- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Will Kaiser Aluminum’s (KALU) Leadership Shift Influence Its Manufacturing Strategy and Operational Momentum?

Reviewed by Sasha Jovanovic

- Kaiser Aluminum Corporation recently announced that Executive Vice President – Manufacturing, Jason D. Walsh, has taken health-related leave, with Thomas H. Robb immediately stepping into the Senior Vice President – Manufacturing role.

- Robb’s rapid progression within the company since August 2024, combined with his deep experience in aluminum and metals, supports a smooth leadership transition during a period of operational focus at the Warrick facility.

- We will explore how Robb’s appointment and manufacturing expertise may influence Kaiser Aluminum’s investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kaiser Aluminum's Investment Narrative?

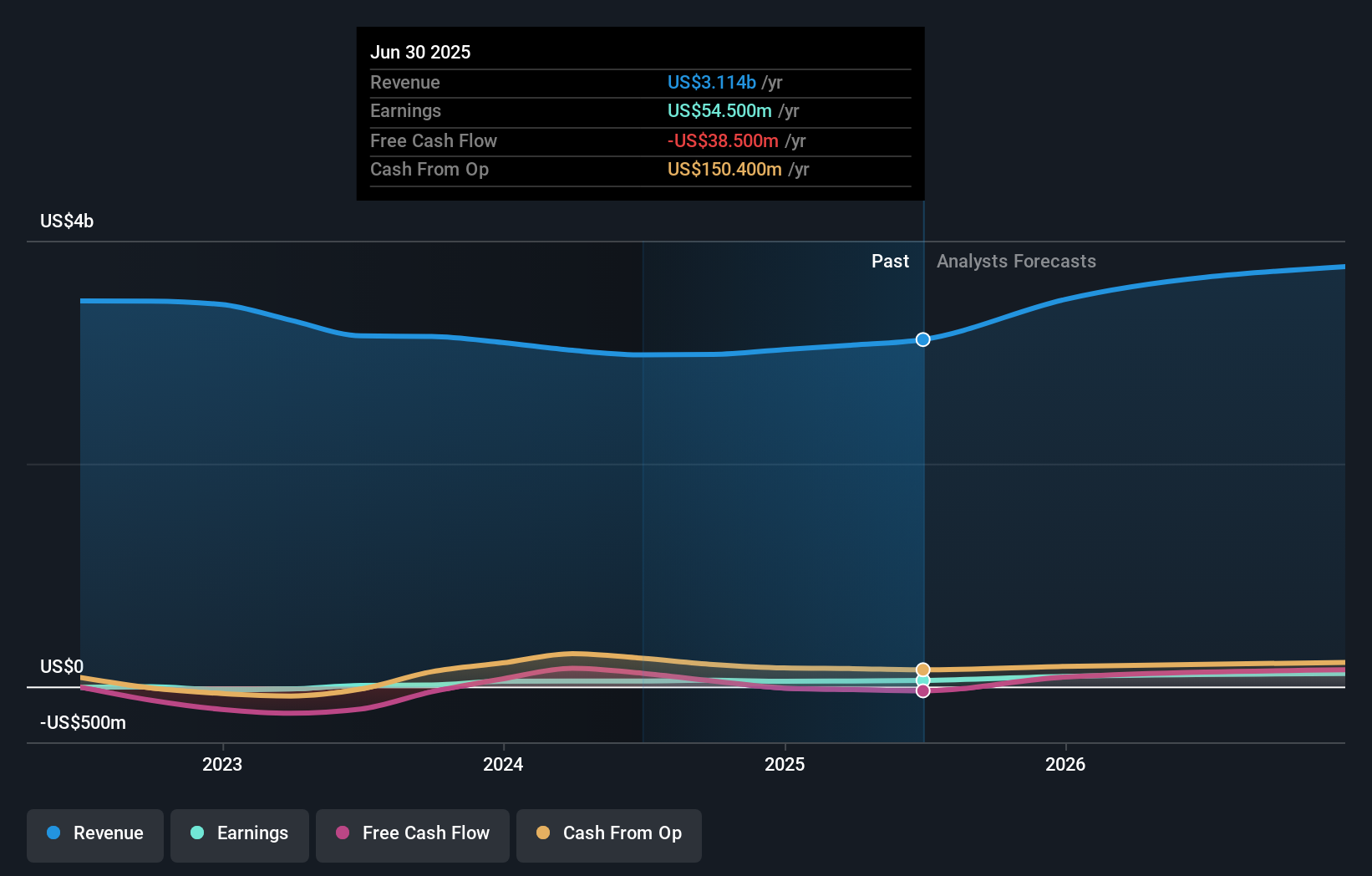

To feel comfortable as a Kaiser Aluminum shareholder, you need to believe in the company’s ability to sustain operational momentum through leadership changes and focus on delivering earnings growth despite industry volatility. The recent appointment of Thomas Robb as Senior Vice President – Manufacturing follows a period of board and executive transitions, but Robb’s experience may help keep the Warrick facility’s key projects on track. Most short-term catalysts, like new line start-ups and capital allocation decisions, remain intact since the company has maintained its earnings guidance and posted strong results last quarter. The shift in manufacturing leadership is unlikely to materially change the risk profile near term, but investors should watch for any signs of disruption or delay at Warrick, given its operational importance. With valuation still below consensus and expectations for profit growth, confidence remains steady, but so do the usual risks in metals, such as margin pressure and debt coverage.

On the other hand, watch for any operational headwinds if the transition hits unexpected hurdles. Kaiser Aluminum's shares have been on the rise but are still potentially undervalued by 28%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Kaiser Aluminum - why the stock might be worth just $106.50!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

No Opportunity In Kaiser Aluminum?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives