by reviewing these 3624 penny stocks with strong financials that pair tiny market caps with resilient balance sheets and identifiable operating momentum.

- Consider structural themes by scanning these 25 AI penny stocks positioned in areas such as machine learning, automation, and data driven business models.

- Focus on income-oriented ideas by reviewing these 13 dividend stocks with yields > 3% that offer meaningful yields alongside sustainable payout ratios and consistent cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion