For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like TriMas (NASDAQ:TRS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for TriMas

How Fast Is TriMas Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. TriMas managed to grow EPS by 4.9% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

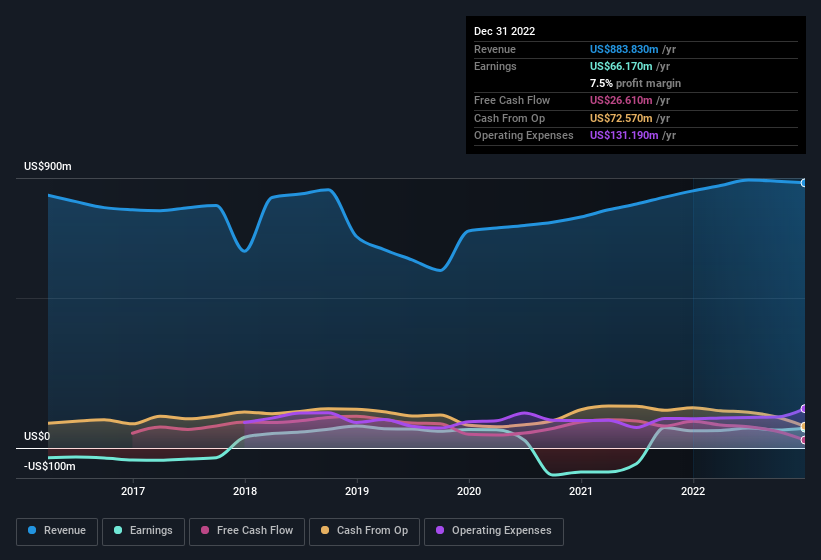

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, TriMas has done well over the past year, growing revenue by 3.1% to US$884m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for TriMas' future EPS 100% free.

Are TriMas Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite US$338k worth of sales, TriMas insiders have overwhelmingly been buying the stock, spending US$563k on purchases in the last twelve months. This overall confidence in the company at current the valuation signals their optimism. Zooming in, we can see that the biggest insider purchase was by Independent Director Teresa Finley for US$250k worth of shares, at about US$26.86 per share.

Along with the insider buying, another encouraging sign for TriMas is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$17m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Tom Amato, is paid less than the median for similar sized companies. For companies with market capitalisations between US$1.0b and US$3.2b, like TriMas, the median CEO pay is around US$5.4m.

TriMas offered total compensation worth US$4.6m to its CEO in the year to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add TriMas To Your Watchlist?

One important encouraging feature of TriMas is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. However, before you get too excited we've discovered 3 warning signs for TriMas (2 can't be ignored!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of TriMas, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TriMas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives