- United States

- /

- Packaging

- /

- NYSE:AMCR

How Amcor’s (AMCR) Global Innovation Challenge Could Shape Its Leadership in Sustainable Packaging

Reviewed by Sasha Jovanovic

- Amcor recently launched the Lift-Off Winter 2025/26 Challenge, inviting global start-ups to collaborate on new technologies for sustainable flexible and paper-based packaging, including home-compostable adhesives and nature-based barrier additives.

- This initiative could accelerate the development of more eco-friendly packaging materials, positioning Amcor at the forefront of sustainability-driven innovation in the packaging industry.

- We'll explore how Amcor's open-innovation push in sustainability could strengthen its longer-term investment narrative and market positioning.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Amcor Investment Narrative Recap

Staying invested in Amcor means believing the company can unlock growth drivers, like synergy realization from its Berry Global merger and leadership in sustainable packaging, while managing ongoing volume pressures and a complex portfolio review. The recently launched Lift-Off Winter 2025/26 Challenge spotlights Amcor’s commitment to sustainability-led innovation but does not materially impact the near-term catalyst, which remains delivering targeted cost synergies or addressing stagnating volume trends; likewise, it does not alter the key risk of persistent weak demand or challenging divestitures in North America.

Among recent developments, Amcor’s approval of a reverse stock split earlier this month is especially pertinent, as it could affect share price optics and liquidity, although the main investment focus remains on improving profit margins and optimizing the company’s business mix after the Berry Global deal.

By contrast, investors should pay close attention to the sizable portion of Amcor’s annual sales now under portfolio review, given the risk of...

Read the full narrative on Amcor (it's free!)

Amcor is projected to reach $24.3 billion in revenue and $1.7 billion in earnings by 2028. This outlook requires a 17.5% annual revenue growth rate and an earnings increase of $1.19 billion from the current $510 million.

Uncover how Amcor's forecasts yield a $10.41 fair value, a 22% upside to its current price.

Exploring Other Perspectives

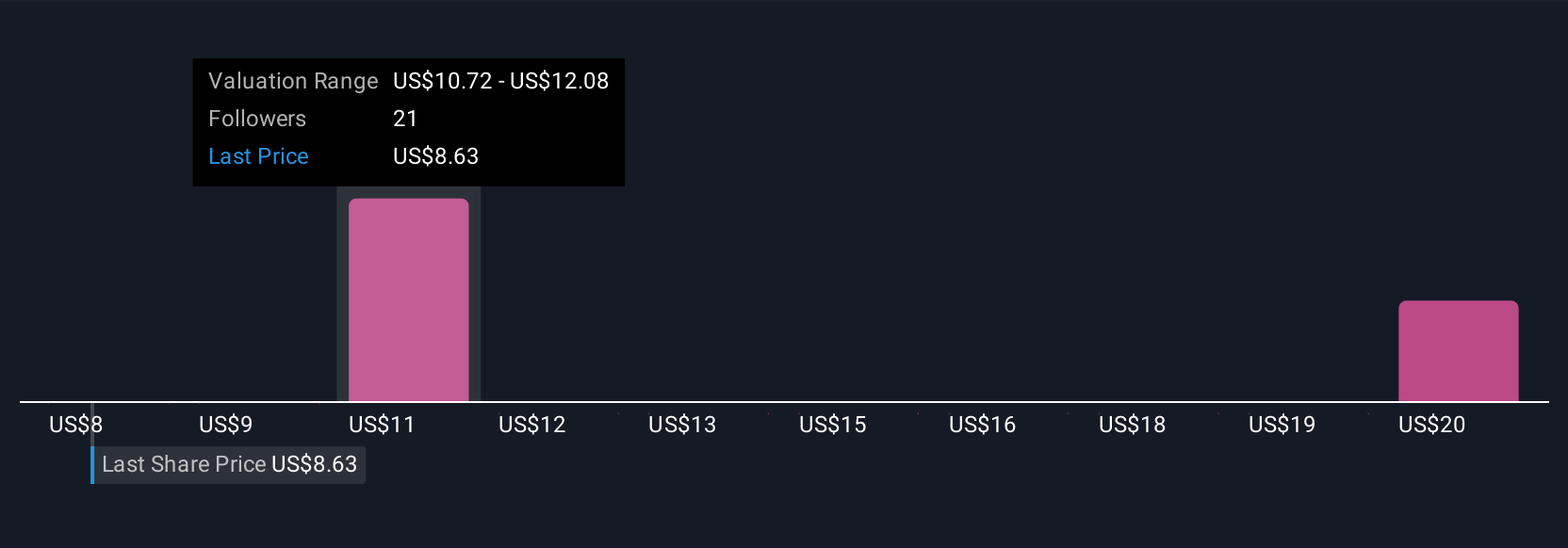

Simply Wall St Community members provided six separate fair value estimates for Amcor, spanning from US$8.43 to US$20.83 per share. With these divergent outlooks in mind, keep in focus that asset sales or restructuring costs from the ongoing portfolio review could shape future profitability and returns.

Explore 6 other fair value estimates on Amcor - why the stock might be worth over 2x more than the current price!

Build Your Own Amcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Amcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amcor's overall financial health at a glance.

No Opportunity In Amcor?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives