- United States

- /

- Chemicals

- /

- NasdaqGS:IOSP

Innospec (IOSP) Profit Margin Drop Challenges Bullish Narratives Despite DCF Undervaluation

Reviewed by Simply Wall St

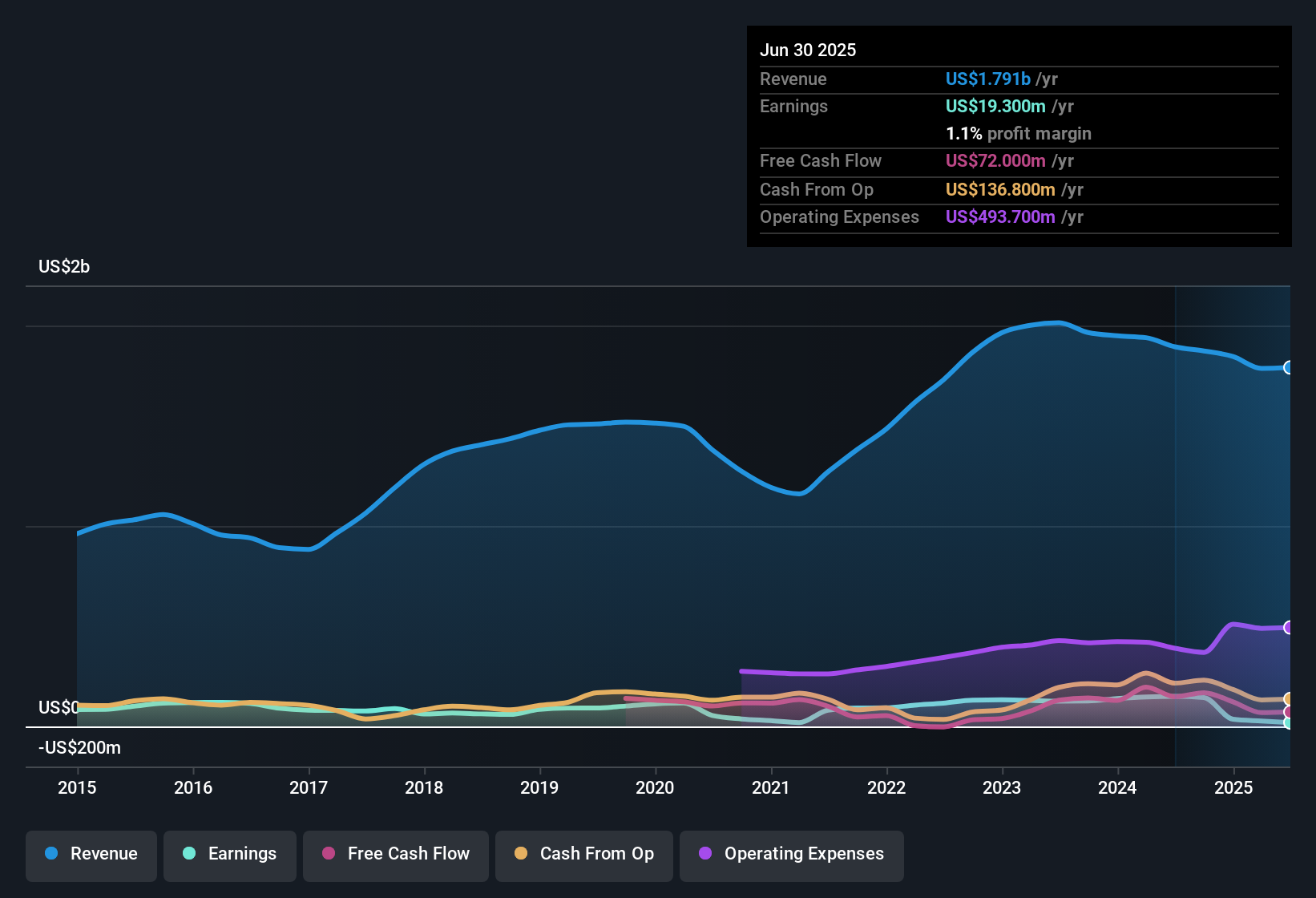

Innospec (IOSP) reported a net profit margin of 1.1%, sharply down from 7.9% a year ago, highlighting a notable drop in profitability over the last twelve months. The company’s earnings contracted compared to its five-year trend, though its long-term record still shows 6.7% average annual earnings growth over the past five years. While high quality of earnings is maintained, the most recent results put investors in a spot as they balance fading margins and negative near-term earnings growth against an apparent undervaluation, as shares currently trade at $74.01 compared to a discounted cash flow fair value estimate of $85.36.

See our full analysis for Innospec.Next, we will see how Innospec’s numbers measure up against the most widely held narratives in the market. Are the recent results fueling the bulls or giving ammo to the skeptics?

See what the community is saying about Innospec

Profit Margin Dip Reframes Industry Standing

- Current net profit margin has dropped to 1.1%, a significant slide from 7.9% last year, marking one of the steepest declines among specialty chemical peers.

- Analysts' consensus view underscores how margin pressures are complicating the long-term bullish narrative of reliable growth:

- While the company averaged 6.7% annual earnings growth over five years, recent profitability headwinds have outpaced sector trends, making near-term margin recovery a central uncertainty.

- The consensus narrative notes that Innospec’s focus on process efficiencies and high-value, sustainable products may help margins rebound, but only if raw material cost volatility and compliance expenses can be brought under control.

See where analysts agree and disagree on Innospec’s path forward. The consensus narrative may surprise you. 📊 Read the full Innospec Consensus Narrative.

DCF Discount vs. Industry PE Premium

- Innospec trades at $74.01, which is an approximate 13% discount to its DCF fair value of $85.36. Yet the current price-to-earnings ratio of 95.2x is far above both the peer group average (25.6x) and US chemicals industry average (26.4x).

- Analysts' consensus narrative challenges investors to weigh opposing valuation signals in light of sector dynamics:

- Although the share price appears undervalued using a DCF framework, the unusually high PE suggests the market doubts near-term earnings quality or expects further margin risk.

- The consensus narrative points out that to justify the analyst price target of 107.5, Innospec’s profit margins would need to rebound significantly. The company would also need to trade on a much lower forward PE, which may be difficult unless segment earnings volatility eases.

Long-Term Growth Hinges on Margin and Cost Control

- Analysts project revenue to grow by 5.4% annually over the next three years, with profit margins expected to reach 21.9%, representing a dramatic turnaround from current levels.

- Analysts' consensus view calls out the risks that could disrupt this growth narrative:

- Persistent raw material cost spikes, notably in Oleochemicals, and the company’s lag in raising prices threaten to delay or even derail margin improvement.

- Additionally, heavy reliance on the Fuel Specialties segment exposes Innospec to structural decline as electrification trends shrink end-markets. This makes the forecasted growth far from guaranteed without major execution improvements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Innospec on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? You can quickly translate your perspective into a personal narrative and shape the conversation in under three minutes. Do it your way

A great starting point for your Innospec research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Recent results highlight how Innospec’s volatile margins and high valuation multiples have cast real doubt on the predictability of its future growth.

If you’re seeking companies with more consistent business momentum and reliability, focus on stable growth stocks screener (2074 results) to discover stocks that have delivered steady earnings and revenue regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IOSP

Innospec

Develops, manufactures, blends, markets, and supplies specialty chemicals in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives