- United States

- /

- Chemicals

- /

- NasdaqGM:LOOP

Is Loop Industries (NASDAQ:LOOP) Using Debt In A Risky Way?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Loop Industries, Inc. (NASDAQ:LOOP) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Loop Industries

What Is Loop Industries's Net Debt?

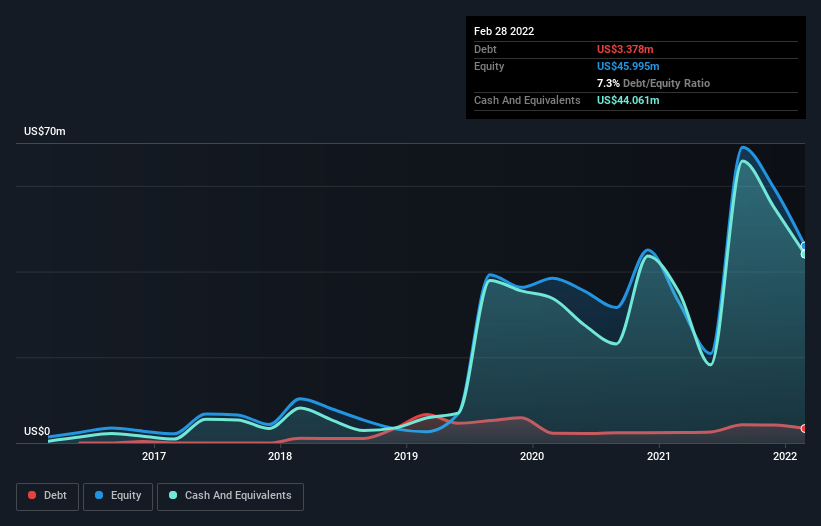

The image below, which you can click on for greater detail, shows that at February 2022 Loop Industries had debt of US$3.38m, up from US$2.45m in one year. But it also has US$44.1m in cash to offset that, meaning it has US$40.7m net cash.

How Healthy Is Loop Industries' Balance Sheet?

The latest balance sheet data shows that Loop Industries had liabilities of US$9.85m due within a year, and liabilities of US$3.38m falling due after that. Offsetting this, it had US$44.1m in cash and US$1.72m in receivables that were due within 12 months. So it actually has US$32.6m more liquid assets than total liabilities.

This surplus suggests that Loop Industries has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Loop Industries boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Loop Industries can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given it has no significant operating revenue at the moment, shareholders will be hoping Loop Industries can make progress and gain better traction for the business, before it runs low on cash.

So How Risky Is Loop Industries?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Loop Industries had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$48m of cash and made a loss of US$45m. But the saving grace is the US$40.7m on the balance sheet. That means it could keep spending at its current rate for more than two years. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 5 warning signs for Loop Industries (2 are a bit unpleasant) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LOOP

Loop Industries

A technology company, focuses on depolymerizing waste polyethylene terephthalate (PET) plastics and polyester fibers into its base building block monomers.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion