- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

How Investors May Respond To Royal Gold (RGLD) Earnings Beat and New Shelf Registration Plans

Reviewed by Sasha Jovanovic

- Royal Gold, Inc. recently reported third quarter results showing sales of US$249.65 million and net income of US$126.82 million, both higher than the prior year period, along with similar increases for the first nine months of 2025.

- Alongside the earnings, Royal Gold filed shelf registrations for stock offerings under employee and dividend reinvestment plans, indicating a focus on liquidity and shareholder engagement.

- We'll consider how Royal Gold's strong revenue and earnings growth for the quarter may influence its investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Royal Gold Investment Narrative Recap

Royal Gold’s investment narrative centers on its ability to convert exposure to gold and copper via royalties and streams into growing, diversified cash flows that support dividend growth and capital returns. The company’s latest quarterly results, with increased sales and net income, reinforce this story and may strengthen near-term confidence. However, these results do not materially change the most important catalyst, the integration and synergy realization from pending acquisitions, or lessen key risks like asset concentration or gold price sensitivity.

The recent shelf registration for a US$56.15 million dividend reinvestment plan offering stands out in context. As Royal Gold continues to expand and integrate new assets, the ability to channel capital through dividend reinvestment could help maintain shareholder engagement and support balance sheet flexibility during periods of elevated capital allocation, without directly influencing short-term catalysts or the underlying risk profile.

Yet, in contrast to the positive earnings momentum, investors should be aware that persistent production issues at major royalty assets could still...

Read the full narrative on Royal Gold (it's free!)

Royal Gold's narrative projects $1.4 billion in revenue and $877.9 million in earnings by 2028. This requires 21.4% yearly revenue growth and a $428 million earnings increase from $449.5 million today.

Uncover how Royal Gold's forecasts yield a $247.91 fair value, a 41% upside to its current price.

Exploring Other Perspectives

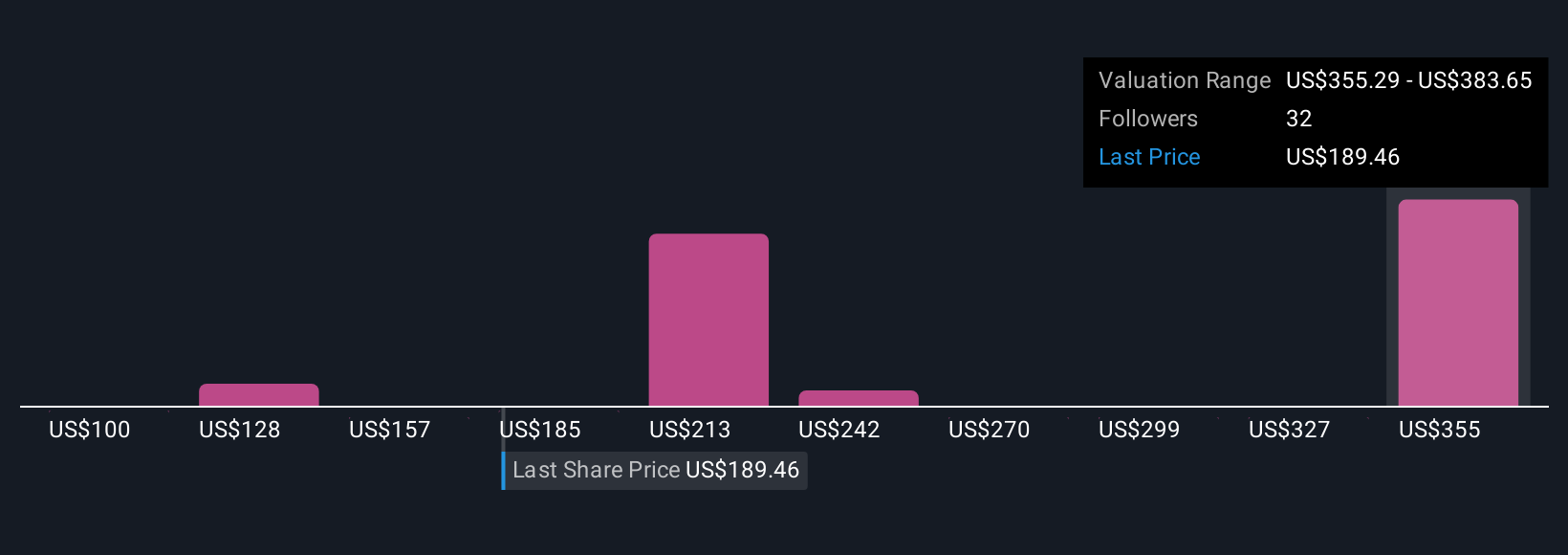

The Simply Wall St Community’s fair value estimates for Royal Gold range from US$143.73 to US$266.61, with ten analyses published. While optimism for long-term asset diversification runs high, opinions differ widely on whether current performance can offset mine-level risks and gold dependency; explore several viewpoints to understand both sides.

Explore 10 other fair value estimates on Royal Gold - why the stock might be worth as much as 52% more than the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives