- United States

- /

- Metals and Mining

- /

- NasdaqGM:USAR

Should You Reconsider USA Rare Earth After Its 64% Weekly Surge and Fresh US Supply Chain News?

Reviewed by Bailey Pemberton

If you’re wondering what to do next with USA Rare Earth stock, you’re definitely not alone. After all, with a stock price that just soared 64.5% in the last week, doubled over the past 30 days, and nearly tripled year-to-date with a 128.5% gain, this company isn’t exactly flying under the radar anymore. The huge 162.2% return over the past year has left investors questioning whether the story here is sustained growth or simply heightened risk perception.

Part of this surge can be traced to recent market interest in rare earth minerals, especially as the United States looks to strengthen its supply chains for critical materials. Developments around government support and shifting global dynamics have made the sector more appealing to long-term investors, as well as traders looking for rapid moves.

But no matter how exciting the headlines, you don’t want to overpay. If you’re like me, you’re curious about the company’s actual value, and that’s where a valuation score comes in handy. For USA Rare Earth, the latest value score is 2 out of 6. In other words, it only checks off 2 boxes out of 6 for being potentially undervalued, so it’s not exactly screaming “bargain buy” at these levels.

In the next section, I’ll break down the valuation approaches behind that score, including how USA Rare Earth measures up to its peers, before sharing a smarter, more nuanced way to see where value might truly lie at the end of this article.

USA Rare Earth scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Rare Earth Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future free cash flows and discounting them back to their present value in dollars. This approach captures not just what the business is making now but also how much it could generate in the years ahead, helping investors gauge whether the stock price reflects its true potential.

For USA Rare Earth, the latest data shows current Free Cash Flow at -$31.48 Million, which means the company is presently burning cash. Analyst estimates are available for the next four years, with negative free cash flows expected through 2027, reflecting the capital-intensive early stages. Looking further ahead, projections show a turnaround beginning in 2028 with Free Cash Flow estimated at $46.86 Million, turning positive and accelerating rapidly. By 2029, Free Cash Flow is expected to reach $122.58 Million, and the forecasting model extrapolates double-digit annual growth through 2035.

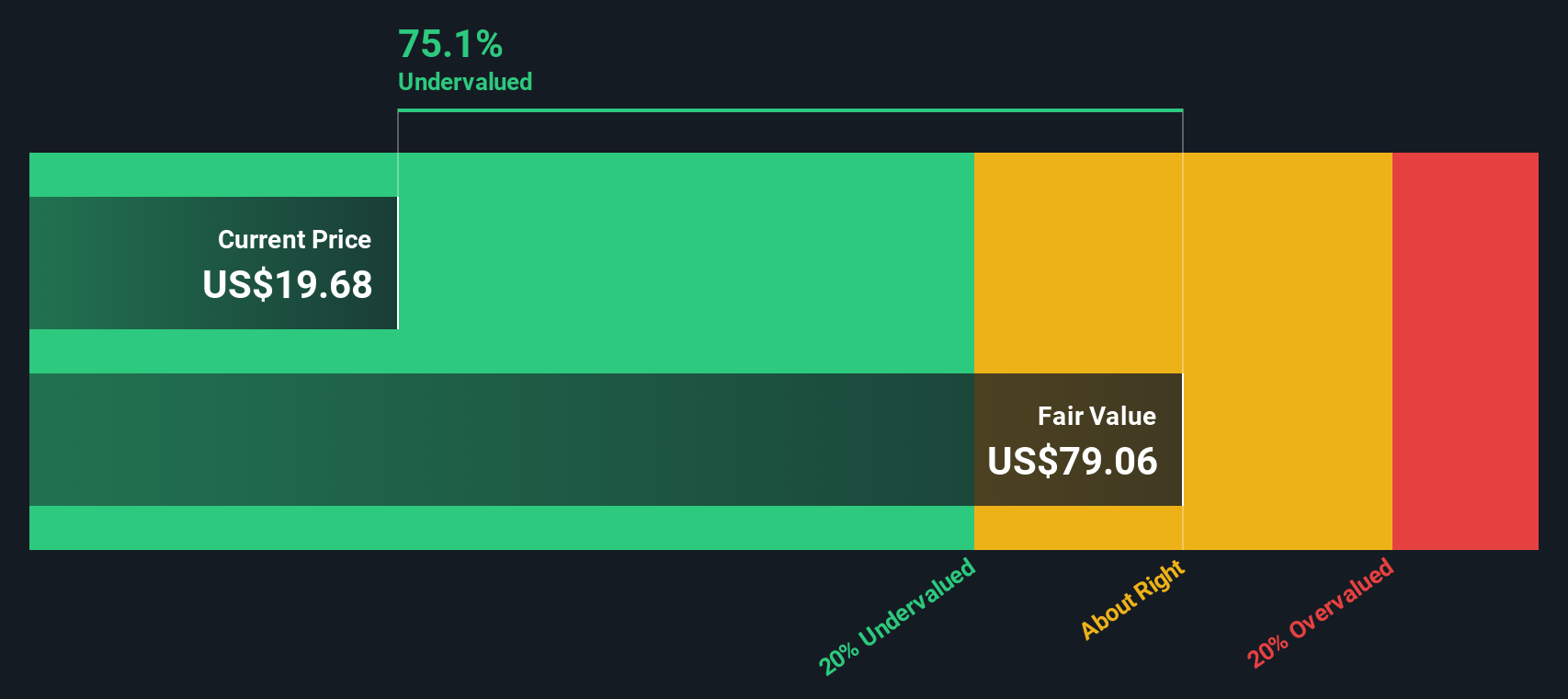

Based on these projections and discounting all future flows, the DCF-derived intrinsic value of USA Rare Earth lands at $80.61 per share. With the current market price sitting approximately 64.9% below this estimate, the analysis signals that the stock could be deeply undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Rare Earth is undervalued by 64.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: USA Rare Earth Price vs Book

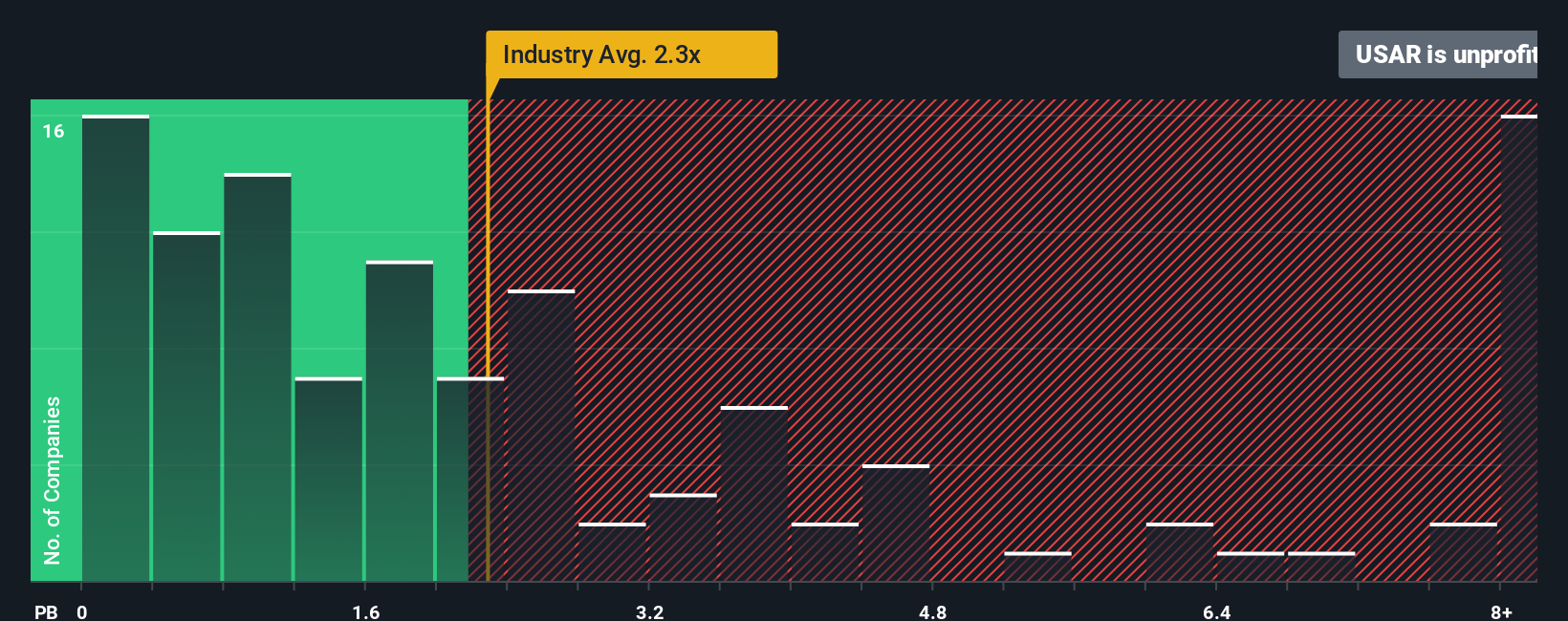

For companies in capital-intensive sectors like minerals and mining, the Price-to-Book (PB) ratio is often the preferred valuation multiple, as it compares the share price to the company’s net asset value on the balance sheet. This metric is especially relevant when profits are unstable or negative, since it focuses on the underlying assets rather than earnings volatility.

When it comes to PB ratios, higher growth expectations and lower risk profiles typically warrant higher multiples. Companies in distress or operating in high-risk environments tend to trade at lower PB ratios. In the case of USA Rare Earth, the company's current PB ratio is -20.5x, which stands in stark contrast to the industry average of 2.4x and the peer average of 21.1x. The negative PB ratio primarily reflects the company’s negative book value, often a byproduct of substantial early-stage investments and ongoing losses.

Simply Wall St’s proprietary “Fair Ratio” goes a step further than a basic peer or industry comparison. It incorporates not just standard valuation anchors but also factors unique to USA Rare Earth, such as its growth prospects, risk profile, profit margins, industry context, and market cap, to provide a more nuanced view of fair value for this specific business at this stage of its development. Because of the negative book value and resulting negative PB, however, even the advanced Fair Ratio methodology flags this as a gray area. Routine comparisons break down, and further improvement in financial fundamentals will be necessary before an accurate PB-based valuation can be relied on. For now, this means that USA Rare Earth’s price to book sits in a range that is hard to benchmark, and investors should look to other fundamentals for a clearer read on value.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Rare Earth Narrative

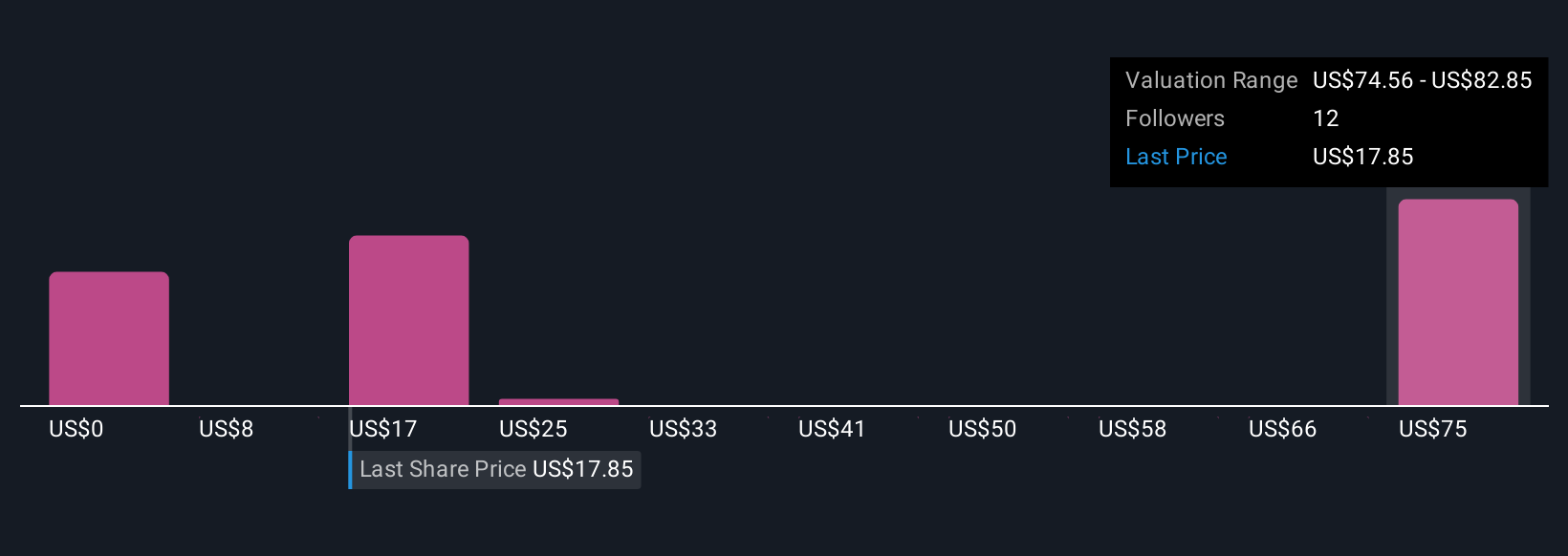

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you create your own story about a company by linking your assumptions and perspective—such as your expected fair value, revenue, or profit margins—to a real financial forecast. This transforms a company’s story into numbers, so you can see how your outlook compares to the current share price and instantly know whether it looks undervalued or overvalued.

Narratives are an easy and accessible feature on Simply Wall St’s Community page, trusted by millions of investors to help guide buy or sell decisions. These Narratives update dynamically as new news, earnings, or events unfold, ensuring your estimates always reflect the latest data. For example, one Narrative on USA Rare Earth has a bullish outlook with a high estimated fair value, while another sees much lower growth and assigns the stock a far more cautious target. Narratives empower you to make smarter investment choices by providing context, transparency, and flexibility in a way that is tailored to your own view of the company.

Do you think there's more to the story for USA Rare Earth? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USAR

USA Rare Earth

Engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives