Amcor plc (NYSE:AMCR) will increase its dividend from last year's comparable payment on the 11th of December to $0.1275. This will take the dividend yield to an attractive 5.0%, providing a nice boost to shareholder returns.

Check out our latest analysis for Amcor

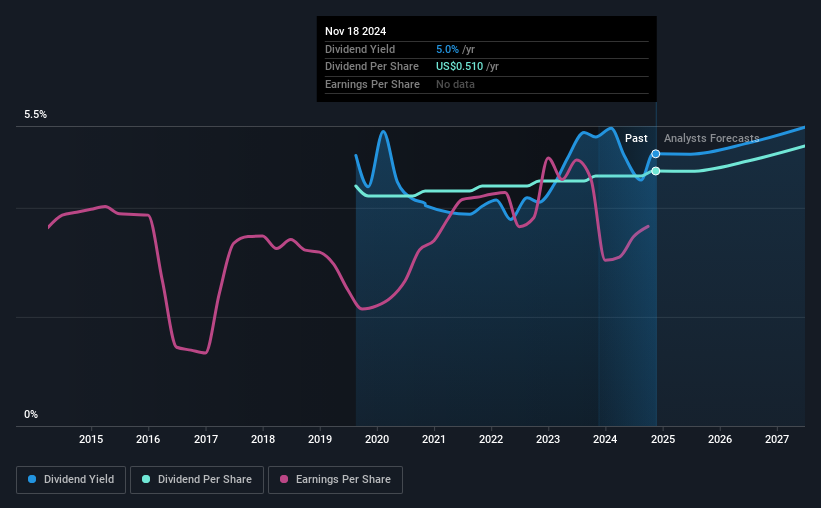

Amcor's Projected Earnings Seem Likely To Cover Future Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. At the time of the last dividend payment, Amcor was paying out a very large proportion of what it was earning and 109% of cash flows. This is certainly a risk factor, as reduced cash flows could force the company to pay a lower dividend.

The next year is set to see EPS grow by 37.8%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 70% which would be quite comfortable going to take the dividend forward.

Amcor Is Still Building Its Track Record

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2019, the dividend has gone from $0.48 total annually to $0.51. This works out to be a compound annual growth rate (CAGR) of approximately 1.2% a year over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Amcor's Dividend Might Lack Growth

The company's investors will be pleased to have been receiving dividend income for some time. Amcor has seen EPS rising for the last five years, at 11% per annum. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Amcor's payments are rock solid. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Amcor that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMCR

Amcor

Develops, produces, and sells packaging products in Europe, North America, Latin America, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives