- United States

- /

- Metals and Mining

- /

- NasdaqCM:SGML

Sigma Lithium (SGML) Showcases Quintuple Zero ESG Model at COP30 Can Sustainability Define Industry Leadership?

Reviewed by Sasha Jovanovic

- In late November 2025, Sigma Lithium showcased its Quintuple Zero ESG model and advanced sustainable mining practices at COP30 in Belém, Brazil, emphasizing Brazil's growing role in the global lithium supply chain.

- An interesting takeaway is Sigma Lithium’s effort to set an international benchmark for environmentally responsible lithium production, positioning its Jequitinhonha Valley operations as a model for low-carbon, socially responsible supply chains in the mining sector.

- We'll consider how Sigma Lithium’s focus on sustainable extraction and global ESG leadership at COP30 may update its investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sigma Lithium Investment Narrative Recap

For someone considering Sigma Lithium, the core belief centers on the company’s ability to translate advanced, green extraction in Brazil into consistent, profitable volumes for global battery and EV supply chains. While showcasing its ESG model at COP30 highlights Sigma's appeal to ESG-sensitive buyers, these events alone do not immediately mitigate the principal short-term catalyst, securing new long-term offtake agreements to stabilize revenues and offset lithium price volatility. The principal risk remains exposure to the uncertain lithium spot market and timing of inventory sales.

Recent production updates are especially relevant, as Sigma reported Q3 2025 output of 44,000 tonnes, lower than the previous year's comparable period. This operational trend is critical for investors, since the company’s growth story depends not only on sustainability credentials but also the ability to scale output and lock in future sales at favorable terms, which is key amid ongoing lithium price uncertainty.

In contrast, investors should also be mindful that with so much operational concentration in Brazil, ...

Read the full narrative on Sigma Lithium (it's free!)

Sigma Lithium's narrative projects $600.1 million in revenue and $57.4 million in earnings by 2028. This requires 64.6% yearly revenue growth and a $105.1 million earnings increase from -$47.7 million today.

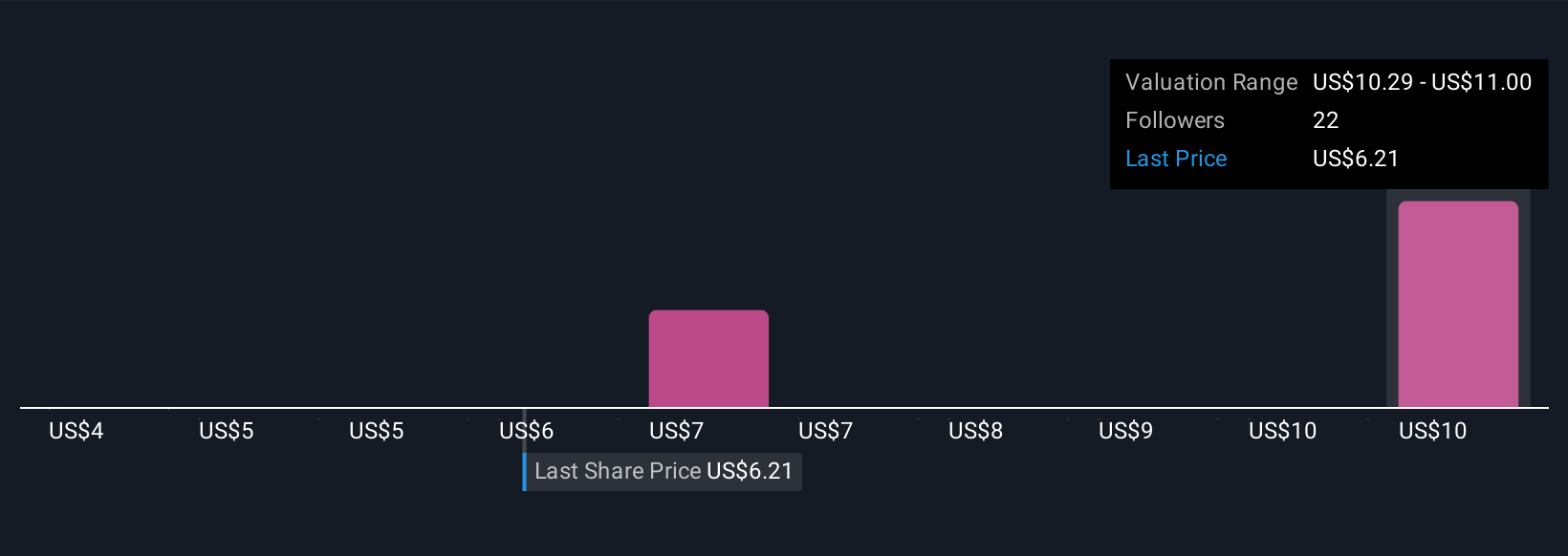

Uncover how Sigma Lithium's forecasts yield a $10.50 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Three private fair value estimates from the Simply Wall St Community place Sigma Lithium’s shares between US$3.86 and US$10.50. As you weigh these viewpoints, remember that revenue stability may hinge on the company's success in strengthening long-term offtake deals.

Explore 3 other fair value estimates on Sigma Lithium - why the stock might be worth less than half the current price!

Build Your Own Sigma Lithium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sigma Lithium research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sigma Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sigma Lithium's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SGML

Sigma Lithium

Engages in the exploration and development of lithium deposits in Brazil.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026