- United States

- /

- Metals and Mining

- /

- NasdaqGS:STLD

Could Steel Dynamics (STLD) Low-Carbon Steel Launch Redefine Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Steel Dynamics recently declared a fourth quarter 2025 cash dividend of US$0.50 per common share, payable on or about January 9, 2026, and earlier announced the launch of low-carbon steel products, BIOEDGE™ and EDGE™, produced using electric arc furnace technology and renewable or emission-free energy certifications.

- The rollout of these steel offerings aims to help customers in sectors such as automotive, construction, and renewable energy achieve their sustainability goals, reflecting broader industry movement toward lower-carbon supply chains.

- Next, we'll consider how the introduction of BIOEDGE and EDGE may influence Steel Dynamics' growth prospects in environmentally focused markets.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Steel Dynamics Investment Narrative Recap

To own shares of Steel Dynamics, investors generally need confidence in the company's future demand for low-carbon steel, successful new product adoption, and its ability to maintain disciplined capital allocation despite heavy investment in growth initiatives. The latest dividend affirmation and the launch of BIOEDGE and EDGE highlight a clear push into sustainable materials, which may modestly support near-term demand from environmentally focused sectors, but do not meaningfully reduce key risks like capital pressures from new projects or market cyclicality at this stage.

Among recent events, the Mercedes-Benz agreement to source over 50,000 tonnes of CO2-reduced steel stands out as the clearest validation of demand for Steel Dynamics’ new BIOEDGE and EDGE product lines. This supports one of the most important investment catalysts: the company’s opportunity to capture share in markets demanding sustainable steel for automotive, construction, and energy applications.

However, while these developments are promising, any investor should also understand that, in contrast, significant ongoing capital investment in new operations continues to...

Read the full narrative on Steel Dynamics (it's free!)

Steel Dynamics' outlook anticipates $21.6 billion in revenue and $2.6 billion in earnings by 2028. This forecast is based on an annual revenue growth rate of 8.1% and a $1.6 billion increase in earnings from the current $1.0 billion level.

Uncover how Steel Dynamics' forecasts yield a $166.58 fair value, a 10% upside to its current price.

Exploring Other Perspectives

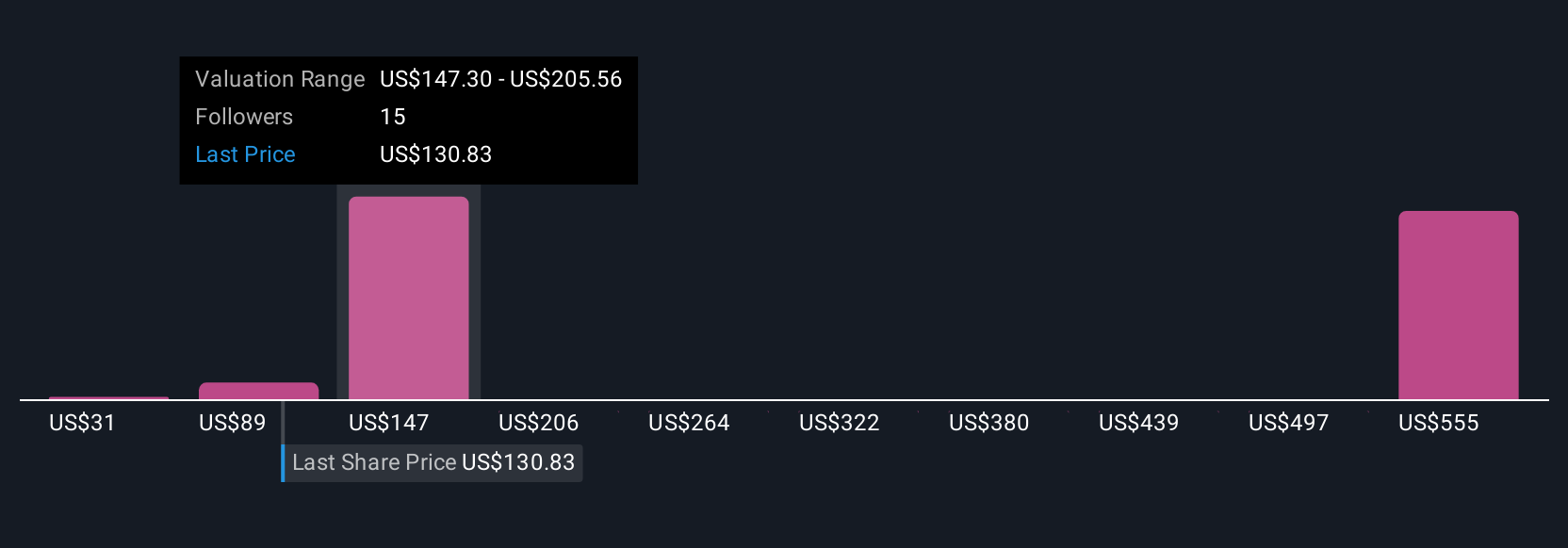

Retail investors in the Simply Wall St Community place Steel Dynamics' fair value between US$95 and US$287, with five different estimates. While catalysts like low-carbon product launches may excite bullish views, extended capital spending remains a concern for future cash flows, explore their outlooks for a fuller picture.

Explore 5 other fair value estimates on Steel Dynamics - why the stock might be worth as much as 89% more than the current price!

Build Your Own Steel Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Steel Dynamics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Steel Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Steel Dynamics' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STLD

Steel Dynamics

Operates as a steel producer and metal recycler in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives