- United States

- /

- Basic Materials

- /

- NasdaqCM:SMID

With EPS Growth And More, Smith-Midland (NASDAQ:SMID) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Smith-Midland (NASDAQ:SMID). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Smith-Midland

Smith-Midland's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Smith-Midland's stratospheric annual EPS growth of 57%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

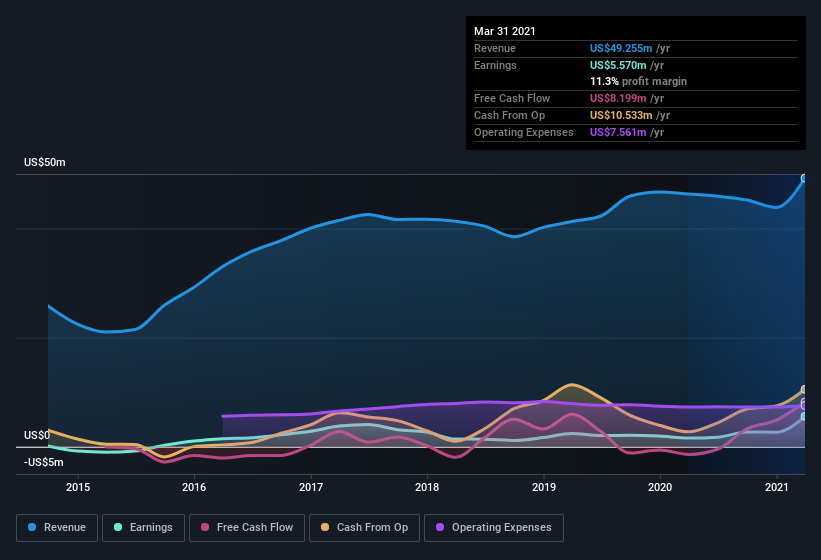

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Smith-Midland is growing revenues, and EBIT margins improved by 11.0 percentage points to 15%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Smith-Midland is no giant, with a market capitalization of US$100m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Smith-Midland Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Smith-Midland insiders have a significant amount of capital invested in the stock. Indeed, they hold US$20m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 20% of the company; visible skin in the game.

Does Smith-Midland Deserve A Spot On Your Watchlist?

Smith-Midland's earnings have taken off like any random crypto-currency did, back in 2017. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Smith-Midland for a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for Smith-Midland that you should be aware of.

Although Smith-Midland certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Smith-Midland or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SMID

Smith-Midland

Smith-Midland Corporation invents, develops, manufactures, markets, leases, licenses, sells, and installs various precast concrete products and systems.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives