- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (LIN): Parsing Valuation After Strong Q3 Earnings Beat and Raised Growth Outlook

Reviewed by Simply Wall St

Linde (LIN) just posted its third-quarter results, delivering earnings per share ahead of expectations and again showing steady growth in cash flow and margins. Management also reaffirmed its outlook for earnings growth in the coming months.

See our latest analysis for Linde.

Linde’s latest earnings beat comes amid a stretch of share price pressure, with a 1-month return of -9.49% and a 1-year total shareholder return of -4.55%, even as the business posts steady growth numbers and reaffirms its long-term outlook. Over the past three and five years, however, total shareholder returns of 50% and 84% respectively point to sustained value creation. This suggests recent weakness may have opened new windows for patient investors as momentum cools from last year’s highs.

If you’re interested in discovering what else is gaining traction across the market, now is a great time to uncover fast growing stocks with high insider ownership.

Yet with shares pulling back over the past month even as Linde delivers profit growth and reaffirms its guidance, the question for investors is whether Linde is now trading below its true worth or if the market has already priced in its prospects for future growth.

Most Popular Narrative: 15.9% Undervalued

According to the most watched narrative, Linde’s last closing share price of $429.91 is notably below the narrative fair value of $511. So, what exactly drives this gap and what needs to unfold for the market to close it?

Linde’s project backlog has doubled over the last 4 years, anchored by long-term, fixed-fee contracts supporting U.S. clean energy and electronics infrastructure. Management expects this robust pipeline to remain at record levels, positioning the company for steady multi-year revenue and earnings growth. Strategic investments and customer commitments in rapidly expanding growth markets such as commercial space launches, electronics, and clean hydrogen (with almost $5 billion in new clean energy contracts) provide a runway for high-margin revenue streams and new project conversion that will structurally lift blended margins and earnings.

There’s a daring set of future forecasts under the hood here. Will Linde’s margin expansion and ambitious revenue mix materialize? Dig in to discover which profit milestones and bold financial targets are shaping this eye-catching valuation.

Result: Fair Value of $511 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in global industrial activity or delays in the energy transition could undermine Linde’s ambitious growth and margin expansion narrative.

Find out about the key risks to this Linde narrative.

Another View: What Do the Ratios Tell Us?

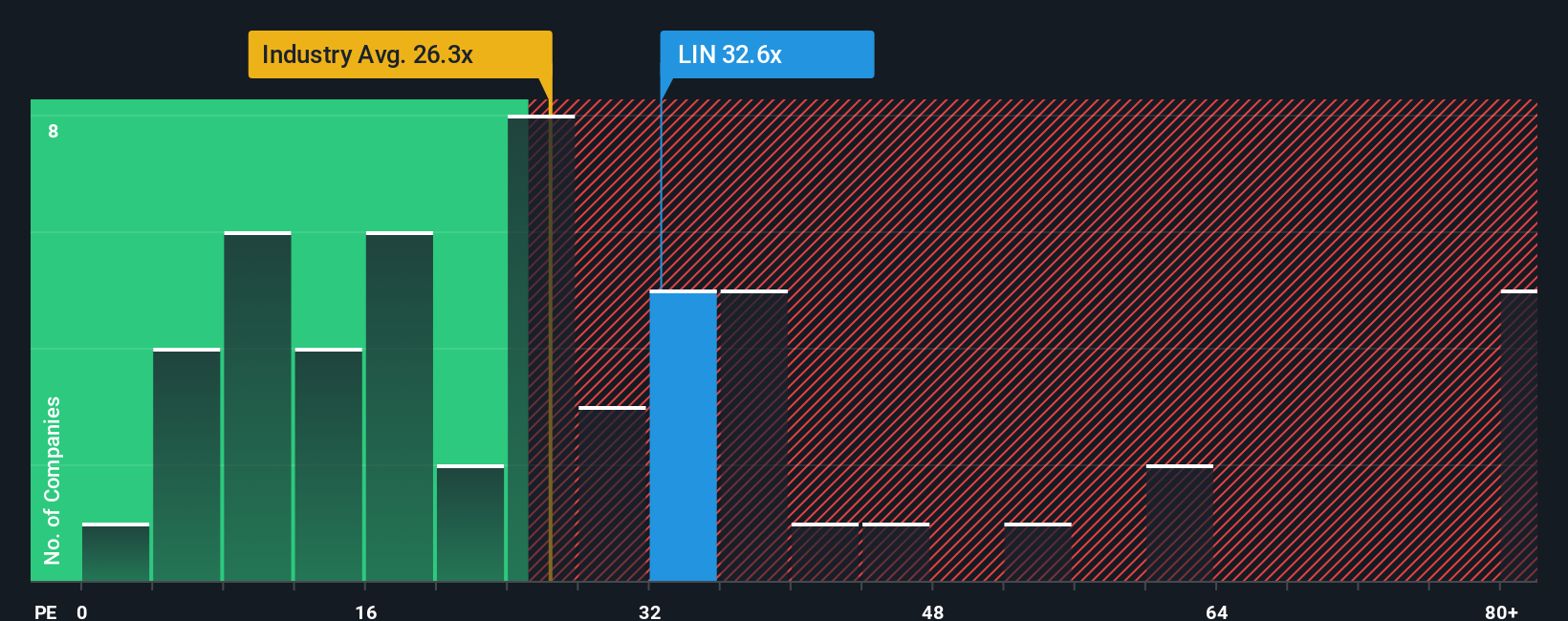

While narrative-driven valuations point to Linde being undervalued, a look at its price-to-earnings ratio offers a more cautious take. Linde trades at 30x earnings, lower than the average peer at 33.3x but above the broader US Chemicals sector at 25.3x. The fair ratio to watch is 25.7x. If the market moves closer to this, today's price could appear lofty. Which approach best captures the opportunity or risk for investors right now?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Linde for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Linde Narrative

If you see things differently or want to build your own perspective, you can dive into the data and craft a custom narrative in just a few minutes, your way. Do it your way.

A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Level up your strategy by handpicking fresh opportunities other investors are already tracking. Don’t let your next big move slip by. These screens surface high-potential stocks every day.

- Spot consistent income with these 24 dividend stocks with yields > 3% that deliver yields above 3%, providing stability even in a volatile market.

- Capitalize on industry-changing technologies by checking out these 26 AI penny stocks reshaping business, health, and finance through artificial intelligence innovation.

- Tap into growth before the crowd and lock in value with these 834 undervalued stocks based on cash flows identified by strong fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives