- United States

- /

- Chemicals

- /

- NYSE:APD

How Job Cuts and NEOM Progress May Shape Air Products' (APD) Clean Energy Ambitions

Reviewed by Sasha Jovanovic

- Air Products and Chemicals recently reported fiscal Q4 2025 results, slightly surpassing earnings forecasts with stable margins and announcing a 16% workforce reduction as part of cost-saving measures; the Board also declared a quarterly dividend of US$1.79 per share, payable in February 2026.

- An important insight is that the NEOM green hydrogen project is now nearly 90% complete, positioning the company for future growth in clean energy production as it maintains disciplined capital spending and cost management.

- With the cost-reset initiative and completion of a major project milestone, we'll examine what this means for Air Products and Chemicals' investment story.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Air Products and Chemicals Investment Narrative Recap

To be a shareholder in Air Products and Chemicals is to back its long-term bets on a low-carbon energy transition, including massive investments in hydrogen and ammonia. The recent quarterly update, highlighting stable margins, ongoing cost discipline, and the near-completion of the NEOM project, does not meaningfully change the near-term catalyst of successfully bringing new clean energy projects online, nor does it significantly reduce the biggest risk: ongoing capital requirements and project execution uncertainties.

Of the recent company news, the 16% workforce reduction announced in Q4 stands out in the context of current cost-control priorities. By trimming expenses during a period of elevated capital investment, the company aims to offset earnings pressure from delays or budget overruns in major projects, factors that remain critical for the EPS growth narrative as new facilities approach operational status.

Yet, while these steps may strengthen financial resilience, investors should also be aware that cost reductions alone cannot fully address the possibility of...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' outlook points to $14.9 billion in revenue and $3.8 billion in earnings by 2028. This scenario is based on a 7.4% annual revenue growth rate and a $2.2 billion increase in earnings from the current level of $1.6 billion.

Uncover how Air Products and Chemicals' forecasts yield a $310.76 fair value, a 20% upside to its current price.

Exploring Other Perspectives

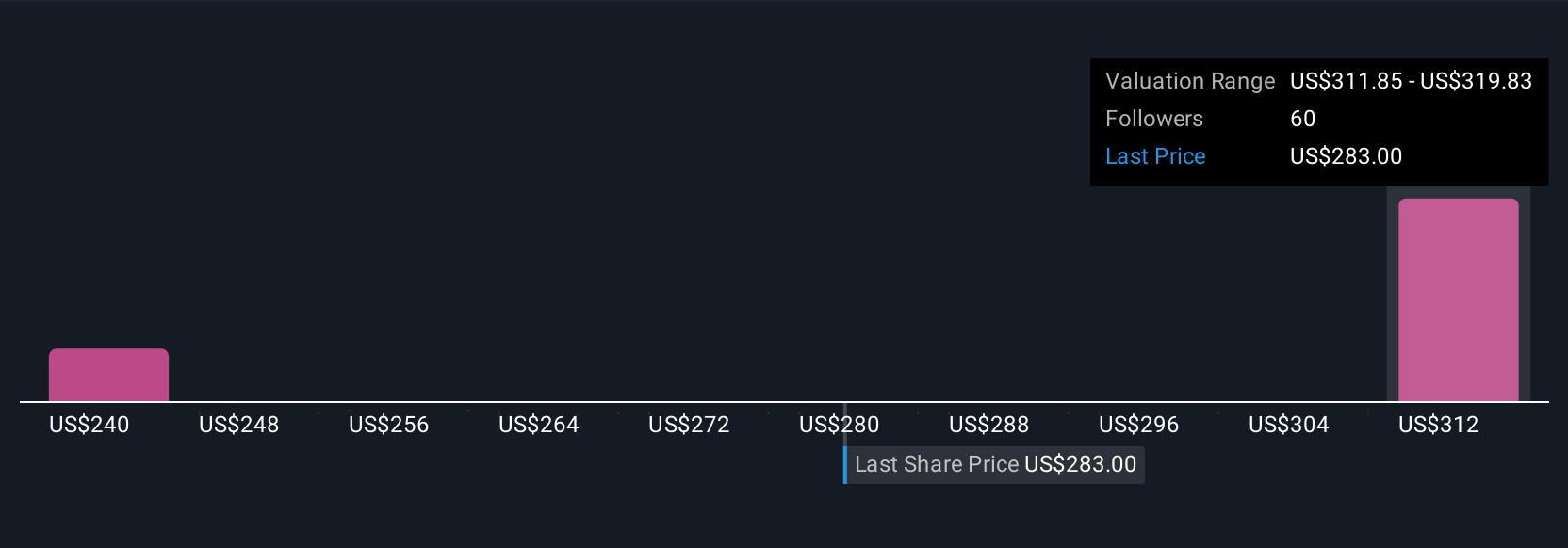

Fair value estimates from three Simply Wall St Community members range from US$297.10 to US$310.76 per share. While some foresee returns driven by major energy projects, ongoing capital expenditure needs remain a key consideration for future results.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth as much as 20% more than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

No Opportunity In Air Products and Chemicals?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success