- United States

- /

- Metals and Mining

- /

- NYSE:AU

A Look at AngloGold Ashanti (NYSE:AU) Valuation Following Strong Q3 Earnings and Dividend Increase

Reviewed by Simply Wall St

AngloGold Ashanti (NYSE:AU) grabbed attention after unveiling its third-quarter earnings, with net income and gold production both increasing sharply compared to last year. The company also announced a higher interim dividend for shareholders.

See our latest analysis for AngloGold Ashanti.

Following that wave of upbeat financial news, AngloGold Ashanti’s stock has powered higher, with a 1-day share price gain of 2.7% and a remarkable 49.99% jump over the past three months. Strong earnings, higher production, and a bigger dividend appear to have reignited investor confidence, contributing to the 237.88% year-to-date share price return and an impressive 248.46% total shareholder return over the last year.

If you’re curious about what else is capturing the market’s attention lately, now is a great time to broaden your investing universe and discover fast growing stocks with high insider ownership

The big question for investors now is whether AngloGold Ashanti’s impressive run still leaves room for upside or if the stock’s recent surge means the market has already priced in all the good news and future growth.

Most Popular Narrative: 8.3% Undervalued

AngloGold Ashanti last closed at $82.24. The most widely followed narrative sets a fair value at $89.71, suggesting the stock has more runway, at least in the eyes of analysts. Let’s take a closer look at what is driving this bullish outlook according to top market consensus.

Ongoing optimization of asset portfolio toward lower-risk jurisdictions, combined with disciplined cost control (notably, stable cash cost and AISC in real terms despite sectoral inflation) is improving production stability and supporting structurally stronger net margins. Organic production growth from brownfield projects (Obuasi ramp-up, Cuiabá, Siguiri, Geita, and upcoming Nevada developments) is set to increase output volumes and extend mine life, driving future revenue and earnings growth over the next decade.

Want to unpack what’s fueling this valuation? There is a bold set of assumptions including rising profits, expanded margins, and ambitious production growth projections underpinning the narrative’s price. Curious how aggressive those targets are? Dive deeper to uncover what makes this fair value so attention-grabbing.

Result: Fair Value of $89.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation driving up mining costs or unexpected regulatory delays could challenge AngloGold Ashanti’s progress and put future earnings growth at risk.

Find out about the key risks to this AngloGold Ashanti narrative.

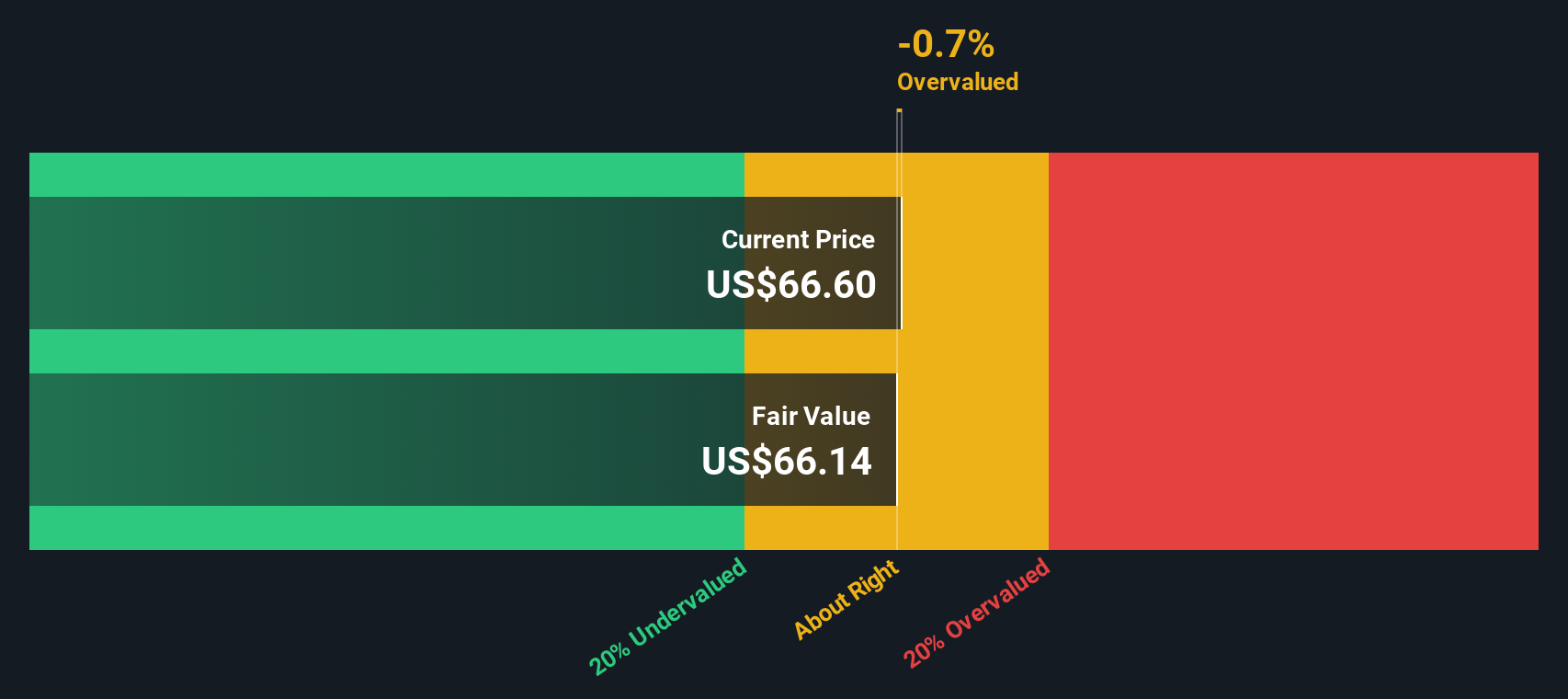

Another View: SWS DCF Model Puts a Different Price on AU

While the analyst consensus gives AngloGold Ashanti a fair value above its recent share price, our SWS DCF model arrives at a different conclusion. By estimating future cash flows and discounting them back to today, this approach values the stock at $69.49, meaning it is trading above our calculated fair value and could be overvalued. Could the optimism embedded in market estimates be overlooking risks that cash flow models do not ignore?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AngloGold Ashanti for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AngloGold Ashanti Narrative

If you prefer to reach your own conclusions or dig deeper into the numbers, you can craft a personal narrative in just a few minutes, so why not Do it your way

A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next best investing move by looking beyond AngloGold Ashanti. Take five minutes now to scan fresh opportunities others are missing and put your capital to work smarter.

- Capitalize on rising artificial intelligence adoption by checking out these 26 AI penny stocks that are positioned to benefit from the next wave of AI-driven growth.

- Secure steady income potential by targeting these 15 dividend stocks with yields > 3% offering attractive yields above 3% along with solid fundamentals.

- Ride the momentum of digital transformation with these 81 cryptocurrency and blockchain stocks leading developments in blockchain and virtual assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives