- United States

- /

- Basic Materials

- /

- NasdaqGS:USLM

Does USLM’s Dividend and Sales Surge Reflect Operational Strength or Mask Deeper Business Shifts?

Reviewed by Sasha Jovanovic

- United States Lime & Minerals, Inc. recently reported third-quarter 2025 results, highlighting strong sales of US$102.02 million and net income of US$38.78 million, alongside a regular quarterly cash dividend of US$0.06 per share payable December 12, 2025.

- The company’s improved year-over-year financials point to robust operational execution and may signal continued momentum for its core business lines.

- We’ll examine how United States Lime & Minerals’ rising sales growth supports its overall investment narrative and operational outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is United States Lime & Minerals' Investment Narrative?

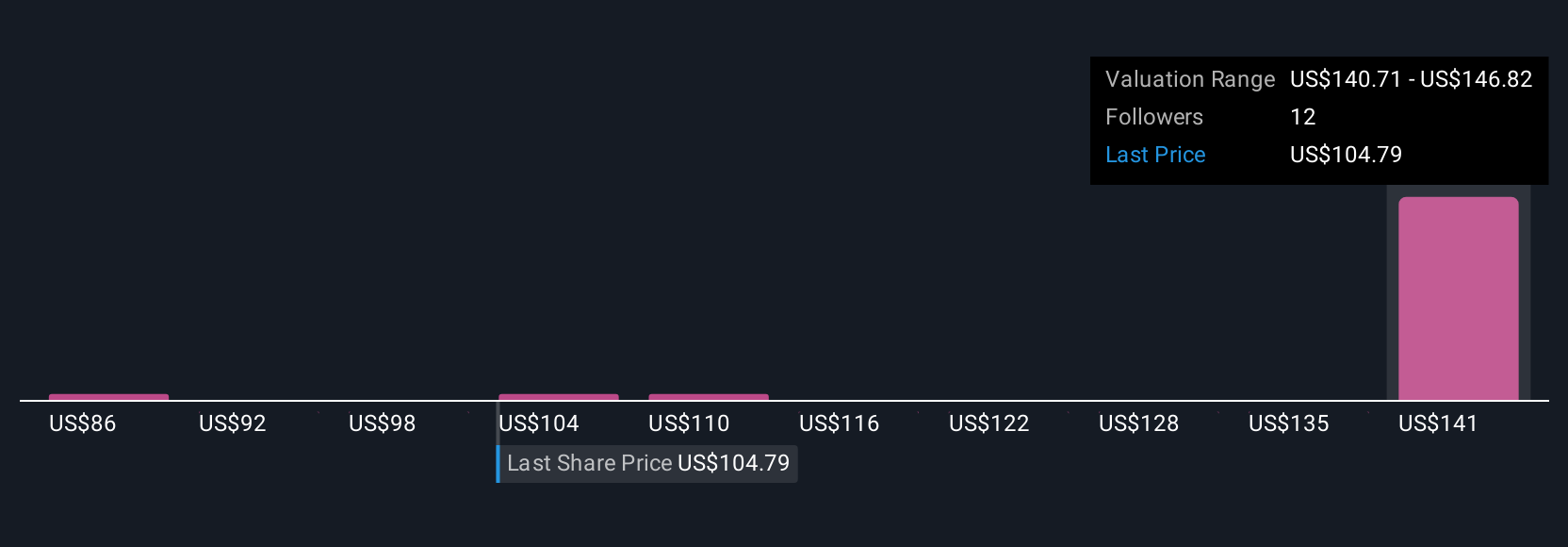

For anyone considering United States Lime & Minerals as an investment, the big picture hinges on the company's ability to drive steady earnings growth and manage cost pressures in a cyclical basic materials sector. The just-reported third-quarter results show another period of expanding sales and net income, which may reinforce confidence in management's operational strength. Announcing a consistent US$0.06 quarterly dividend could offer some short-term reassurance, suggesting financial stability even with recent share price volatility. While this strong financial update provides momentum on the revenue front, previous analysis highlighted risks such as USLM’s premium valuation versus industry averages and recent insider selling. At the same time, the recent decline in share price seems out of step with these latest positive earnings, potentially altering some risk narratives, especially if this operational momentum persists. Ultimately, the impact of this news may lessen near-term concerns about slowing revenue, but will not eliminate underlying sector risks or valuation headwinds.

On the flip side, recent insider selling is a risk that shouldn’t be overlooked.

Exploring Other Perspectives

Explore 4 other fair value estimates on United States Lime & Minerals - why the stock might be worth 25% less than the current price!

Build Your Own United States Lime & Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Lime & Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United States Lime & Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Lime & Minerals' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:USLM

United States Lime & Minerals

Manufactures and supplies lime and limestone products in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives