- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

These 4 Measures Indicate That Allegheny Technologies (NYSE:ATI) Is Using Debt In A Risky Way

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Allegheny Technologies Incorporated (NYSE:ATI) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Allegheny Technologies

What Is Allegheny Technologies's Debt?

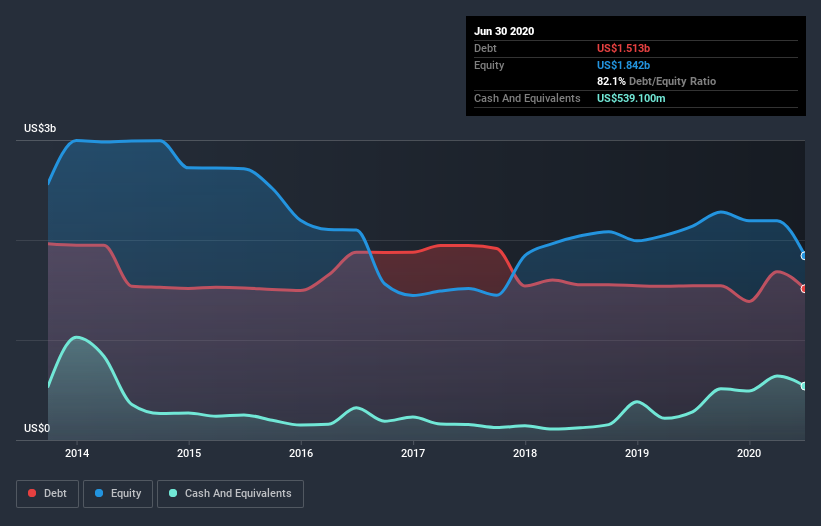

The chart below, which you can click on for greater detail, shows that Allegheny Technologies had US$1.49b in debt in June 2020; about the same as the year before. However, it also had US$539.1m in cash, and so its net debt is US$949.0m.

A Look At Allegheny Technologies's Liabilities

We can see from the most recent balance sheet that Allegheny Technologies had liabilities of US$614.4m falling due within a year, and liabilities of US$2.71b due beyond that. On the other hand, it had cash of US$539.1m and US$525.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.3b.

This deficit casts a shadow over the US$1.11b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Allegheny Technologies would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Allegheny Technologies has a debt to EBITDA ratio of 2.5 and its EBIT covered its interest expense 2.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Unfortunately, Allegheny Technologies's EBIT flopped 15% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Allegheny Technologies's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Allegheny Technologies's free cash flow amounted to 34% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Allegheny Technologies's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Taking into account all the aforementioned factors, it looks like Allegheny Technologies has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Allegheny Technologies .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Allegheny Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026