- United States

- /

- Basic Materials

- /

- NasdaqGS:USLM

Why Investors Shouldn't Be Surprised By United States Lime & Minerals, Inc.'s (NASDAQ:USLM) 26% Share Price Surge

Despite an already strong run, United States Lime & Minerals, Inc. (NASDAQ:USLM) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 118% following the latest surge, making investors sit up and take notice.

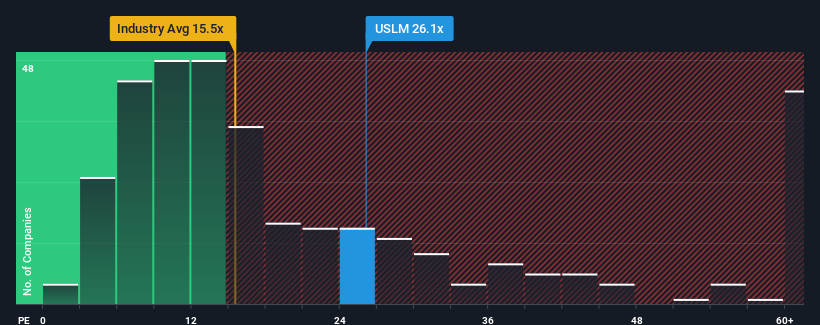

Following the firm bounce in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider United States Lime & Minerals as a stock to avoid entirely with its 26.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for United States Lime & Minerals as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for United States Lime & Minerals

Is There Enough Growth For United States Lime & Minerals?

There's an inherent assumption that a company should far outperform the market for P/E ratios like United States Lime & Minerals' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 48%. The strong recent performance means it was also able to grow EPS by 166% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why United States Lime & Minerals is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From United States Lime & Minerals' P/E?

United States Lime & Minerals' P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of United States Lime & Minerals revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for United States Lime & Minerals you should know about.

Of course, you might also be able to find a better stock than United States Lime & Minerals. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:USLM

United States Lime & Minerals

Manufactures and supplies lime and limestone products in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives