- United States

- /

- Packaging

- /

- NYSE:BALL

Ball (BALL): $384 Million Loss Highlights Ongoing Quality and Valuation Concerns vs Bullish Narratives

Reviewed by Simply Wall St

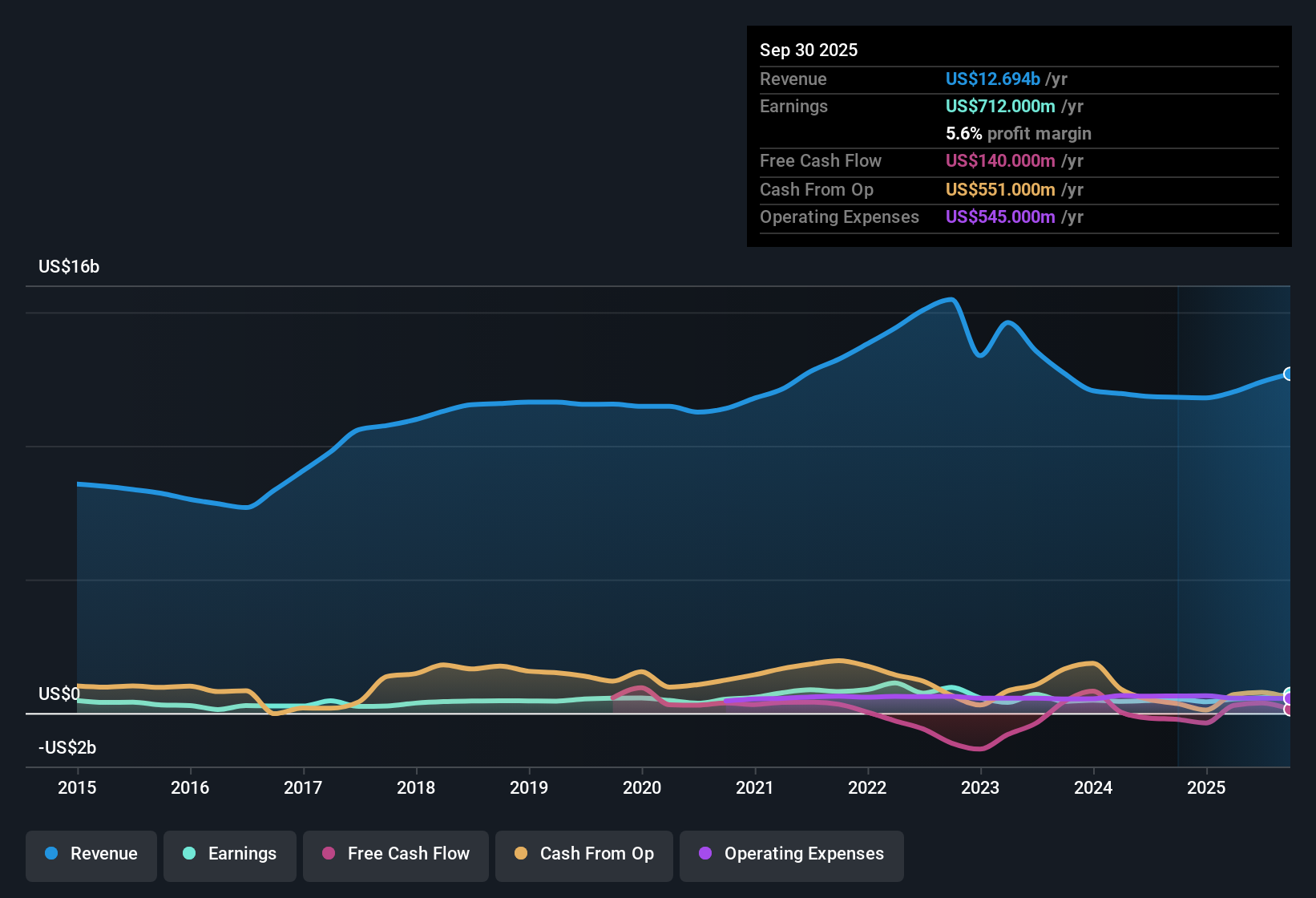

Ball (BALL) posted mixed results, with revenue forecast to grow at 3.8% per year, lagging well behind the broader US market’s 10.5% annual pace. EPS is expected to rise at 11.4% per year, again trailing the market’s 16% and remaining below levels considered “significant.” While the past year brought a robust 34.6% earnings rebound, this contrasts with average annual declines of 9.1% over five years. Profit margins improved to 5.6% from 4.5% last year, but the period was weighed down by a one-off $384 million loss.

See our full analysis for Ball.Next up, we’ll see how these numbers stack up against the widely followed narratives about Ball at Simply Wall St. Some assumptions could be confirmed, and others might be put to the test.

See what the community is saying about Ball

Profit Margins Climb on Cost Focus

- Profit margins rose to 5.6% from 4.5% in the most recent period, showing tangible improvement even as last year included a $384 million one-off loss that weighed on results.

- According to the analysts' consensus view, Ball’s operational discipline and shift toward its core packaging business support higher net margins. Cost control initiatives and new contracts are expected to drive margins closer to the 7.7% mark over the next three years.

- Analysts forecast margin expansion from the current 4.7% to 7.7% by 2027, linking it to strong North American contracts covering over 90% of volume for 2026.

- Revenue stability from long-term contracts and divestiture of non-core segments are credited with helping margin gains outpace historical trends.

Want the full story on how analysts think cost controls and contract wins could lift Ball's margins? 📊 Read the full Ball Consensus Narrative.

Premium Valuation Despite Analyst Discount

- Ball's price-to-earnings ratio of 18.3x stands above both peer (15.5x) and industry averages (16.4x), even though its share price of $47.83 sits below the analyst target price of $61.23 and well below its DCF fair value of $91.40.

- Analysts’ consensus view underlines a valuation mismatch, where ongoing profit and revenue growth justify a target 22.2% above today’s price. Achieving this depends on sustained earnings improvement.

- Consensus assumptions only play out if Ball delivers future earnings of $1.1 billion and operates at a 15.9x PE multiple, which is below its current sector.

- The ambitious analyst target assumes not only higher margins but also a steady decline in shares outstanding and disciplined capital returns to justify this premium.

Dividend and Earnings Quality Under Pressure

- Ball faces notable risks around dividend sustainability and earnings quality, with recent financials spotlighting exposure to a large one-off $384 million loss and dependence on major customers, especially in South America.

- Analysts’ consensus view calls out that rising input costs and heavier reliance on lower-margin product lines could undermine the bullish case, threatening stable cash flow and compressing profitability.

- Contract coverage reduces some risk, but price volatility in aluminum and shifting product mix may keep margins below bullish expectations.

- High customer concentration leaves Ball’s revenue and margins vulnerable if a key partner retrenches or renegotiates contracts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ball on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on the numbers? Share your viewpoint and shape your own narrative in just a few minutes by Do it your way

A great starting point for your Ball research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite margin progress, Ball’s premium price, one-off losses, and vulnerable dividends highlight challenges in delivering reliable growth and financial stability.

If you’re looking for steadier returns, use stable growth stocks screener (2077 results) to quickly find companies that have a track record of consistent earnings and revenue expansion through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ball might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BALL

Ball

Supplies aluminum packaging products for the beverage, personal care, and household products industries in the United States, Brazil, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives