- United States

- /

- Packaging

- /

- NYSE:BALL

Is Ball a Hidden Opportunity After 3.9% Stock Rebound Amid Sustainability News?

Reviewed by Bailey Pemberton

- Curious if Ball is a hidden bargain or just another stock on your watchlist? You are not alone. Plenty of investors are searching for answers about its true value right now.

- Recently, Ball's stock price has seen a mild rebound of 3.9% over the past week, even though it is still down 9.3% year-to-date and 19.7% over the past year.

- One driver behind these price changes has been ongoing industry news about sustainability trends and material supply chain shifts. Both are areas where Ball has strong exposure. Analysts and media alike have focused on Ball's response to global sustainability demands and strategic partnerships, which could support future growth or highlight new risks.

- On our value scorecard, Ball scores a perfect 6 out of 6 on undervalued checks, an achievement that is rare among its peers. In the sections to come, we will break down exactly which valuation models lead to this conclusion, while keeping an eye out for an even deeper perspective you will not want to miss by the end.

Approach 1: Ball Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model seeks to estimate the intrinsic value of a company by forecasting its future cash flows and discounting them back to their present value. Essentially, it answers the question: what is Ball worth today, given the cash it is expected to produce in the years ahead?

For Ball, the current Free Cash Flow (FCF) reported over the last twelve months is negative, at -$206.8 million. Despite this, analysts predict a swift turnaround with FCF projected to rise above $1 billion by 2026, climbing to over $1.3 billion by 2035. The projections combine direct analyst estimates for the next few years and then transition to steady growth extrapolated beyond 2027.

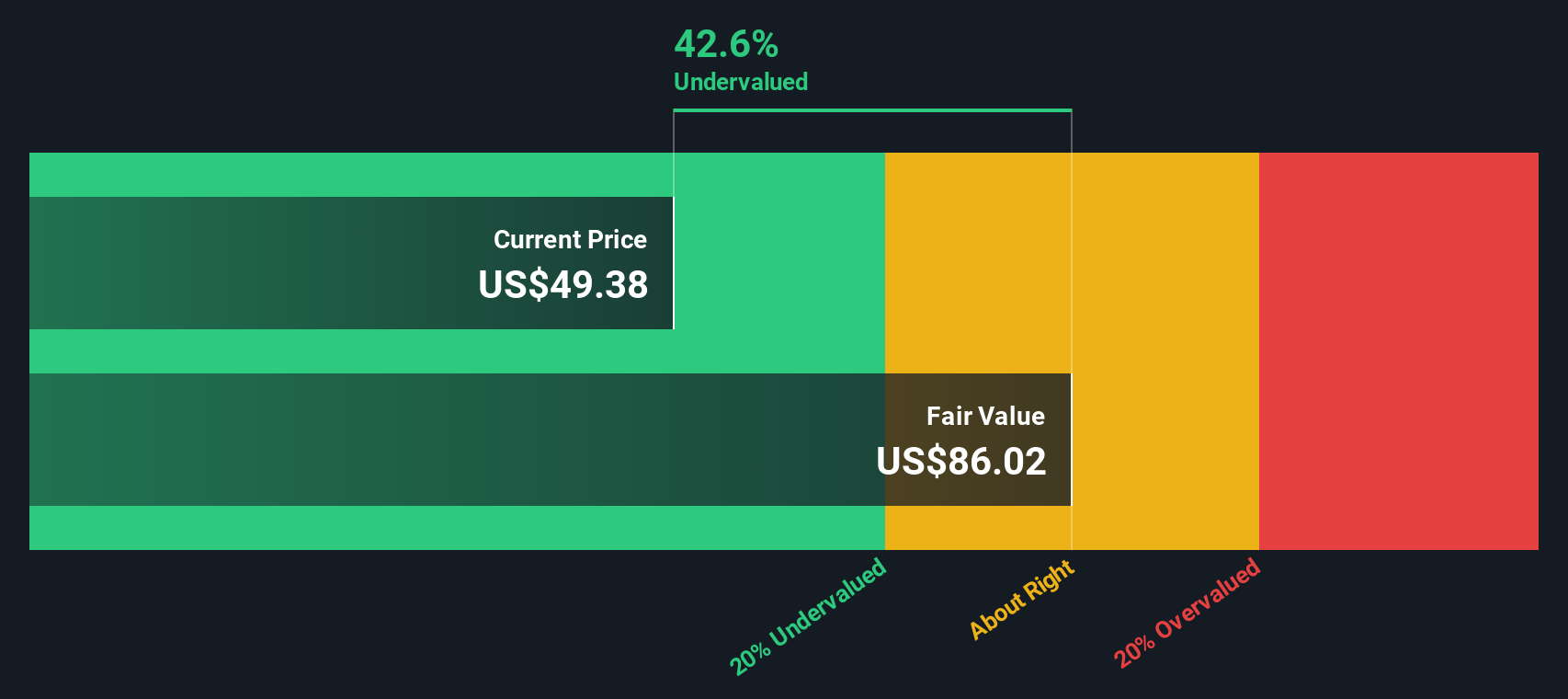

Applying the DCF model to these cash flows results in an estimated intrinsic value of $86.02 per share. Relative to the current market price, this model suggests Ball is trading at a 42.6% discount, indicating considerable undervaluation by this metric.

This significant discrepancy between calculated value and market price points to potential upside for investors who trust in Ball’s cash flow trajectory and industry position.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ball is undervalued by 42.6%. Track this in your watchlist or portfolio, or discover 933 more undervalued stocks based on cash flows.

Approach 2: Ball Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is widely considered a fundamental metric when valuing profitable companies, as it reflects how much investors are willing to pay for each dollar of a company's earnings. Because it directly ties a company’s share price to its actual profits, the PE ratio gives a clearer sense of affordability relative to performance, which is especially important for companies with consistent earnings like Ball.

Growth expectations and risk levels are key levers that influence what a typical or “fair” PE ratio should be. Faster-growing or more stable companies often command higher multiples, as investors anticipate future profit expansion or view them as safer bets. Conversely, if a company faces elevated risks or slowing growth, its “fair” PE may be lower.

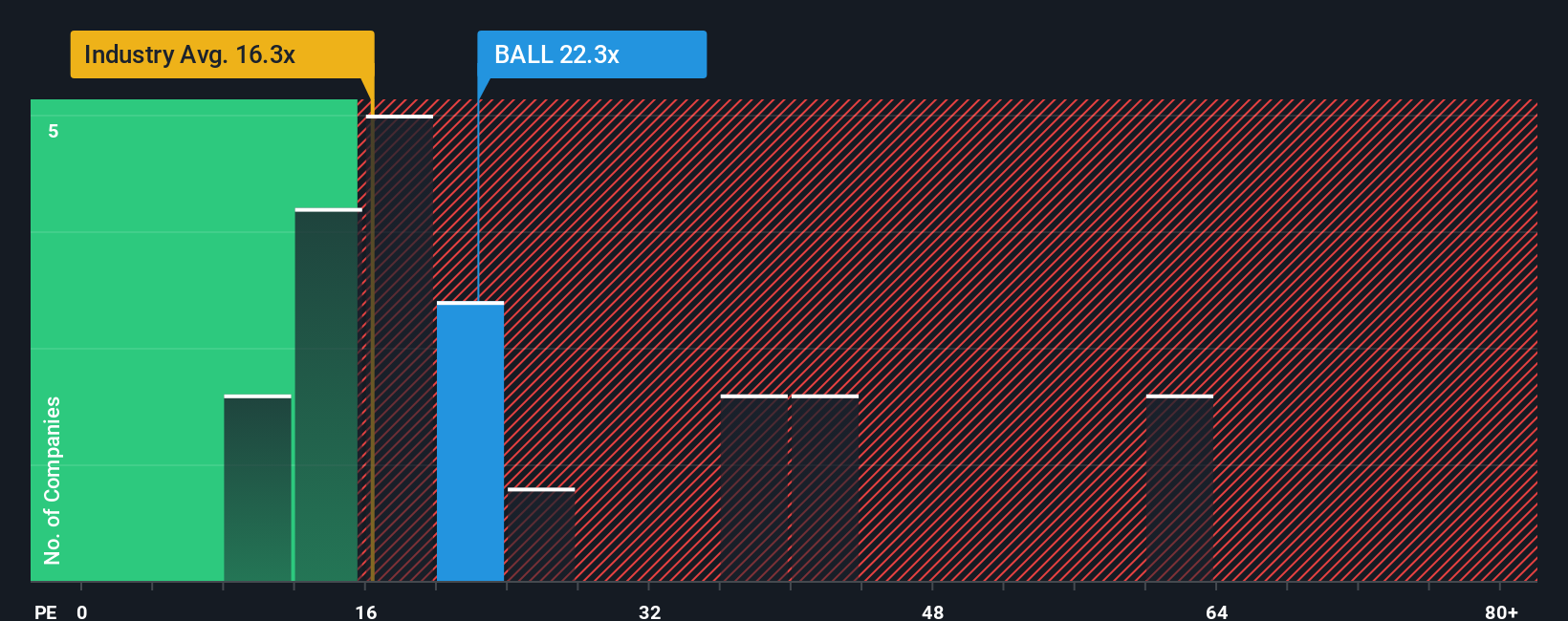

Currently, Ball’s PE ratio stands at 18.6x. This is above the average among packaging peers (15.6x) but far below the peer group’s average (57.2x). To provide a more tailored benchmark, Simply Wall St’s proprietary “Fair Ratio,” which incorporates Ball’s growth prospects, profit margins, industry position, market cap, and risk profile, calculates a value of 20.5x for Ball. Compared to simple peer or industry averages, this Fair Ratio offers a much deeper and more specific picture of what investors might reasonably expect to pay for Ball’s earnings in today’s market, since it is designed to capture nuances missed by broad comparisons.

With Ball trading at an 18.6x PE, just below its Fair Ratio of 20.5x, the stock appears somewhat undervalued based on this more holistic view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ball Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a tool designed to bring your investment ideas to life by combining your view of the company's story with concrete expectations for its future financial performance and value.

A Narrative is simply your unique perspective on how a business like Ball will evolve, blending your beliefs about its opportunities, risks, and the numbers behind them such as revenue, profit margins, and fair value. Rather than just focusing on ratios and static data, Narratives connect what you think will drive Ball’s future (like new ESG initiatives, customer contracts, or evolving market trends) directly to your financial forecasts, making your valuation far more thoughtful and personal.

On Simply Wall St’s Community page, Narratives are easy to explore, create, and compare. This helps millions of investors see how their judgment matches up to others and reveals exactly when the current price looks attractive or expensive versus their calculated fair value.

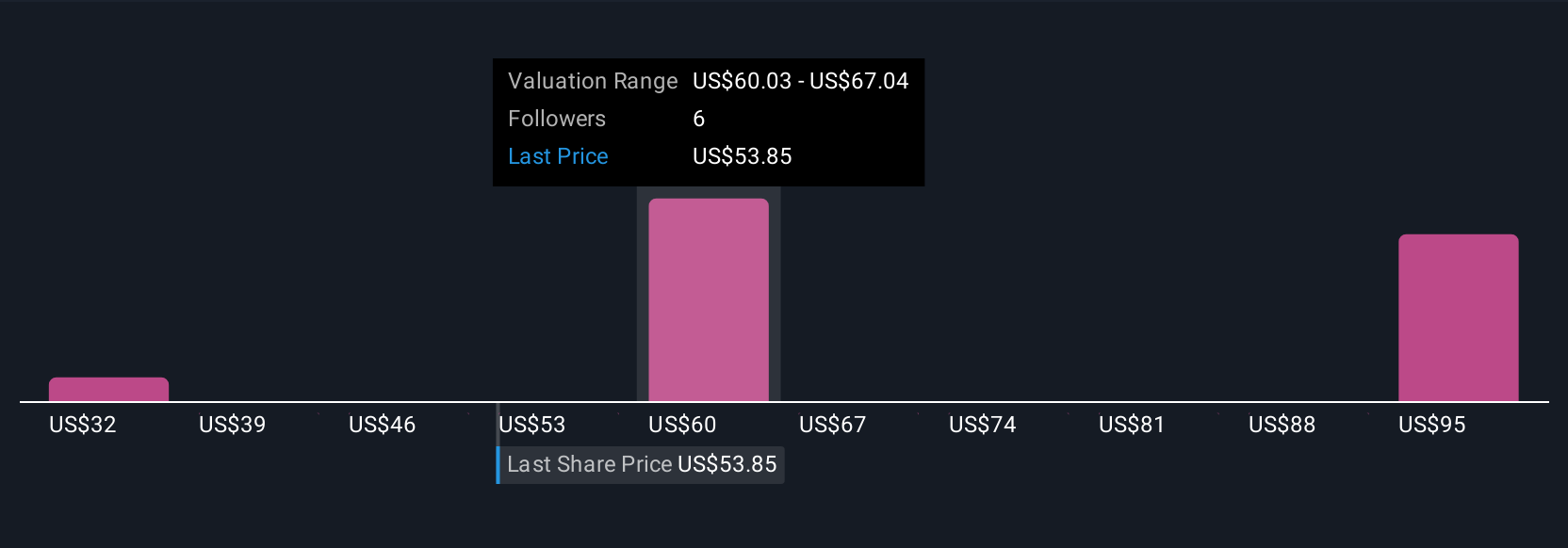

Best of all, Narratives update as news and financial results come in, so your investment case can adjust in real time. For instance, one Ball Narrative might see upside thanks to expanding sustainable packaging, projecting a $84 fair value, while another Narrative might caution about margin risks and assign a much lower $54 fair value.

Do you think there's more to the story for Ball? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ball might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BALL

Ball

Supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success