- United States

- /

- Metals and Mining

- /

- NasdaqCM:SGML

Sigma Lithium (SGML) Is Up 32.6% After Expanding Brazil Output and Improving Q3 Results Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Sigma Lithium Corporation recently reported third-quarter 2025 results, highlighting sales of US$28.55 million and a net loss of US$11.58 million, both improved from the previous year, alongside ongoing production expansion in Brazil and updates on potential collaborations in the electric vehicle sector.

- Growing investor enthusiasm has been fueled by bullish global lithium demand forecasts and positive industry commentary, reinforcing Sigma Lithium's relevance within the fast-evolving battery materials supply chain.

- Next, we'll assess how expectations for surging lithium demand could reshape Sigma Lithium's investment narrative and long-term growth positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Sigma Lithium Investment Narrative Recap

To be a shareholder in Sigma Lithium, you need to believe in sustained, robust global lithium demand that can drive higher prices and offset the company’s current unprofitability. The recent earnings reveal improved operating results, but until sustained profitability or a major supply agreement is secured, near-term performance remains driven by lithium price cycles and the risk of delayed contract finalizations, which were not materially resolved in this quarter.

Of all recent announcements, the October 6 operational upgrades stand out. Cost-reduction measures through improved mining efficiency are especially relevant as Sigma Lithium seeks resilience amid price volatility, supporting the company’s efforts to better absorb downturns while positioning for price recoveries, an important consideration given the tight linkage between operational success and revenue stability.

Yet, investors should be aware that, in contrast to operational improvements, the company’s heavy reliance on lithium price movements still exposes Sigma to…

Read the full narrative on Sigma Lithium (it's free!)

Sigma Lithium's narrative projects $600.1 million revenue and $57.4 million earnings by 2028. This requires 64.6% yearly revenue growth and a $105.1 million increase in earnings from -$47.7 million today.

Uncover how Sigma Lithium's forecasts yield a $8.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

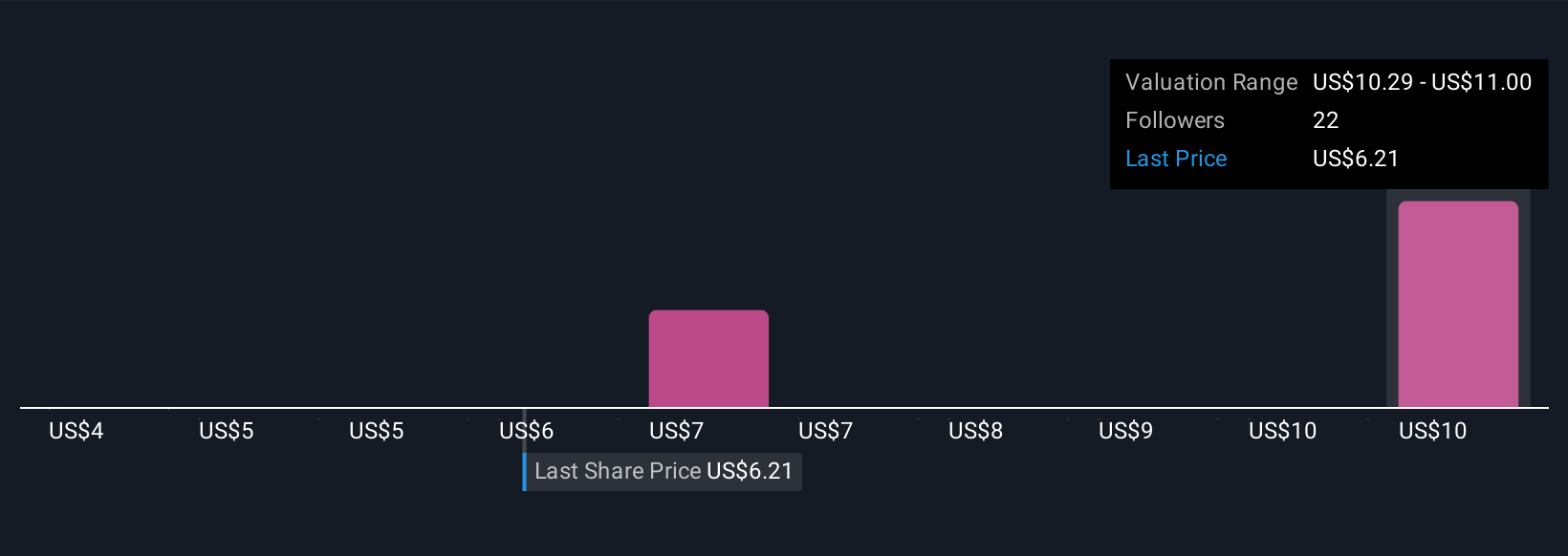

Three Simply Wall St Community members supplied fair value estimates for Sigma Lithium ranging from US$3.86 to US$8.50 per share. While these varied outlooks underscore the diversity of investor opinion, it is worth considering that Sigma’s improved quarterly results do not eliminate the risk of lithium price volatility impacting earnings.

Explore 3 other fair value estimates on Sigma Lithium - why the stock might be worth less than half the current price!

Build Your Own Sigma Lithium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sigma Lithium research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sigma Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sigma Lithium's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SGML

Sigma Lithium

Engages in the exploration and development of lithium deposits in Brazil.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives