- United States

- /

- Packaging

- /

- NYSE:AMCR

Assessing Amcor (NYSE:AMCR) Valuation After Recent Flat Performance and Shifting Market Sentiment

Reviewed by Simply Wall St

Amcor (AMCR) has been showing limited movement recently, with the stock finishing near flat over the past month. Investors are taking note because broader packaging industry trends continue to shape expectations for the quarters ahead.

See our latest analysis for Amcor.

While Amcor's share price has seen a modest rebound lately, longer-term momentum has faded. Its 1-year total shareholder return sits at -16.5%, underscoring the shift in market sentiment despite pockets of operational growth.

If you’re weighing your next move, broaden your investing horizons and discover fast growing stocks with high insider ownership

With Amcor trading below analyst price targets but grappling with sluggish returns, the question for investors is clear: is this current weakness a sign of undervaluation, or is the market already factoring in all growth potential?

Most Popular Narrative: 22.6% Undervalued

With the most-followed narrative estimating a fair value well above Amcor’s last close, the spotlight is firmly on the potential gap between market and analyst expectations.

The company's leadership and continued investment in sustainable, recyclable, and reusable packaging solutions aligns Amcor with strengthening regulatory and consumer demand for eco-friendly products. This enables market share gains and price premiums, supporting both revenue and margin improvement.

Want to see what’s fueling that high fair value? The future price leans on industry-shaking growth ambitions, bold margin expansion, and aggressive market moves. The core of the narrative hinges on a dramatic transformation in Amcor's financial story, but the quantitative assumptions behind it just might surprise you. Find out what the consensus expects to drive this valuation jump.

Result: Fair Value of $10.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volume declines or delays in synergy gains from acquisitions could pose challenges to the optimism surrounding Amcor’s medium-term upside and valuation narrative.

Find out about the key risks to this Amcor narrative.

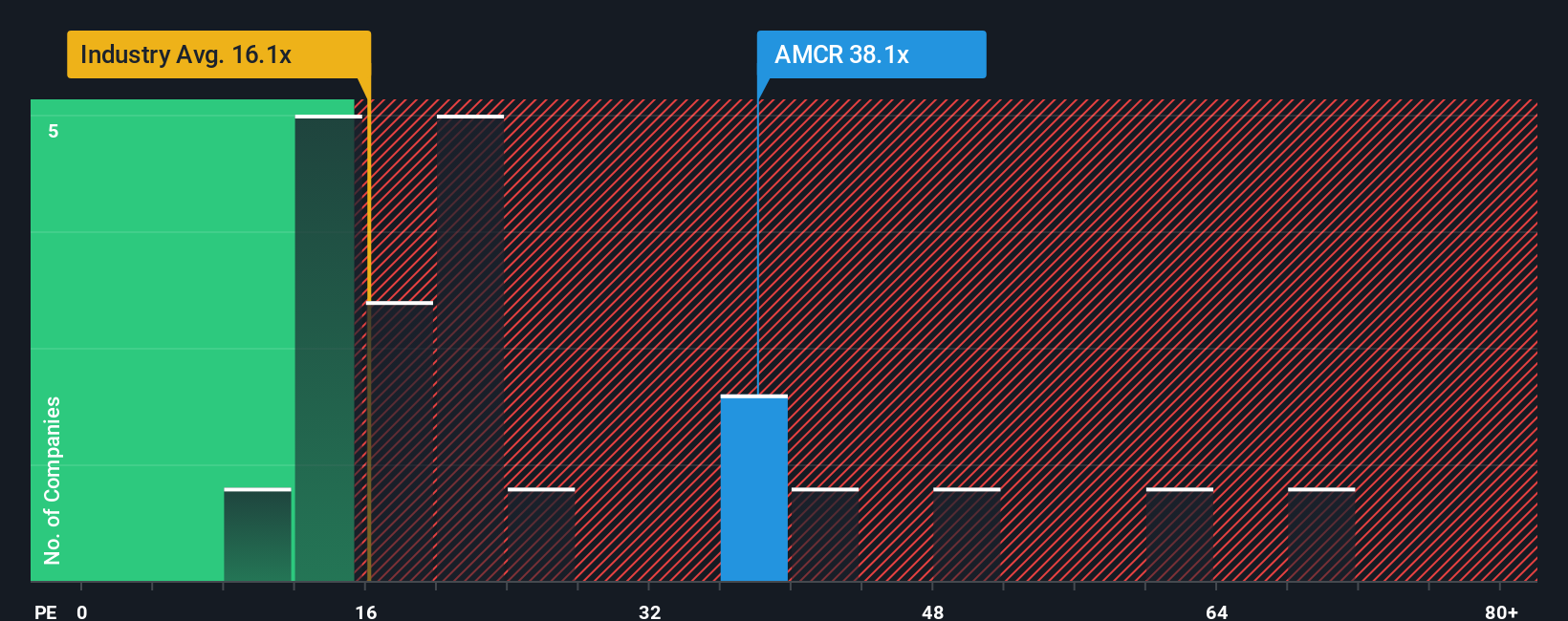

Another View: A Look at Price Multiples

Using market price ratios, Amcor’s current valuation tells a different story. The company trades at a price-to-earnings ratio of 36.5x, which is much higher than the industry average of 16.3x and even further above its peer average of 19.5x. The fair ratio, or what the market could eventually move towards, is 25.9x. This substantial gap raises concern that the stock may be priced above its fundamentals, signaling potential downside risk if market sentiment shifts. Could investor optimism be setting up for a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amcor Narrative

If the consensus narrative doesn’t reflect your perspective or you like to form your own conclusions from the numbers, you can craft your own in just a few minutes. Do it your way

A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Supercharge your portfolio by taking action on powerful trends that others may miss. The right screen could reveal your next standout opportunity. Do not let it pass you by.

- Tap into the unstoppable momentum of artificial intelligence by checking out these 26 AI penny stocks, which are redefining how industries operate and unlocking new market leaders.

- Maximize your returns with these 840 undervalued stocks based on cash flows that appear primed for a turnaround, based on strong underlying fundamentals and attractive prices.

- Boost your income stream instantly by choosing from these 20 dividend stocks with yields > 3% that consistently deliver yields above 3 percent for reliable long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives