- United States

- /

- Chemicals

- /

- NYSE:CTVA

Is Market Sentiment Shifting on Corteva After 3.5% Weekly Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Corteva is undervalued, overhyped, or flying under the radar? You are not alone. Today we are breaking it all down in plain English.

- The stock climbed 9.1% year-to-date and has gained 2.0% over the past year. However, it dipped by 3.5% in just the last week, hinting that the market is reacting to shifting sentiment.

- Much of this volatility has come on the back of developments in the agricultural and crop protection industry. Sustainability initiatives and trade discussions shape investor expectations. While new partnerships and evolving input prices have grabbed headlines, these shifts all feed back into how the market values Corteva today.

- Corteva currently earns a 3 out of 6 on our valuation score, meaning it ticks half the boxes for being undervalued and half where value concerns remain. We will break down each approach shortly and, by the end, share a smarter way to judge value than simply comparing scores or ratios.

Approach 1: Corteva Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then calculating what those are worth in today's dollars. This helps investors see past short-term market moves and focus on long-term value.

For Corteva, the current Free Cash Flow stands at $2.58 Billion. Analysts provide forecasts for the next five years, with Free Cash Flow expected to rise steadily and reach $2.62 Billion by 2028. Beyond that, Simply Wall St extrapolates annual estimates showing potential growth up to $3.74 Billion in 2035. All amounts are reported in $.

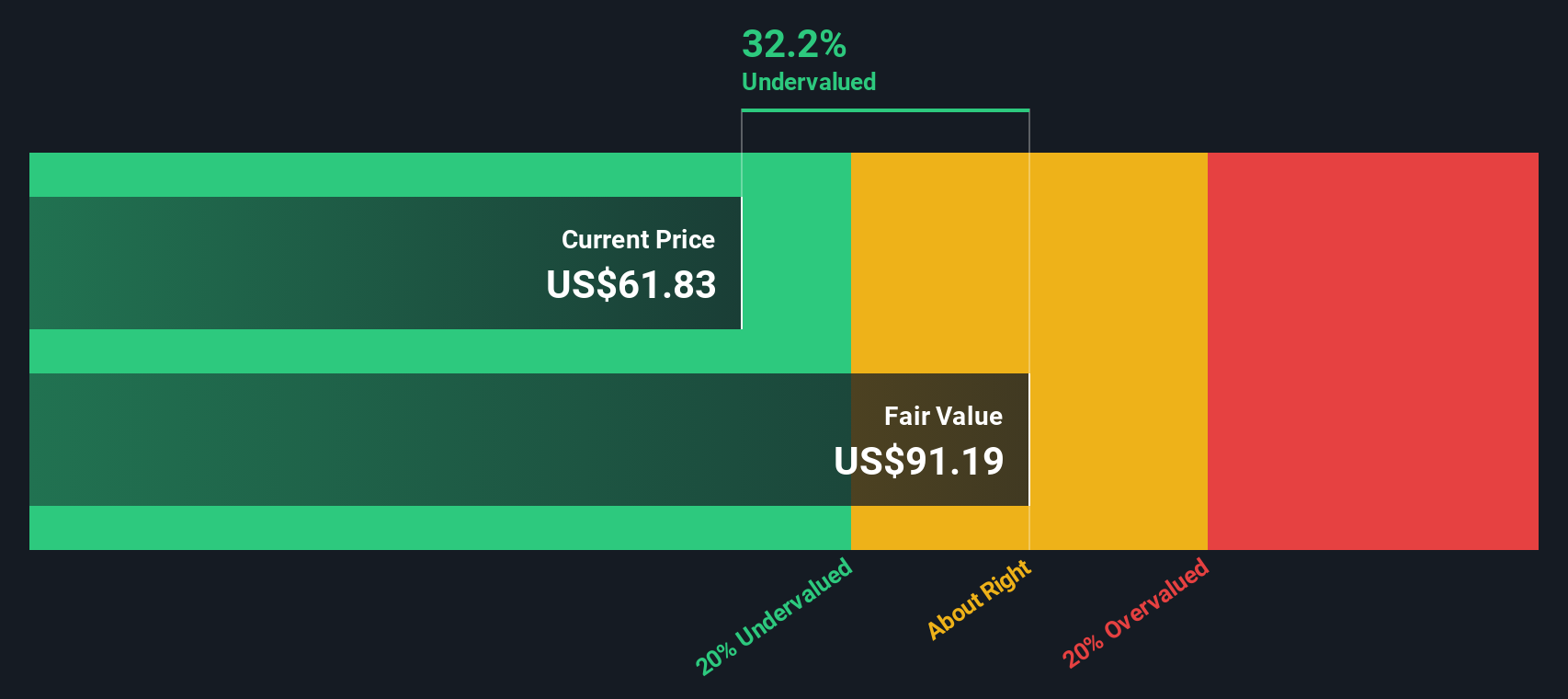

When these projected cash flows are discounted back to today, the model arrives at an intrinsic value of $93.04 per share. This represents a 34.0% discount compared to Corteva’s current trading price, suggesting the share may be undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corteva is undervalued by 34.0%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Corteva Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Corteva, as it directly links a company’s current share price to its underlying earnings. This makes it especially useful for assessing whether investors are paying a fair price relative to expected profitability.

A "normal" or "fair" PE ratio is influenced by factors such as expected earnings growth and the level of risk associated with the business. Companies poised for higher growth or carrying lower perceived risk usually command higher PE ratios. In contrast, slower-growing or higher-risk businesses often trade at lower PEs.

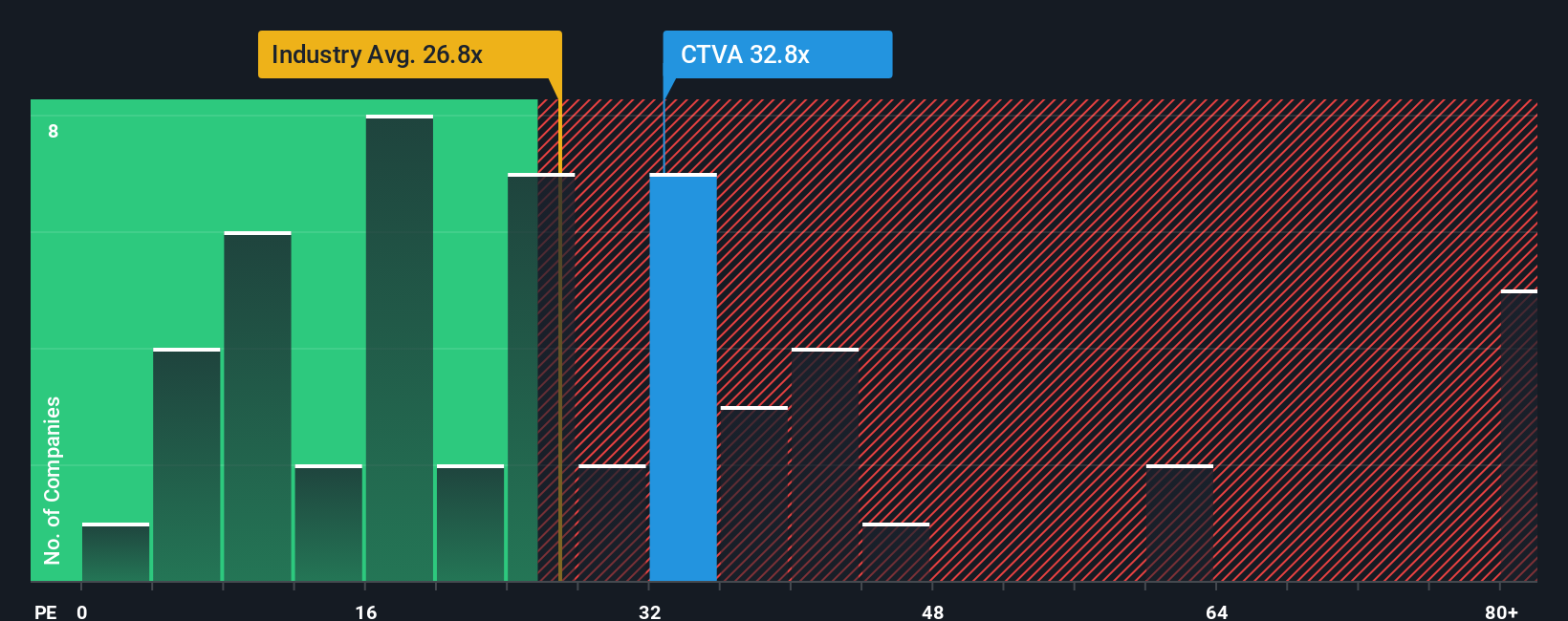

Corteva currently trades at a PE ratio of 28.4x. This is notably higher than the Chemicals industry average of 25.3x and its peer average of 25.2x. These comparisons might suggest Corteva is somewhat richly valued relative to its immediate industry landscape.

However, Simply Wall St’s proprietary "Fair Ratio" offers a more tailored benchmark. Calculated at 25.0x for Corteva, the Fair Ratio provides a deeper assessment by weighing the company’s earnings growth outlook, risk profile, profit margins, size, and industry factors. This comprehensive approach gives a clearer sense of value than simply comparing with peers or sector norms, as it reflects Corteva’s unique opportunities and challenges.

Given Corteva’s current PE of 28.4x versus its Fair Ratio of 25.0x, the stock appears slightly overpriced on a risk- and growth-adjusted basis. The difference exceeds 0.10, supporting a view that the valuation is on the high side today.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corteva Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a story you create about a company, connecting your perspective on its business, industry trends, and future with your own estimates of fair value, revenue, earnings, and margins.

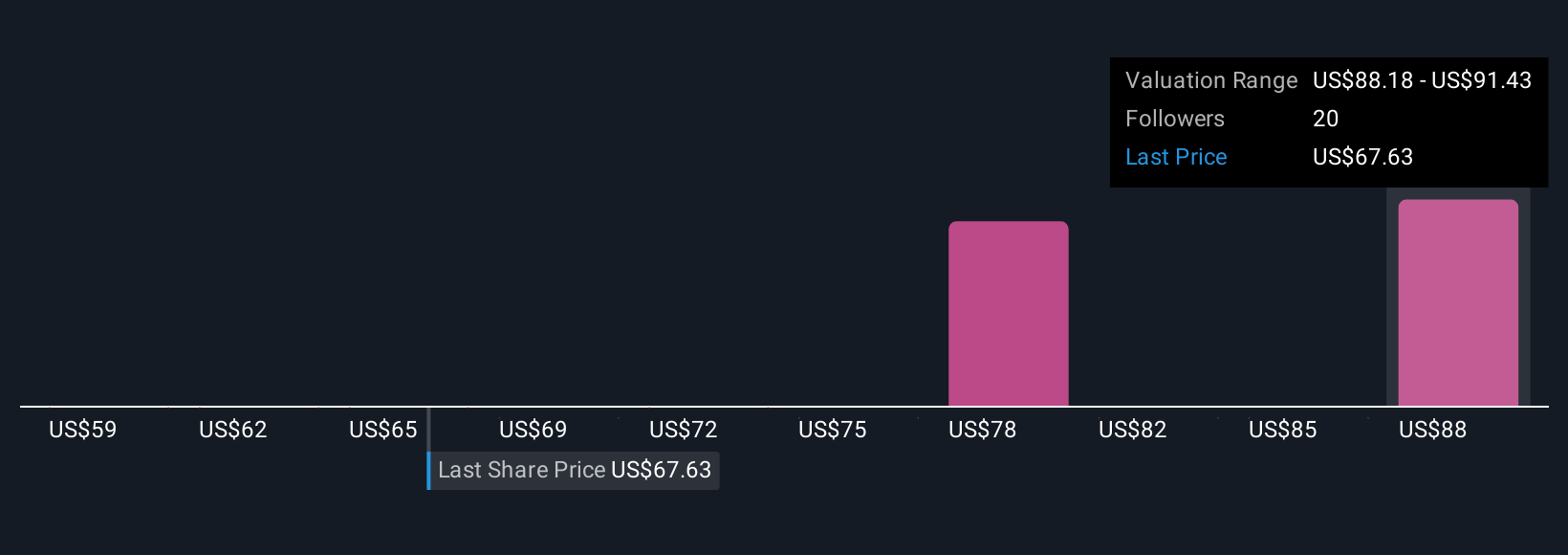

With Narratives, you add a human layer to the numbers, linking Corteva’s real-world story to a financial forecast and, ultimately, to a fair value for its shares. Narratives are easy to use and accessible right within the Community page on Simply Wall St, where millions of investors regularly share and compare insights.

These Narratives help you decide when to buy, hold, or sell by showing, in real time, how your Fair Value compares to the current market Price as news, earnings, and forecasts are updated. For example, some investors might see robust earnings growth and expanding margins as a reason to set a high fair value (like $92.0), while others, more cautious about competition and regulatory risks, might set it lower (such as $68.0), giving you a full spectrum of perspectives right at your fingertips.

Do you think there's more to the story for Corteva? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives