- United States

- /

- Chemicals

- /

- NYSE:CBT

Cabot (CBT): Assessing Valuation Following Earnings Drop, Leadership Change, and Share Buybacks

Reviewed by Simply Wall St

Cabot (NYSE:CBT) just released quarterly and full-year earnings, highlighting declines in both revenue and net income compared to the previous year. Investors are closely watching how the company responds to these results and recent executive changes.

See our latest analysis for Cabot.

The combination of earnings declines, a high-profile leadership change, and continued share repurchases has kept Cabot in the spotlight. The recent 30-day share price return of -13.7% and a year-to-date fall of 30.8% show momentum has clearly faded, with the 1-year total shareholder return at -45.4%. Long-term holders, however, have still seen a solid five-year total return.

If Cabot's recent swings have you thinking bigger picture, now could be the right time to broaden your perspective and discover fast growing stocks with high insider ownership

With Cabot's stock sharply down and trading at a notable discount to analyst targets, the question is whether this slump signals an undervalued buying opportunity or if the market is rightly accounting for its growth outlook.

Price-to-Earnings of 9.9x: Is it justified?

Cabot trades at a price-to-earnings ratio of 9.9x, which puts the stock well below both its US Chemicals industry peers and the broader market. At the last close of $61.48, Cabot's valuation suggests investors are discounting its recent earnings decline, even as the company’s price remains significantly off prior highs.

The price-to-earnings (P/E) ratio compares the company’s share price to its earnings per share and is widely used to measure how much investors are paying for each dollar of earnings. For companies in the chemicals sector, a lower P/E ratio may signal concerns around growth outlook or cyclical risk, especially following weak performance.

Cabot's P/E of 9.9x stands out as a significant discount compared to the US Chemicals industry average of 23x and the peer average of 30.4x. This disparity points to either an overlooked value opportunity or continued skepticism regarding Cabot’s ability to rebound from recent challenges. If the market adjusts its perception, there is substantial room for the P/E to move closer to industry norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.9x (UNDERVALUED)

However, weak recent returns and uncertain net income trends could signal further downside if Cabot's earnings recovery falters or if sector headwinds persist.

Find out about the key risks to this Cabot narrative.

Another View: SWS DCF Model Suggests Even Deeper Discount

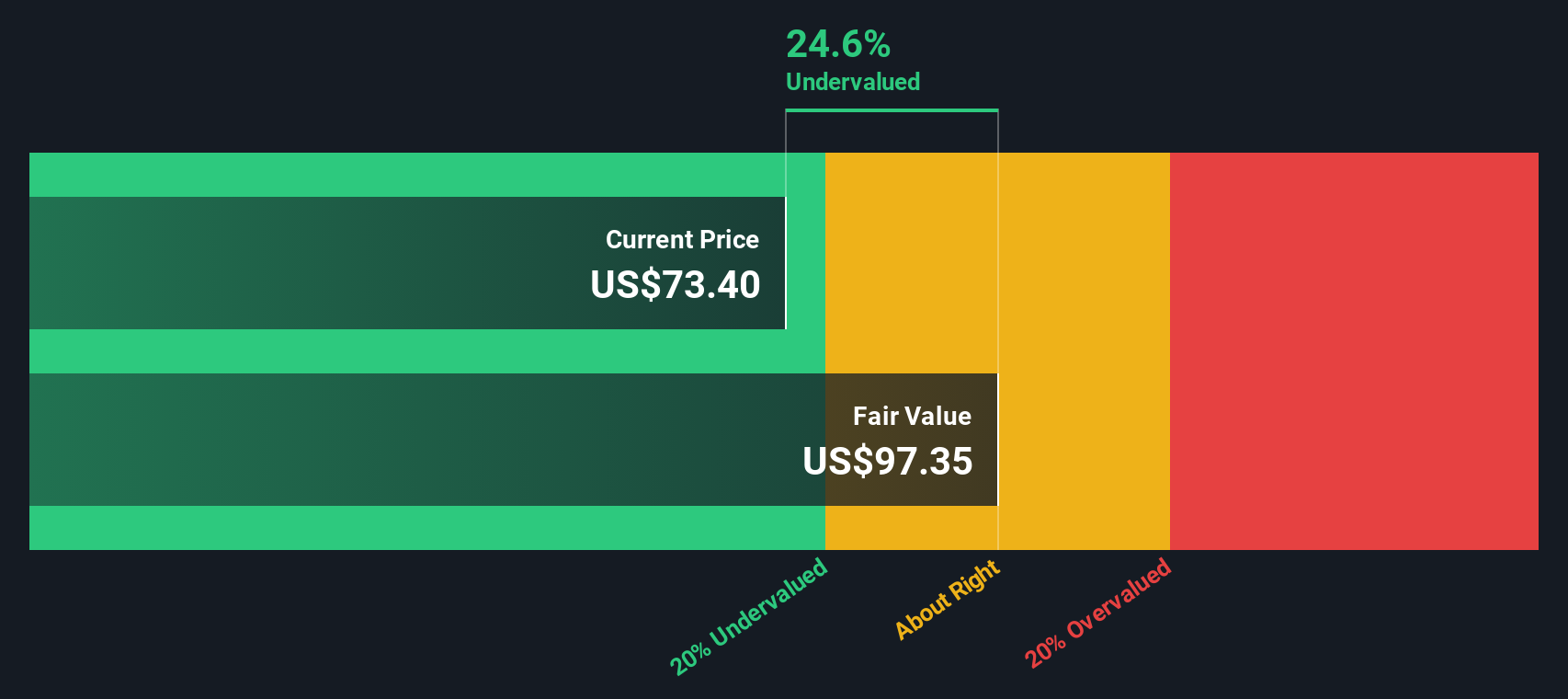

Taking a different approach, our DCF model estimates Cabot’s fair value at $95.20 while shares trade at $61.48. This points to Cabot being around 35% below its calculated fair value, which could signal undervaluation beyond what multiples suggest. However, are these assumptions too optimistic given current headwinds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cabot for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cabot Narrative

If you see things differently or want to dig into the details yourself, building your own take takes just a few minutes, so why not Do it your way

A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take your portfolio to the next level by targeting stocks with unique growth stories and untapped potential that others might overlook. Here are three smart places to get started:

- Capitalize on tomorrow’s breakthroughs by checking these 27 quantum computing stocks, which is making waves in quantum computing and advanced encryption applications.

- Unlock high-yield opportunities and strengthen your income stream through these 16 dividend stocks with yields > 3%, which offers consistent returns above 3%.

- Gain an edge on market trends by reviewing these 24 AI penny stocks, featuring companies at the forefront of artificial intelligence innovation and rapid expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBT

Cabot

Operates as a specialty chemicals and performance materials company.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives