- United States

- /

- Chemicals

- /

- NasdaqGM:LOOP

After Leaping 28% Loop Industries, Inc. (NASDAQ:LOOP) Shares Are Not Flying Under The Radar

Loop Industries, Inc. (NASDAQ:LOOP) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

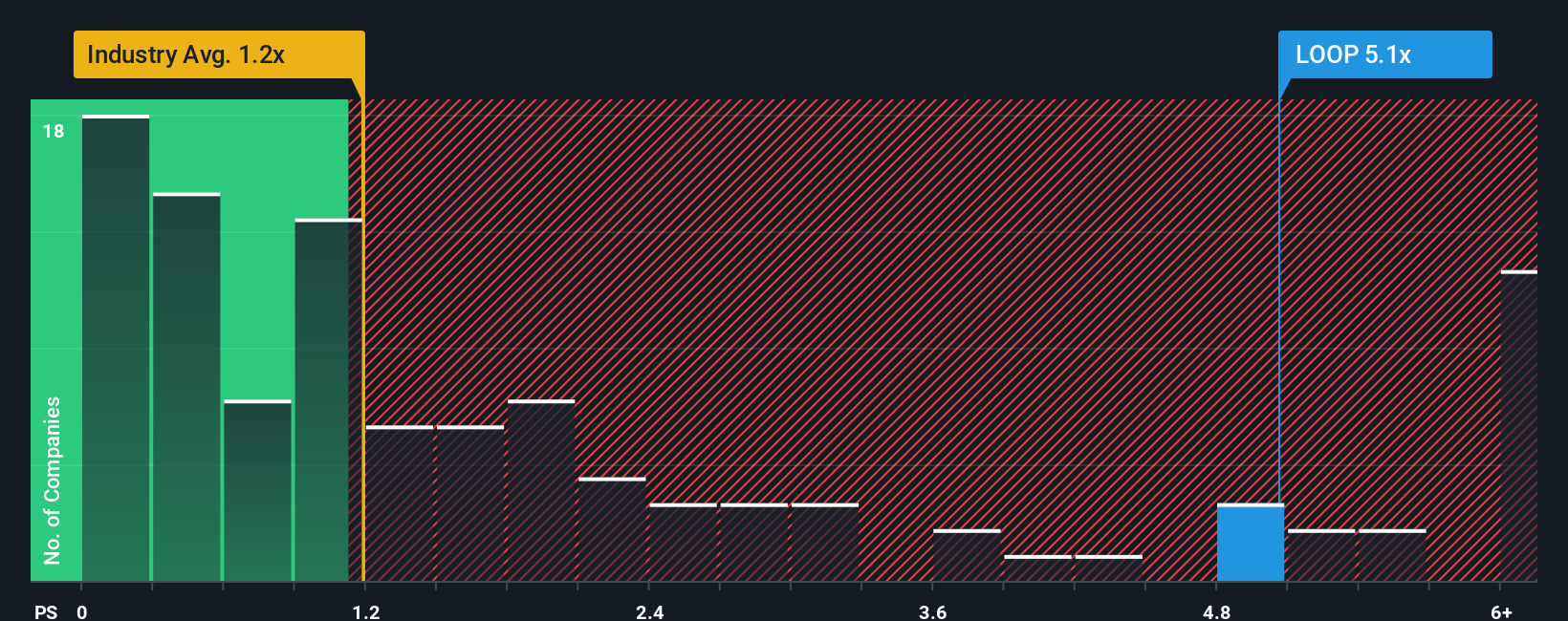

After such a large jump in price, you could be forgiven for thinking Loop Industries is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Loop Industries

What Does Loop Industries' Recent Performance Look Like?

Loop Industries certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Loop Industries will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Loop Industries' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 78% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.5% per annum, which is noticeably less attractive.

In light of this, it's understandable that Loop Industries' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Loop Industries' P/S Mean For Investors?

Loop Industries' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Loop Industries shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Loop Industries (at least 2 which are potentially serious), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LOOP

Loop Industries

A technology company, focuses on depolymerizing waste polyethylene terephthalate (PET) plastics and polyester fibers into its base building block monomers.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Inotiv NAMs Test Center

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

MongoDB Inc. (MDB): The Data Platform Pivot – Navigating the FY2027 Outlook in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks