- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

$500 Million Debt Refinancing Might Change The Case For Investing In Kaiser Aluminum (KALU)

Reviewed by Sasha Jovanovic

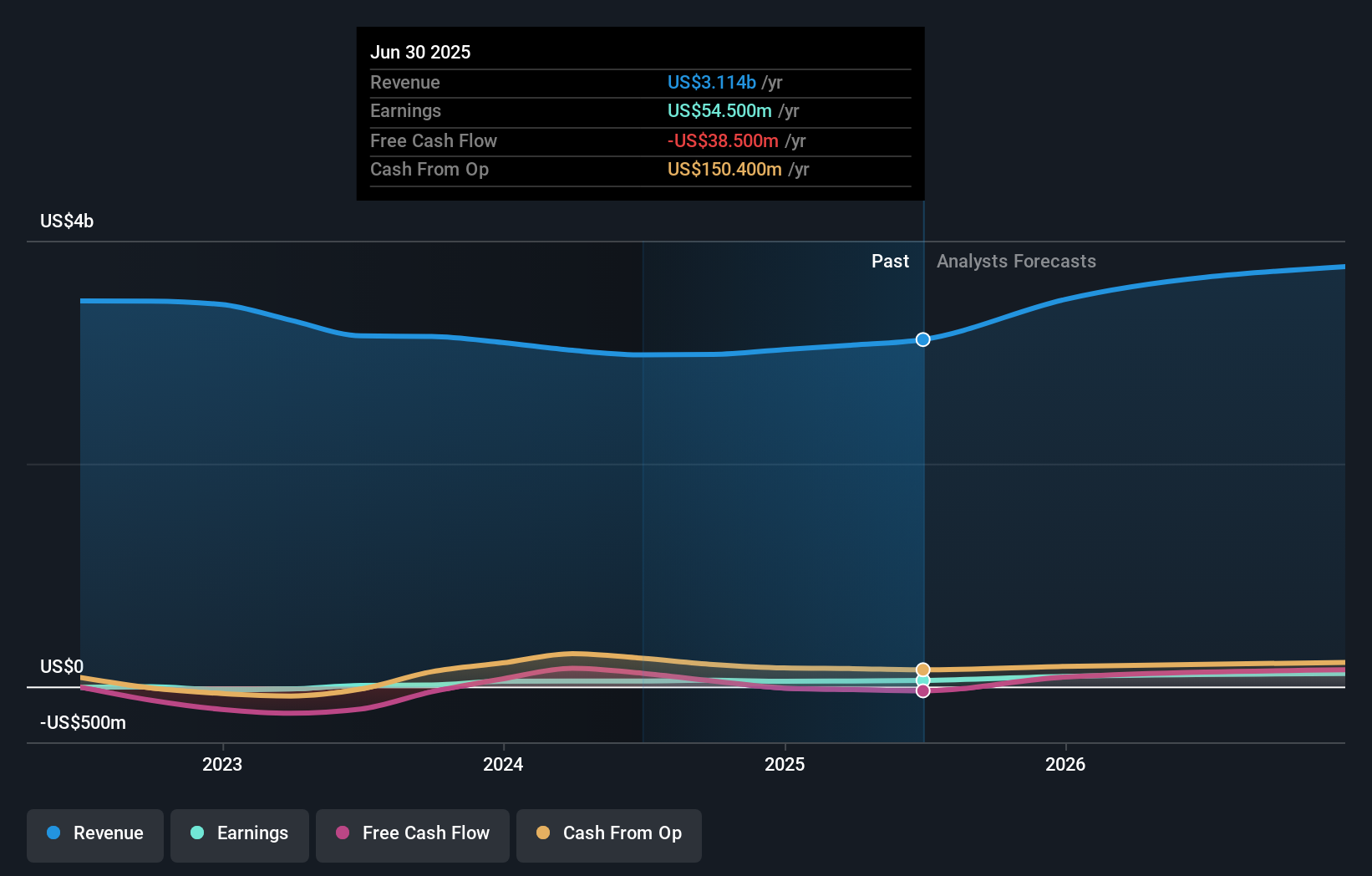

- Kaiser Aluminum Corporation recently completed a US$500 million private offering of 5.875% senior notes due 2034, guaranteed by key domestic subsidiaries and aimed at redeeming existing 2028 notes.

- This debt refinancing follows robust third-quarter results and raised 2025 revenue guidance, signaling increased confidence in the company's ability to strengthen its financial position and execute growth plans.

- We'll examine how the successful debt offering enhances Kaiser Aluminum's investment narrative as it prioritizes financial flexibility and future opportunities.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Kaiser Aluminum's Investment Narrative?

To be a Kaiser Aluminum shareholder right now, you would need to believe in the company’s ability to drive consistent profit growth and to strengthen its balance sheet despite ongoing sector pressures. The recent completion of a US$500 million senior notes offering is a pivotal move, directly aimed at refinancing older, costlier debt and extending maturities. This action fits in well with management’s clear focus on boosting financial flexibility, coming right after a quarter of strong earnings and an uptick in revenue guidance. With shares currently trading at a discount to consensus fair value, recent price gains suggest the market sees this debt refinancing as supportive of future growth catalysts, but concerns remain about higher interest costs, slower revenue growth against market averages, and weaker dividend coverage. For now, the biggest risk that stands out is whether higher debt service obligations could offset the benefits of improved liquidity and flexibility, especially if cash flow remains tight.

However, higher debt and weaker free cash flow coverage could magnify risk for existing shareholders.

Despite retreating, Kaiser Aluminum's shares might still be trading 29% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Kaiser Aluminum - why the stock might be worth as much as 42% more than the current price!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives