- United States

- /

- Packaging

- /

- NYSE:BALL

The Bull Case For Ball (BALL) Could Change Following Strong Q3, Board Addition, and Capital Focus

Reviewed by Sasha Jovanovic

- In the past week, Ball Corporation reported third quarter 2025 results with revenue rising to US$3.38 billion and net income increasing to US$321 million, alongside a continued cash dividend and the addition of Solenis CEO John E. Panichella to its board of directors.

- A key insight is Ball's reaffirmed focus on returning capital to shareholders, substantial progress in sustainable packaging, and strong long-term contractual visibility, all supporting confidence in its outlook despite input cost and operational pressures.

- We'll explore how Ball's robust earnings growth and strong contractual commitments this quarter influence its overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ball Investment Narrative Recap

To be a Ball Corporation shareholder, you need confidence in global demand for sustainable aluminum packaging, the company's contractual visibility, and its ability to manage input cost risks. The Q3 2025 results, which featured higher revenue and improved net income, reinforce Ball's earnings rebound, but do not materially alter the short-term catalyst: continued volume growth in high-demand beverage segments. However, the greatest risk, volatility in aluminum prices and other input costs, remains in focus despite near-term performance.

Among the recent developments, Ball's continued quarterly dividend of US$0.20 per share stands out for investors. This steady payout reflects management's ongoing commitment to capital returns, even as the company navigates shifting costs and industry headwinds. Dividend sustainment in this environment reinforces the company's cash flow discipline relative to its operational catalysts.

By contrast, those same input cost pressures can quickly resurface, and investors should be aware of what happens if aluminum price volatility increases faster than Ball’s ability to offset...

Read the full narrative on Ball (it's free!)

Ball's narrative projects $14.2 billion revenue and $1.1 billion earnings by 2028. This requires 4.6% yearly revenue growth and a $519 million earnings increase from $581 million.

Uncover how Ball's forecasts yield a $61.23 fair value, a 25% upside to its current price.

Exploring Other Perspectives

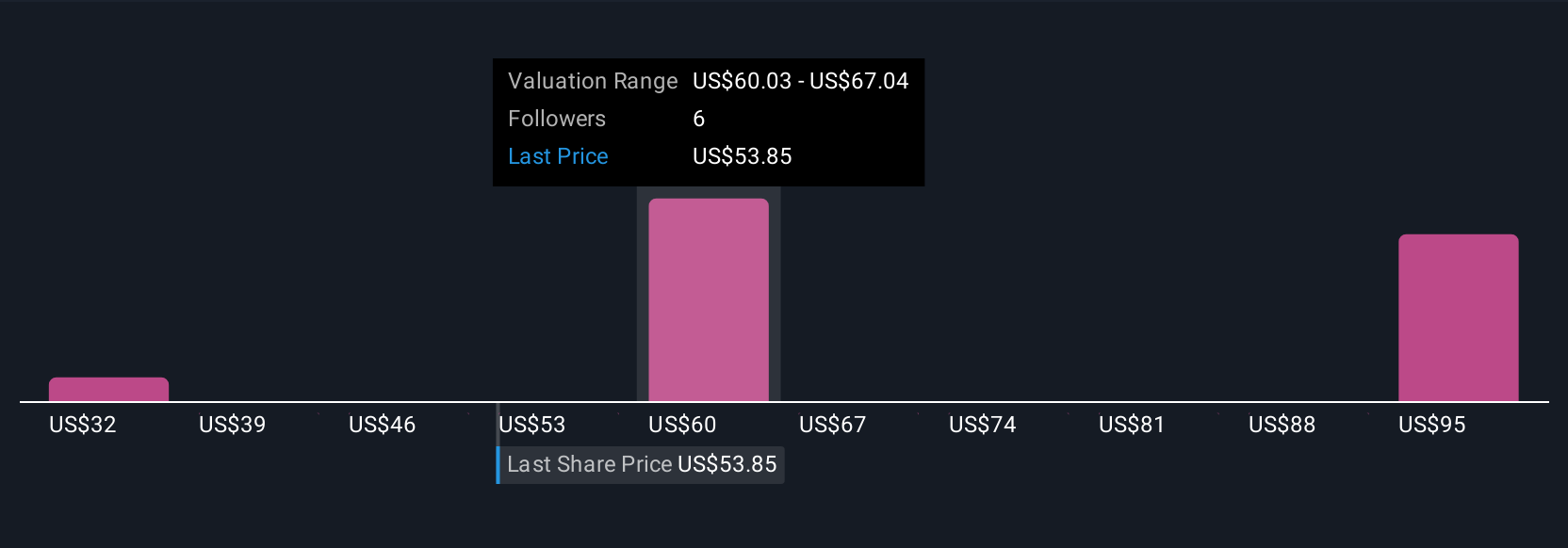

Five community members from Simply Wall St estimate Ball's fair value between US$32 and US$82.82 per share. As input cost volatility remains a central risk, you should consider how different investor views reflect varying expectations about Ball's future earnings resilience.

Explore 5 other fair value estimates on Ball - why the stock might be worth 35% less than the current price!

Build Your Own Ball Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ball research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ball research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ball's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ball might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BALL

Ball

Supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives