- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Is There Still Upside After Strong Multi-Month Momentum?

Reviewed by Simply Wall St

Agnico Eagle Mines (NYSE:AEM) has continued to capture investors’ attention, especially as recent price swings show a mixed month but strong performance over the past three months. Gold sector dynamics remain central as traders weigh the stock’s momentum and fundamentals.

See our latest analysis for Agnico Eagle Mines.

After a stellar multi-year run, Agnico Eagle Mines' 1-year total shareholder return of 105.6% and a 90-day share price return of nearly 23% highlight how momentum has been steadily building. Recent swings are a reminder that gold stocks can move quickly as sentiment shifts, but the bigger picture remains undeniably strong.

If the recent surge in Agnico Eagle Mines has you looking for your next opportunity, now is a perfect time to discover fast growing stocks with high insider ownership

Yet with such impressive gains, investors are left wondering whether Agnico Eagle Mines is still undervalued, or if the latest rally means future growth is already reflected in the price, leaving little room for upside.

Most Popular Narrative: 11.2% Undervalued

With Agnico Eagle Mines closing at $167.67 and the widely followed fair value estimate at $188.80, there is a notable gap between the current price and where consensus expects it to be. This divergence sets the stage for a narrative that leans on sector catalysts and powerful projections.

Exploration success and rapid reserve expansion near key long-life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth. This supports a long runway of high-quality, low-risk volume expansion that can drive top-line revenue growth and production leverage.

Want to know what’s behind this aggressive valuation? The most influential assumption hinges on massive output expansion from freshly discovered reserves and a bold ramp-up in production. Curious about which numbers are powering these future projections, and if the market has fully priced them in? The full narrative reveals the details driving this potential upside.

Result: Fair Value of $188.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained drop in gold prices or major project delays could quickly undermine many bullish assumptions that support the current outlook.

Find out about the key risks to this Agnico Eagle Mines narrative.

Another View: Valuation Based on Market Comparisons

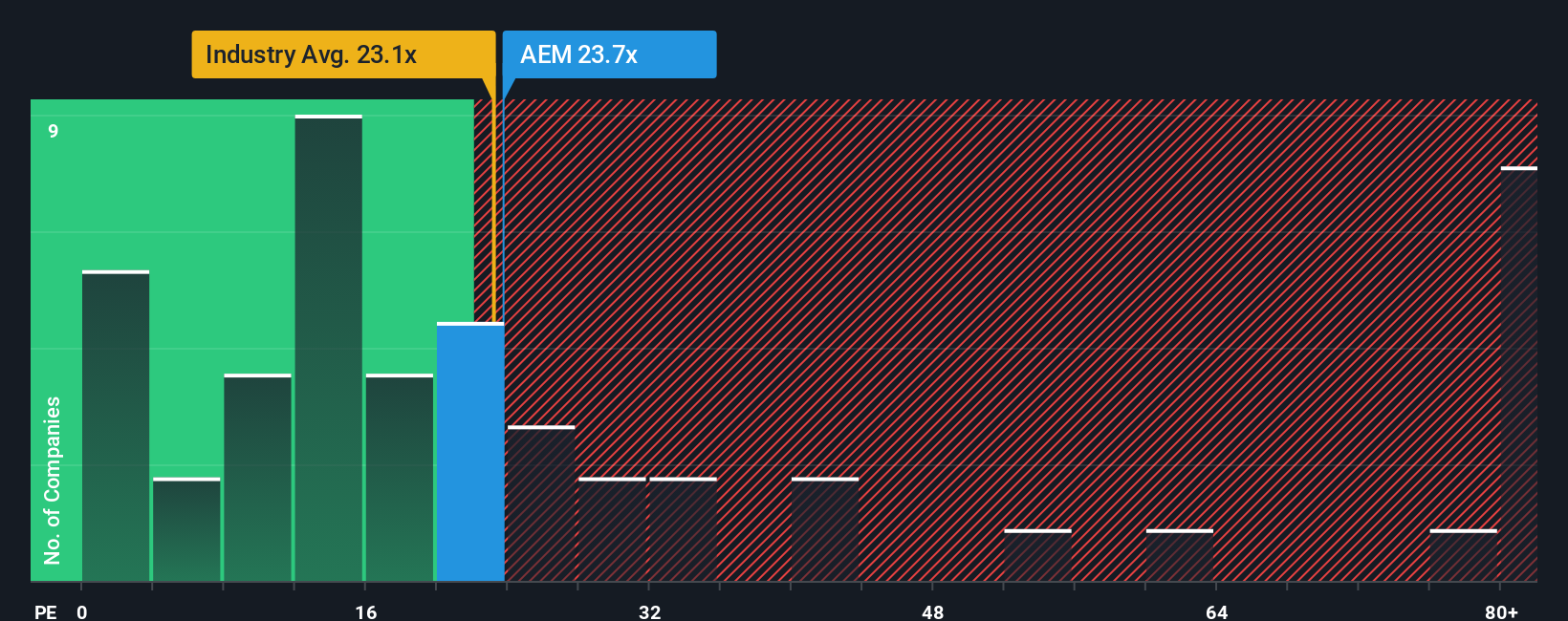

Taking a step back from fair value estimates, Agnico Eagle Mines trades at a price-to-earnings ratio of 24.4x. This is notably higher than both the US Metals and Mining industry average of 20.6x and the average of its direct peers at 22x, as well as above its fair ratio of 22.7x. This higher valuation implies investors are paying a premium for the company's momentum and prospects. However, it also introduces valuation risk if market sentiment shifts or growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agnico Eagle Mines Narrative

If you see things differently, or want to dig deeper into the data firsthand, you can build your own perspective quickly and easily in just a few minutes. Do it your way

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity. The Simply Wall Street Screener is your shortcut to spotting what others miss and making smarter, faster moves across the market.

- Capture the potential of high-yield assets by tapping into these 15 dividend stocks with yields > 3%, delivering reliable income streams for your portfolio.

- Accelerate your search for tech innovation by checking out these 26 AI penny stocks, poised to lead in artificial intelligence advancements.

- Secure tomorrow’s winners early and unlock value with these 908 undervalued stocks based on cash flows, which remain overlooked despite strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives