- United States

- /

- Packaging

- /

- NasdaqGS:TRS

TriMas (TRS) CFO Transition: Evaluating the Company’s Valuation After Naming Paul Swart as Finance Chief

Reviewed by Simply Wall St

TriMas (TRS) just moved to solidify its finance bench by naming long time company veteran and former RealTruck executive Paul Swart as chief financial officer and principal accounting officer, effective December 15, 2025.

See our latest analysis for TriMas.

The CFO appointment lands as TriMas trades around $33.88, with a strong year to date share price return of roughly 42 percent but a softer 3 year total shareholder return of about 27 percent, suggesting momentum is improving after a bumpy stretch.

If this leadership change has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other under the radar growth stories with committed insiders.

With shares trading at a double digit discount to Wall Street targets despite weak recent revenue trends, the real question now is whether TriMas is mispriced value or if the market already sees the next leg of growth.

Most Popular Narrative Narrative: 18.4% Undervalued

With TriMas closing at 33.88 dollars versus a narrative fair value of 41.50 dollars, the valuation hinges on a bold earnings and margin reset.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 41.7x today. This future PE is lower than the current PE for the US Packaging industry at 22.2x.

Curious how a lower future earnings multiple can still support meaningful upside? The narrative leans on aggressive profit expansion and disciplined reinvestment to bridge that gap.

Result: Fair Value of $41.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a deeper downcycle in aerospace or integration missteps in recent packaging acquisitions could quickly compress margins and undercut that optimistic earnings trajectory.

Find out about the key risks to this TriMas narrative.

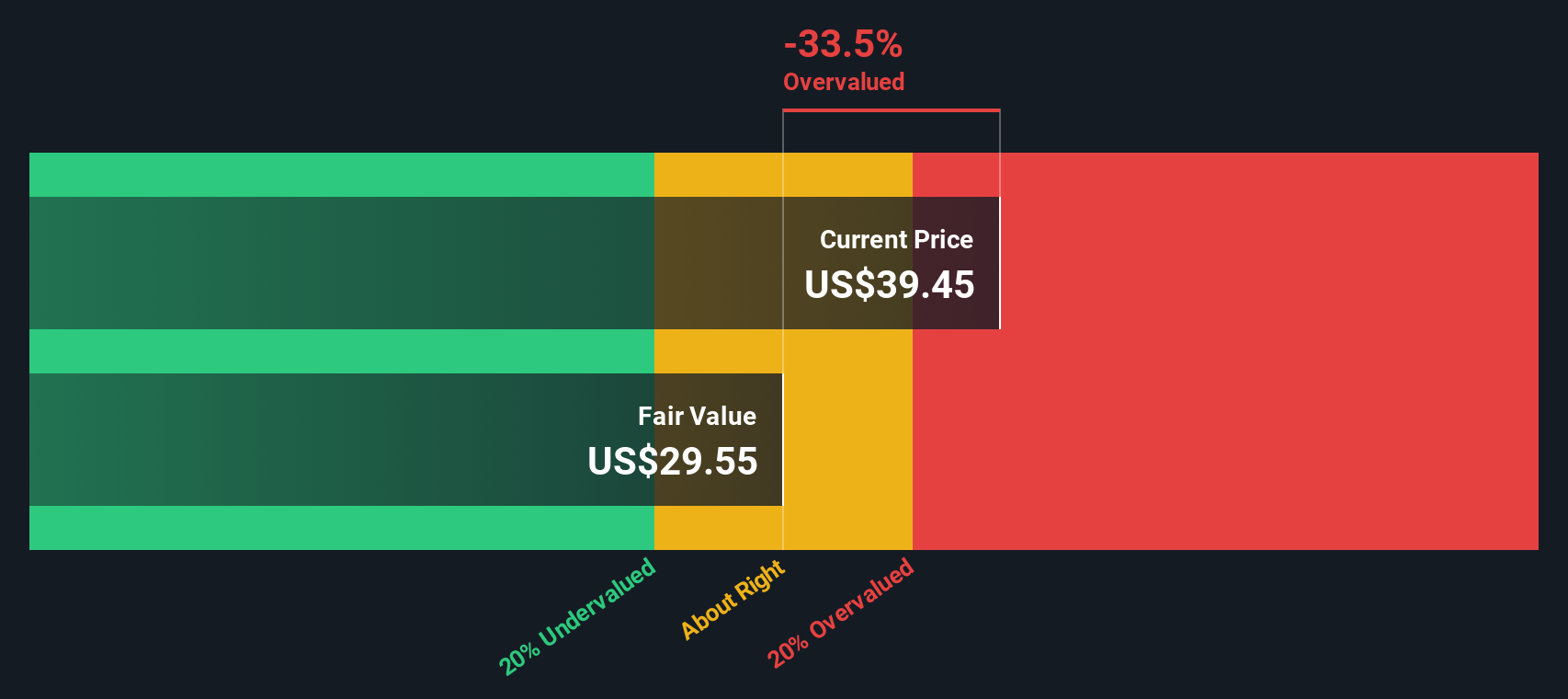

Another Lens on Valuation

The SWS DCF model presents a more tempered view than the upbeat narrative, with fair value at about 39.27 dollars, only modestly above today’s 33.88 dollars. This still suggests potential upside, but also indicates a smaller margin of safety if earnings or margins weaken from here.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TriMas Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your TriMas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities across themes and strategies on Simply Wall Street that most investors are still overlooking.

- Target potential rebounds by reviewing these 912 undervalued stocks based on cash flows that the market has temporarily mispriced but still generate cash flows.

- Position yourself in the next tech wave by evaluating these 26 AI penny stocks shaping intelligent automation and data driven products.

- Strengthen your income stream by assessing these 13 dividend stocks with yields > 3% that offer yields with room for steady, long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TriMas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion