- United States

- /

- Packaging

- /

- NYSE:ATR

AptarGroup (ATR): Exploring Valuation After Recent Share Retreat and Analyst Optimism

Reviewed by Simply Wall St

AptarGroup (ATR) shares have retreated by 2% over the past month, following a slow streak that has seen the stock drop nearly 20% from its spring highs. Investors are weighing recent financial results against the company’s longer-term performance.

See our latest analysis for AptarGroup.

After a rocky couple of months, AptarGroup’s share price has given up nearly 20% from its spring peak, reflecting shifting investor sentiment around growth prospects and risk appetite. Over the past year, shareholders have faced a total return decline of about 23%. However, the three- and five-year total returns of 32% and 20% highlight the company’s staying power, even as momentum has faded recently.

If you’re considering what else is moving right now, this could be the moment to broaden your investment search and discover fast growing stocks with high insider ownership

With shares now trading well below analyst price targets and fundamentals showing modest growth, the key question emerges: does AptarGroup’s current valuation offer a buying opportunity, or is the market already pricing in future gains?

Most Popular Narrative: 27.2% Undervalued

AptarGroup’s consensus fair value is dramatically higher than its current market price, highlighting sharp optimism among analysts despite recent share declines.

Ongoing investments in innovation, such as next-generation nasal and derma dispensing systems and expansion into active material sciences, are anticipated to capture share in both pharmaceuticals and high-growth dermacosmetic markets. This strengthens AptarGroup's market leadership and supports long-term top-line growth.

Curious what’s fueling this premium? The real story lies in powerful growth forecasts, ambitious margin assumptions, and a future profit multiple that outpaces the entire sector. Want to see what projections make this price target possible? The numbers behind this narrative may surprise you.

Result: Fair Value of $177 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained legal costs or weaker pharma segment sales could still weigh on AptarGroup’s margins and challenge bullish valuation assumptions in the near term.

Find out about the key risks to this AptarGroup narrative.

Another View: Market Ratios Raise a Caution Flag

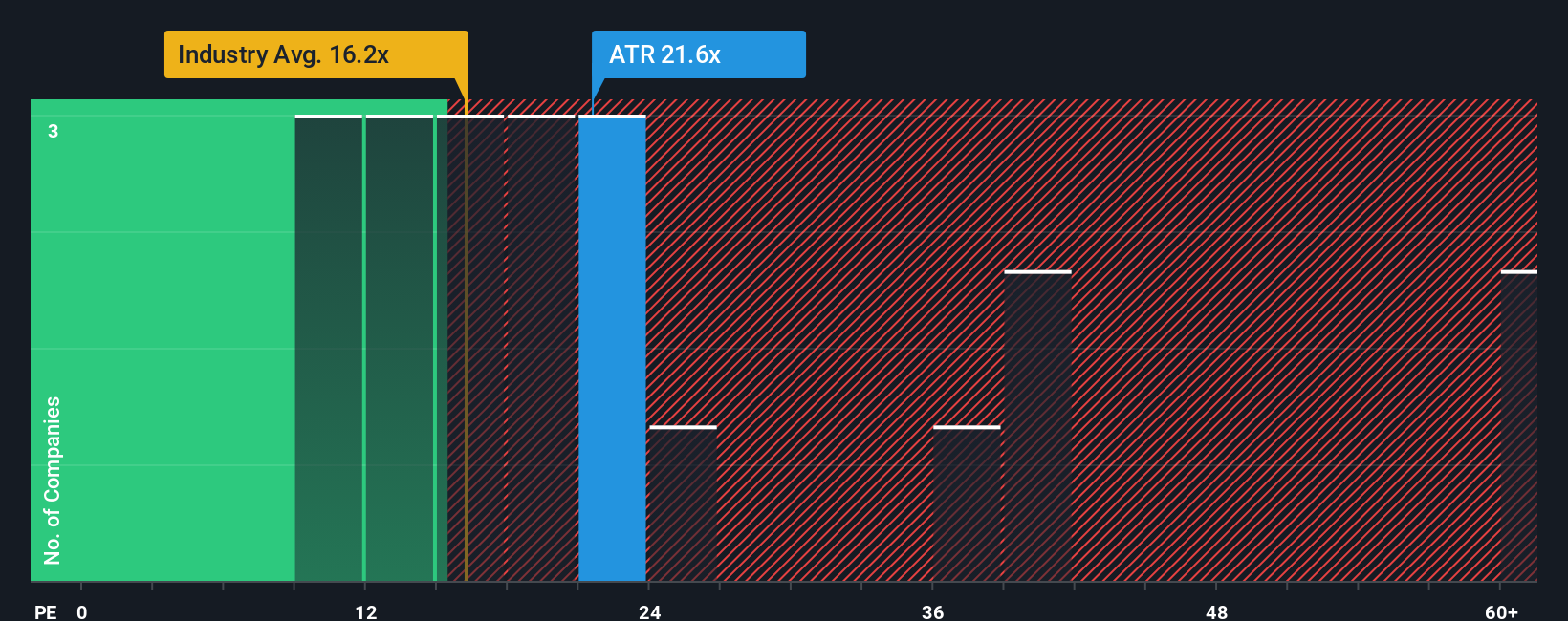

While analyst forecasts and price targets say AptarGroup is undervalued, a closer look at its price-to-earnings ratio tells a different story. Shares trade at 21.7 times earnings, which is steeper than the industry average of 16 and its fair ratio of 17. This gap suggests investors are paying a premium, leaving less margin for error if future results fall short. Does the market have the story right, or is optimism running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AptarGroup Narrative

If you see things differently, or want to shape your own perspective, you can easily dig into the data and craft your own story in just a few minutes: Do it your way

A great starting point for your AptarGroup research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your strategy when there’s a world of fresh opportunities waiting. Smart investors always keep their watchlist sharp. Here are a few you won’t want to overlook:

- Unlock potential high yields and steady cash flows by targeting companies from these 17 dividend stocks with yields > 3% with strong dividend records and robust financials.

- Capitalize on the AI revolution by examining these 27 AI penny stocks that are set to transform entire industries and drive future growth.

- Catch the next undervalued gem before the crowd by reviewing these 872 undervalued stocks based on cash flows offering attractive valuations based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATR

AptarGroup

Designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives