- United States

- /

- Chemicals

- /

- NYSE:CE

Did the Lanaken Closure Signal a Strategic Shift in Celanese's (CE) Cost Management Approach?

Reviewed by Sasha Jovanovic

- Celanese Corporation recently announced its intent to cease operations at its Lanaken acetate tow facility in Belgium by the second half of 2026, citing declining demand, regulatory uncertainty, and high operating costs; the closure is expected to impact about 160 employees and has prompted a formal consultation process with local union representatives.

- This decision reflects ongoing challenges in the acetate tow market and highlights Celanese’s efforts to streamline its cost structure amidst shifting industry and regulatory pressures.

- We’ll explore how the closure of the Lanaken facility as a cost-saving measure could reshape Celanese’s long-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Celanese Investment Narrative Recap

Celanese attracts investors anchored to the belief that cost discipline and flexible operations can eventually unlock earnings potential as demand stabilizes across core end-markets. The planned Lanaken facility shutdown is a direct response to market headwinds; however, the short-term catalyst remains a rebound in acetyls and engineered materials demand, while the key risk continues to be persistent overcapacity and weak order flows in critical global markets, neither of which is fundamentally altered by this closure.

Among recent announcements, the signing of a definitive agreement to divest the Micromax® portfolio to Element Solutions stands out. While not directly tied to the Lanaken shutdown, it reflects Celanese's focus on asset optimization, bolstering financial flexibility, an important lever as the company works to offset volatility in its core business segments and seeks eventual earnings turnaround.

Yet, in contrast to cost savings from restructuring, investors should be aware that prolonged overcapacity and weak industry demand could...

Read the full narrative on Celanese (it's free!)

Celanese's outlook projects $10.2 billion in revenue and $799.9 million in earnings by 2028. This assumes a -1.0% annual revenue decline and a $2.4 billion increase in earnings from the current level of -$1.6 billion.

Uncover how Celanese's forecasts yield a $53.69 fair value, a 34% upside to its current price.

Exploring Other Perspectives

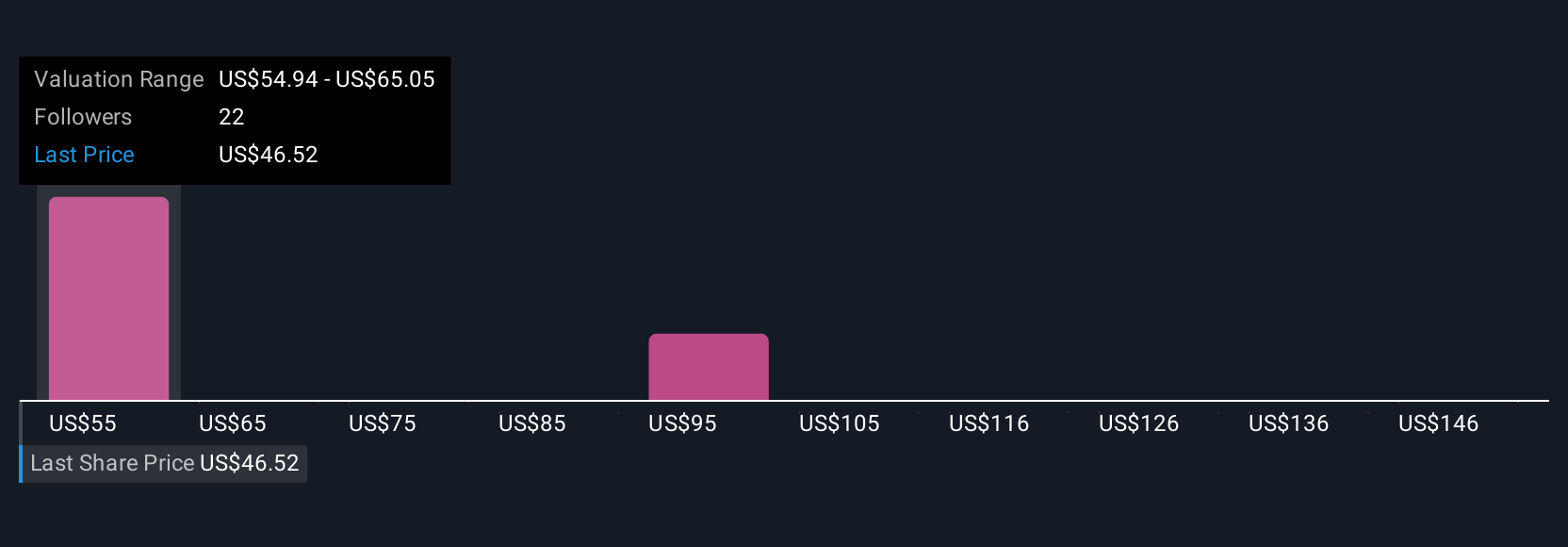

Simply Wall St Community members offered eight fair value estimates for Celanese, ranging from US$50 to over US$107 per share. In a market where opinions sharply diverge, persistent weak demand and margin compression remain important factors for you to assess alongside these alternative viewpoints.

Explore 8 other fair value estimates on Celanese - why the stock might be worth over 2x more than the current price!

Build Your Own Celanese Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Celanese research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celanese's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CE

Celanese

A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives