- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Fresh Results and Confident Guidance Spark New Valuation Debate

Reviewed by Simply Wall St

Agnico Eagle Mines (NYSE:AEM) just posted some eye-catching quarterly results, with strong year-over-year gains in both net income and earnings per share. The company also chose to reaffirm its full-year gold production guidance, which signals operational consistency and management’s positive outlook.

See our latest analysis for Agnico Eagle Mines.

There’s been no shortage of headlines for Agnico Eagle Mines lately, with standout earnings, a steady dividend, and ongoing share buybacks all helping to shape sentiment around the stock. These moves appear to have energized investors, with the most recent 1-year total shareholder return surging an impressive 94.9%. Momentum looks strong, which shows the market is increasingly confident about the company’s growth and stability.

If Agnico’s strong run has you thinking about where to look next, now is the perfect moment to broaden your investment search and discover fast growing stocks with high insider ownership

With shares nearing record highs and strong results fueling optimism, investors are left wondering whether Agnico Eagle Mines is still undervalued or if the market is already pricing in the company’s next phase of growth.

Most Popular Narrative: 15.4% Undervalued

According to the most popular narrative, Agnico Eagle Mines’ fair value estimate sits well above its latest closing price, suggesting further upside may exist just as optimism peaks. This setup is driving debate over what is fueling such a bullish outlook, especially as gold prices hover near highs.

“Exploration success and rapid reserve expansion near key long-life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth. This supports a long runway of high-quality, low-risk volume expansion that can drive top-line revenue growth and production leverage.”

Want to know what is behind this surprisingly high valuation? The narrative hinges on assumptions you do not see every day such as aggressive future growth, expanding margins, and strong leverage to underlying commodity trends. Curious which bold financial forecasts justify such a big gap to market price? Dig into the full story behind the narrative to uncover the hidden math.

Result: Fair Value of $188.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in gold prices or unexpected operational hurdles could quickly challenge these optimistic projections and affect both earnings and the company’s valuation.

Find out about the key risks to this Agnico Eagle Mines narrative.

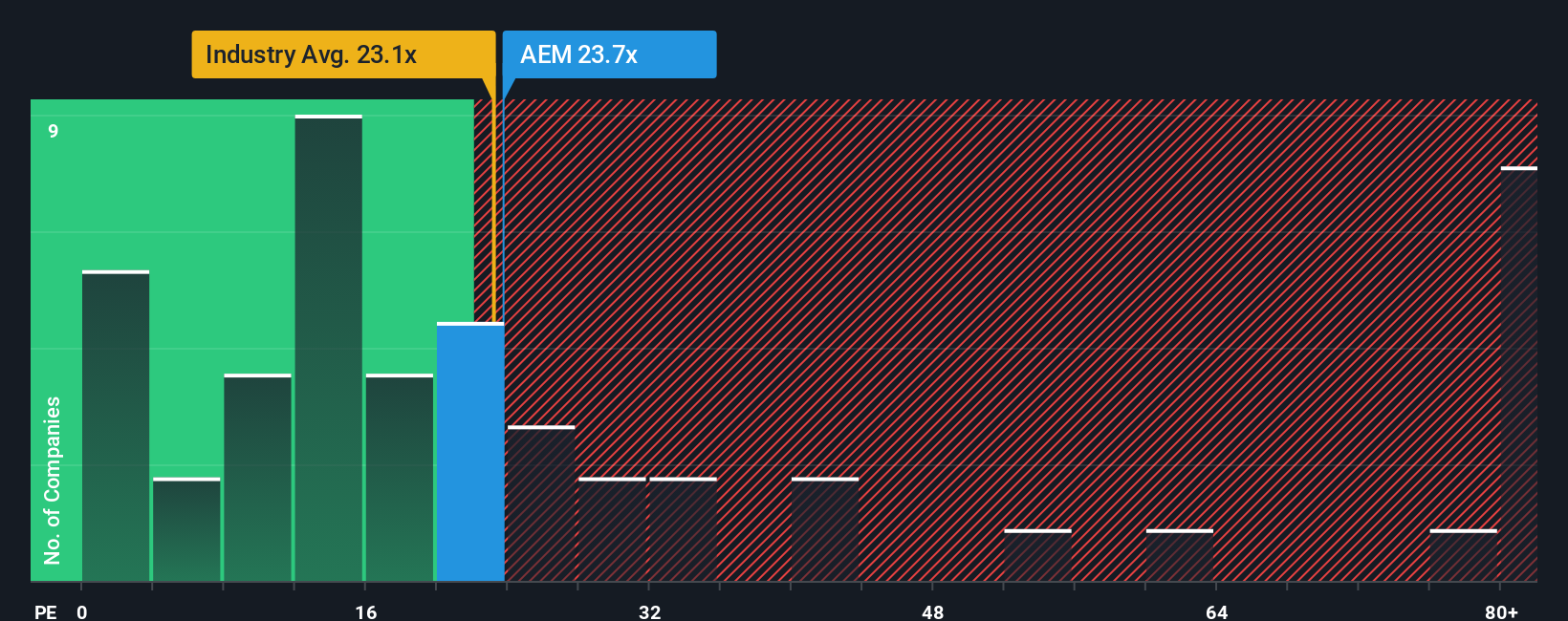

Another View: Multiples Suggest a Different Story

While the fair value estimate hints Agnico Eagle Mines could be undervalued, comparing its price-to-earnings ratio of 23.3x to industry (22.3x), peer average (21.5x), and the fair ratio (22x) shows the shares are actually trading at a premium. This signals more valuation risk if sentiment shifts or gold prices retreat. Should investors rethink the risks of chasing recent momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agnico Eagle Mines Narrative

If you see things differently or would rather reach your own conclusions, you can explore the numbers yourself and shape a unique perspective in just minutes, then Do it your way

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to a single opportunity when the market is packed with promising options. Smart investors keep an edge by acting early on emerging trends. Simply Wall Street’s Screeners make it easy.

- Catch new growth by targeting strong companies with attractive payouts through these 20 dividend stocks with yields > 3% and pursue reliable income streams others miss.

- Tap into technology’s boldest frontier and make your move into tomorrow’s breakthroughs with these 26 AI penny stocks built around artificial intelligence innovation.

- Maximize long-term value when you spot mispriced gems using these 838 undervalued stocks based on cash flows, and set yourself up to benefit before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives