- United States

- /

- Chemicals

- /

- NasdaqCM:TANH

Tantech Holdings (NASDAQ:TANH) Strong Profits May Be Masking Some Underlying Issues

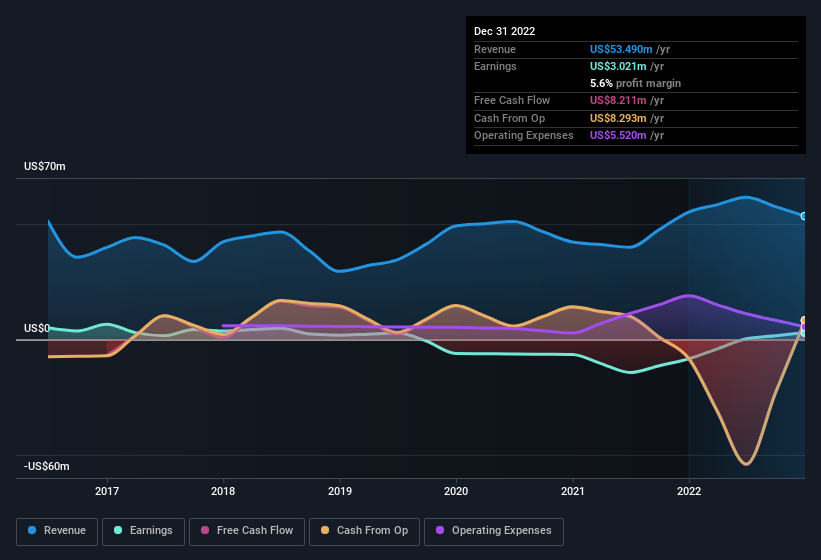

The market for Tantech Holdings Ltd's (NASDAQ:TANH) stock was strong after it released a healthy earnings report last week. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

Check out our latest analysis for Tantech Holdings

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Tantech Holdings expanded the number of shares on issue by 195% over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Tantech Holdings' EPS by clicking here.

How Is Dilution Impacting Tantech Holdings' Earnings Per Share (EPS)?

Three years ago, Tantech Holdings lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If Tantech Holdings' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Tantech Holdings.

Our Take On Tantech Holdings' Profit Performance

Over the last year Tantech Holdings issued new shares and so, there's a noteworthy divergence between EPS and net income growth. As a result, we think it may well be the case that Tantech Holdings' underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. At Simply Wall St, we found 3 warning signs for Tantech Holdings and we think they deserve your attention.

Today we've zoomed in on a single data point to better understand the nature of Tantech Holdings' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Tantech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TANH

Tantech Holdings

Develops and manufactures bamboo-based charcoal products for industrial energy applications and household cooking, heating, purification, agricultural, and cleaning uses in the People’s Republic of China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives