- United States

- /

- Chemicals

- /

- NYSE:APD

Air Products and Chemicals (APD): Exploring Valuation After Q4 Earnings Beat and Hydrogen Milestones

Reviewed by Simply Wall St

Air Products and Chemicals (APD) caught the market’s attention after reporting fiscal Q4 earnings that edged past expectations. Strong operating margins and progress on its cost-reset initiative are keeping investor sentiment constructive.

See our latest analysis for Air Products and Chemicals.

Against this backdrop, Air Products and Chemicals has seen its momentum struggle recently, with the 1-year total shareholder return at -20.3% and the stock trading at $258.96. Although recent cost-cutting and progress on clean hydrogen projects have encouraged longer-term optimism, near-term share price returns remain subdued as investors weigh both growth potential and ongoing headwinds.

If you’re keeping an eye out for other standouts in the sector, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading below recent analyst price targets, the question remains: is Air Products and Chemicals being undervalued by the market, or has its expected growth already been fully accounted for in today’s price?

Most Popular Narrative: 16.7% Undervalued

Air Products and Chemicals' narrative fair value sits well above its most recent closing price, suggesting that market pessimism may be overdone as forward-looking assumptions get re-examined.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (such as the Middle East, Asia, and the U.S. Gulf Coast), are set to come online over the next several years. These are expected to provide robust and stable earnings and support a trajectory of consistently higher operating margins.

Curious about the bold revenue and margin moves that underpin this narrative's high valuation? Find out what big growth leaps and daring profit assumptions drive the gap between market and narrative. The secret lies in forecasts usually reserved for industry disruptors. Will you agree with the strategy, or spot something the consensus is missing?

Result: Fair Value of $310.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost overruns on key hydrogen projects or extended softness in helium markets could quickly dampen Air Products and Chemicals’ positive long-term outlook.

Find out about the key risks to this Air Products and Chemicals narrative.

Another View: How Do Market Ratios Compare?

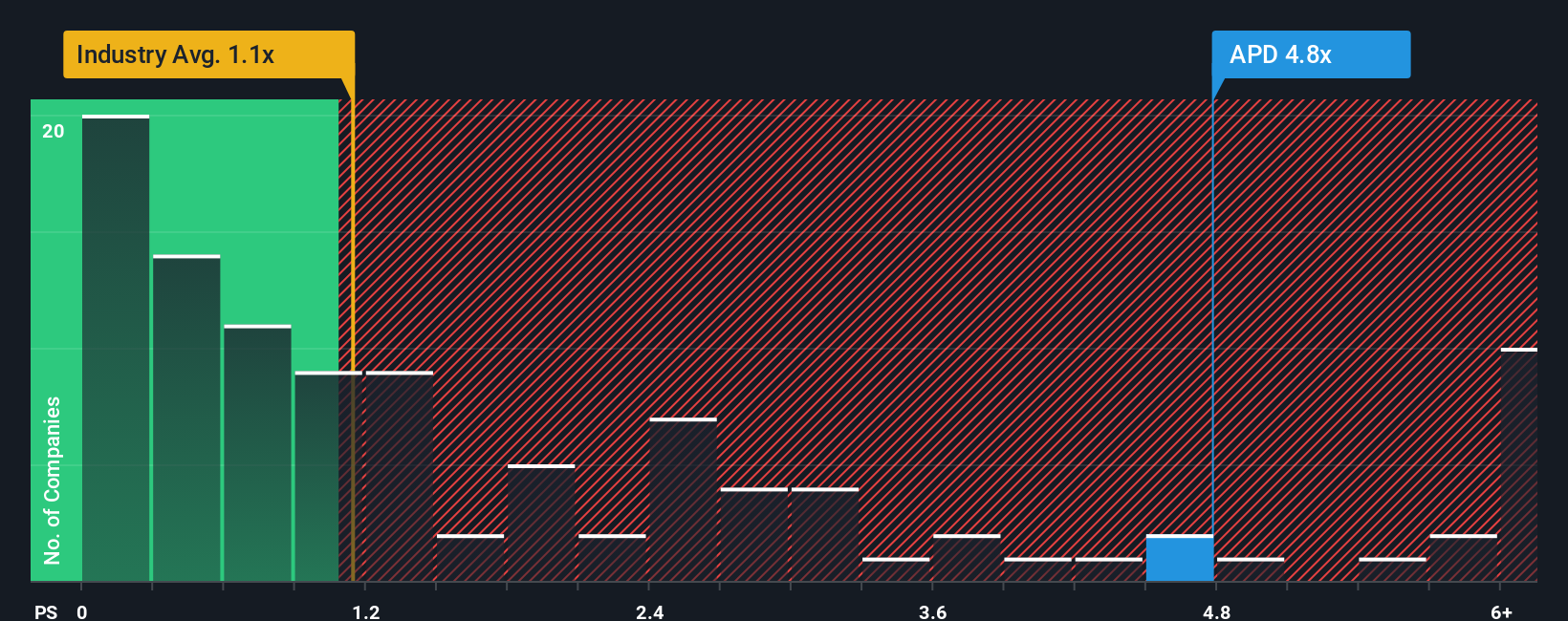

Looking at valuation through the lens of the price-to-sales ratio provides a different perspective. Air Products and Chemicals is currently valued at 4.8 times sales, which is noticeably above both the US Chemicals industry average of 1.1 and its own fair ratio of 2.4. This suggests the stock might be pricing in a lot of optimism already. Will future execution justify this premium, or is there downside risk if reality falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Air Products and Chemicals Narrative

If you see things differently or want to dig deeper, explore the available data and craft your own outlook in just a few minutes. Do it your way

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stick to the usual picks when you can unlock investment ideas that others overlook? Give yourself the advantage and expand your watchlist with unique opportunities below.

- Spot undervalued potential before the crowd jumps in by checking out these 926 undervalued stocks based on cash flows with robust fundamentals and upside based on real cash flow analysis.

- Boost your income prospects and stability as you see these 15 dividend stocks with yields > 3% offering yields over 3%, which may appeal to both seasoned and new investors seeking reliable returns.

- Get ahead of the next AI breakthrough as you track these 25 AI penny stocks using artificial intelligence to transform industries and identify tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success