- United States

- /

- Paper and Forestry Products

- /

- NasdaqGS:MERC

Mercer International (NASDAQ:MERC) Is Due To Pay A Dividend Of $0.075

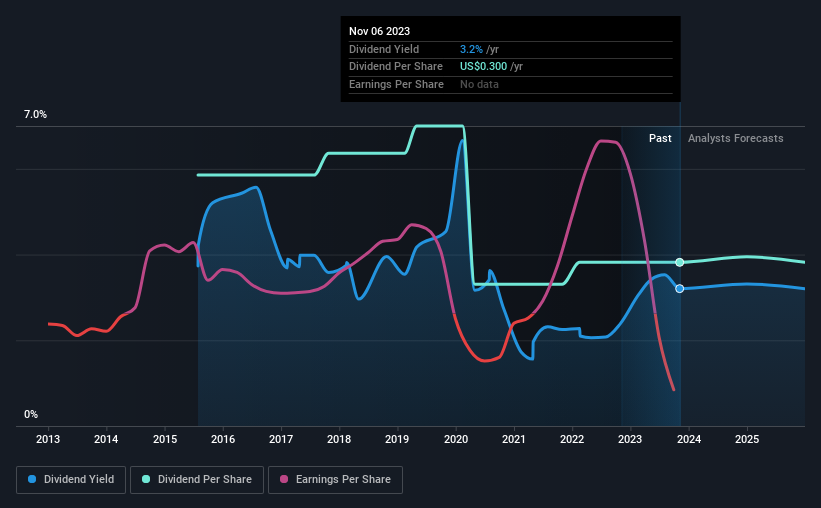

The board of Mercer International Inc. (NASDAQ:MERC) has announced that it will pay a dividend on the 28th of December, with investors receiving $0.075 per share. This payment means that the dividend yield will be 3.2%, which is around the industry average.

Check out our latest analysis for Mercer International

Mercer International's Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. Even though Mercer International is not generating a profit, it is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Analysts expect a massive rise in earnings per share in the next year. If the dividend extends its recent trend, estimates say the dividend could reach 1.4%, which we would be comfortable to see continuing.

Mercer International's Dividend Has Lacked Consistency

It's comforting to see that Mercer International has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The dividend has gone from an annual total of $0.46 in 2015 to the most recent total annual payment of $0.30. Doing the maths, this is a decline of about 5.2% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

We Could See Mercer International's Dividend Growing

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. We are encouraged to see that Mercer International has grown earnings per share at 5.9% per year over the past five years. Even though the company isn't making a profit, strong earnings growth could turn that around in the near future. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

Mercer International's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Mercer International's payments, as there could be some issues with sustaining them into the future. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Mercer International that investors need to be conscious of moving forward. Is Mercer International not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MERC

Mercer International

Manufactures and sells northern bleached softwood kraft (NBSK) and northern bleached hardwood kraft (NBHK) pulp in the United States, Germany, China, and internationally.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026