- United States

- /

- Chemicals

- /

- NYSE:ALB

A Look at Albemarle (ALB) Valuation Following US-China Tensions and Critical Mineral Demand Surge

Reviewed by Kshitija Bhandaru

Albemarle, a leading lithium producer, saw its stock climb after renewed geopolitical tensions between the US and China shifted investor focus toward critical mineral suppliers. Expectations for increased demand for lithium and upbeat sector sentiment have supported this move.

See our latest analysis for Albemarle.

Albemarle’s share price has surged over 26% in the past month alone, building solid momentum on the back of geopolitical headlines and growing enthusiasm for lithium demand in electric vehicles. While the short-term price return is impressive, total shareholder return over the past year is still slightly negative. This highlights how much sentiment has shifted recently.

If you’re considering where sector momentum could spark the next opportunity, this is a great moment to discover fast growing stocks with high insider ownership

Yet after such a rapid rally and with optimism running high, investors are left wondering if Albemarle is undervalued at current levels or if the market is already pricing in all the future lithium growth.

Most Popular Narrative: 9.7% Overvalued

With Albemarle’s last close at $96.34 and the most followed narrative assigning a fair value of $87.79, there is a visible premium in market price. This dynamic spotlights why many are questioning the optimism priced into the shares right now.

Secular policy tailwinds, such as the US Inflation Reduction Act and EU emissions targets, are incentivizing domestic lithium sourcing and battery production. This could potentially allow Albemarle to command premium pricing, expand market share through its US and Chilean assets, and lock in future revenue growth as sustainability and supply chain localization accelerate.

What is driving analysts to put a higher price on Albemarle? The fair value stems from ambitious projections for future profit margins, revenue expansion, and long-term cash flows, all influenced by regulatory policy shifts. Uncover the exact growth assumptions and scrutinize the high-stakes narrative powering this valuation.

Result: Fair Value of $87.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering oversupply concerns and volatility in lithium prices could quickly erode Albemarle’s margin gains. This may challenge the optimistic long-term outlook.

Find out about the key risks to this Albemarle narrative.

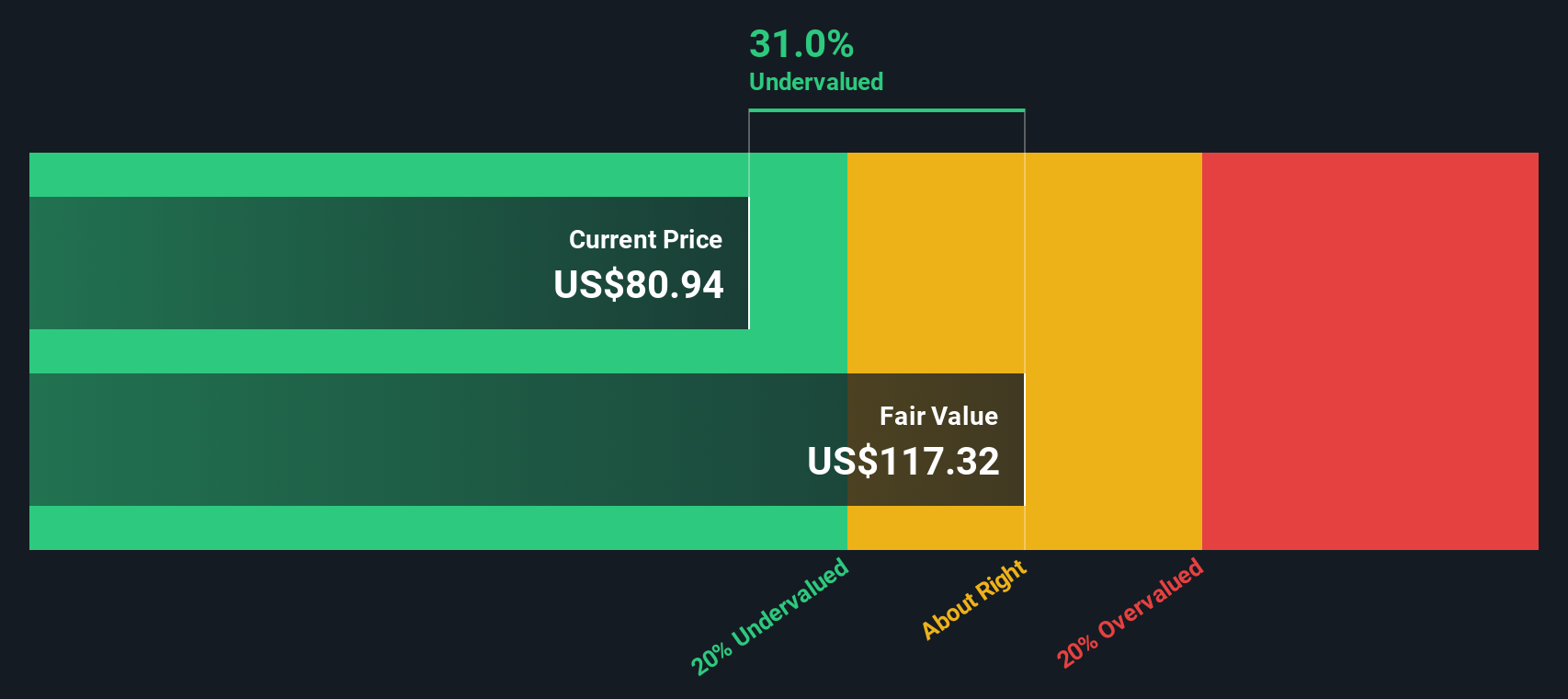

Another View: Discounted Cash Flow Suggests Undervaluation

Changing the perspective, our DCF model estimates Albemarle’s fair value at $153.60 per share, which is well above its current market price. This indicates the stock could be significantly undervalued if its long-term cash flows develop as projected. Which method best represents Albemarle’s true potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albemarle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albemarle Narrative

If you want a fresh perspective or simply prefer to dive into the data yourself, you can piece together your own story about Albemarle in just a few minutes. Do it your way

A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd and expand your watchlist with fresh opportunities you might be missing in today’s fast-paced markets. Don’t let these trends pass you by. Put your money to work where it matters most.

- Unlock potential growth by checking out these 881 undervalued stocks based on cash flows companies that the market may be overlooking right now.

- Target strong passive income streams by reviewing these 18 dividend stocks with yields > 3% offering yields above 3% for your portfolio.

- Ride the surge in innovation and get in early on these 25 AI penny stocks shaping the future of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion