- United States

- /

- Chemicals

- /

- NasdaqGS:HWKN

Does Hawkins’ Price Reflect Its Growth After Recent Industry Partnerships?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Hawkins is a hidden bargain or trading at a premium, you are in the right place. Let's break down what really matters when assessing value.

- Shareholders have seen a rollercoaster lately, with the stock jumping 5.1% over the last week but still down 22.7% in the past month. Over the long haul, Hawkins has posted a massive 442.0% return across five years.

- In the past few weeks, Hawkins has attracted attention thanks to industry partnerships and strategic expansion updates, shining a spotlight on the company's ability to find new growth avenues. These announcements have sparked speculation about longer-term prospects, adding new context to the recent price moves.

- The company scores just 1 out of 6 on our undervaluation checks so far. We are about to dive into each method used to assess Hawkins' worth, but stay tuned, as there is an even better way to think about value at the end of this article.

Hawkins scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hawkins Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation tool that estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors assess what Hawkins could be worth based on the cash it generates, rather than just current earnings or analyst sentiment.

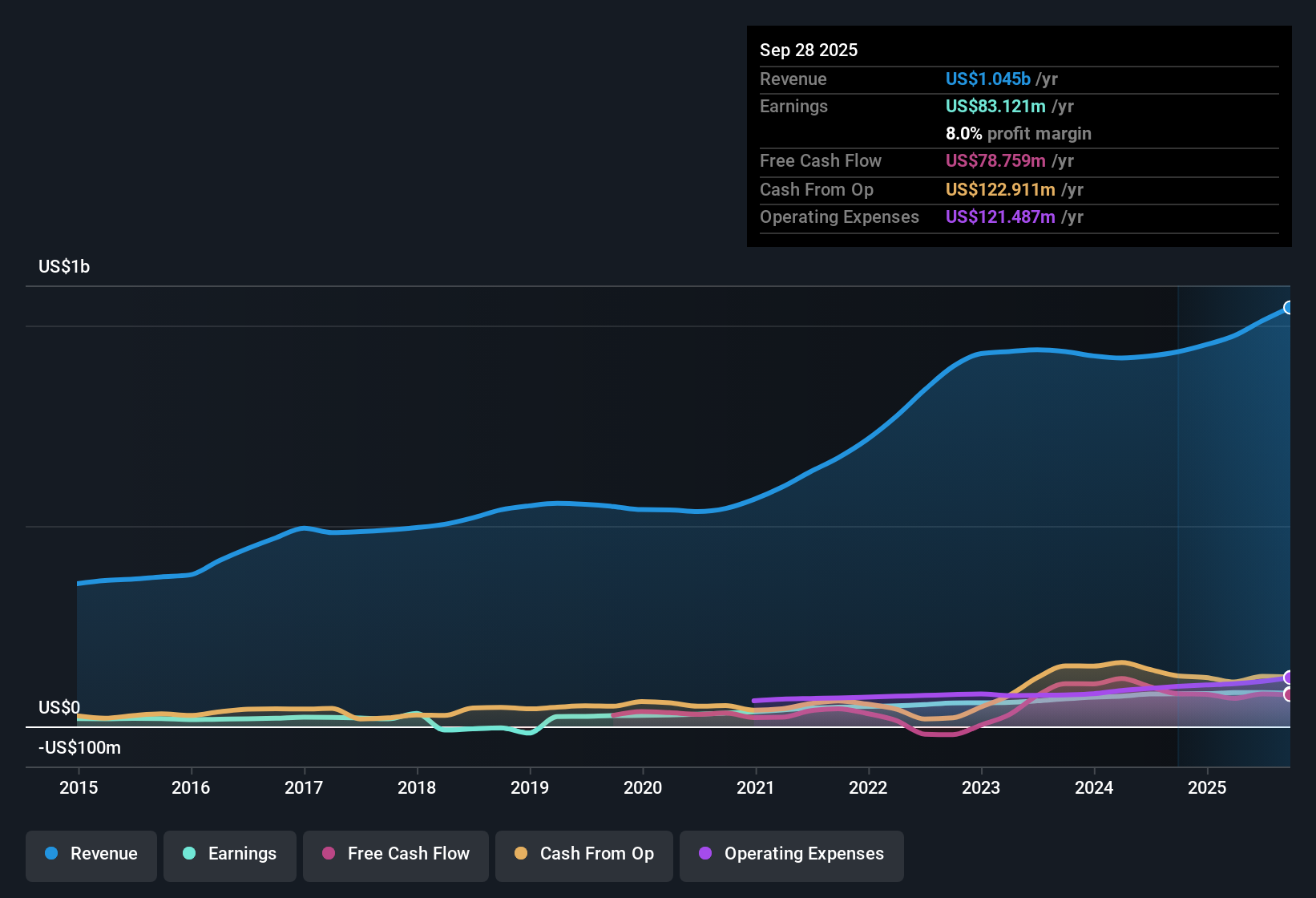

For Hawkins, the current Free Cash Flow stands at $75.1 Million. Analysts have projected steady growth, estimating Free Cash Flow to reach $97 Million by 2028. Beyond this point, further ten-year projections, extrapolated by Simply Wall St, suggest incremental increases based on industry trends and recent performance. The model incorporates gradual annual growth rates.

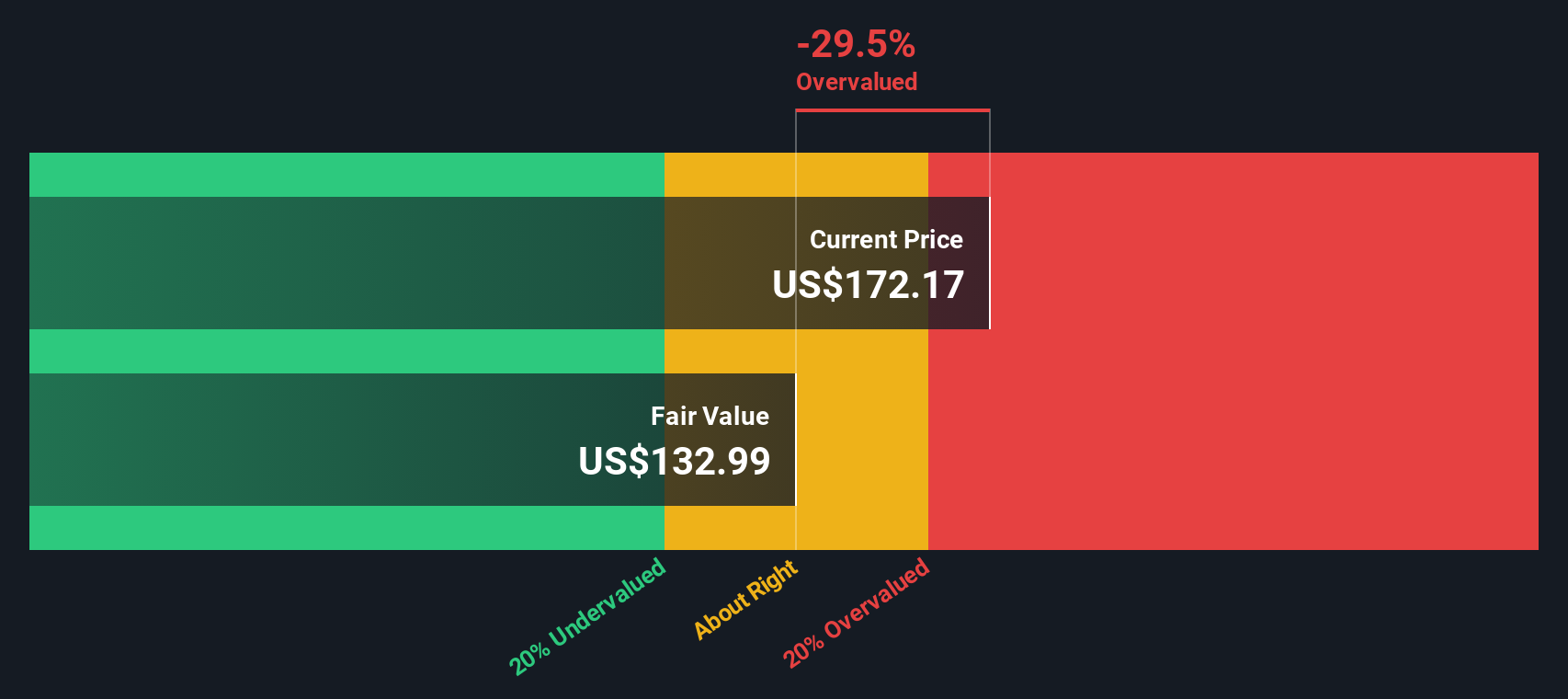

According to the DCF model, the estimated intrinsic value of Hawkins shares is $98.54. When compared to the current market price, the calculations reveal the stock is trading at a 33.0% premium to intrinsic value. In other words, Hawkins appears overvalued based on this method, indicating the recent price may reflect overly optimistic expectations for future growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hawkins may be overvalued by 33.0%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hawkins Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a relevant valuation tool for profitable companies, as it directly links the share price to per-share earnings. This metric is particularly useful for evaluating businesses like Hawkins that consistently generate profits, offering investors an accessible gauge of value for each dollar earned.

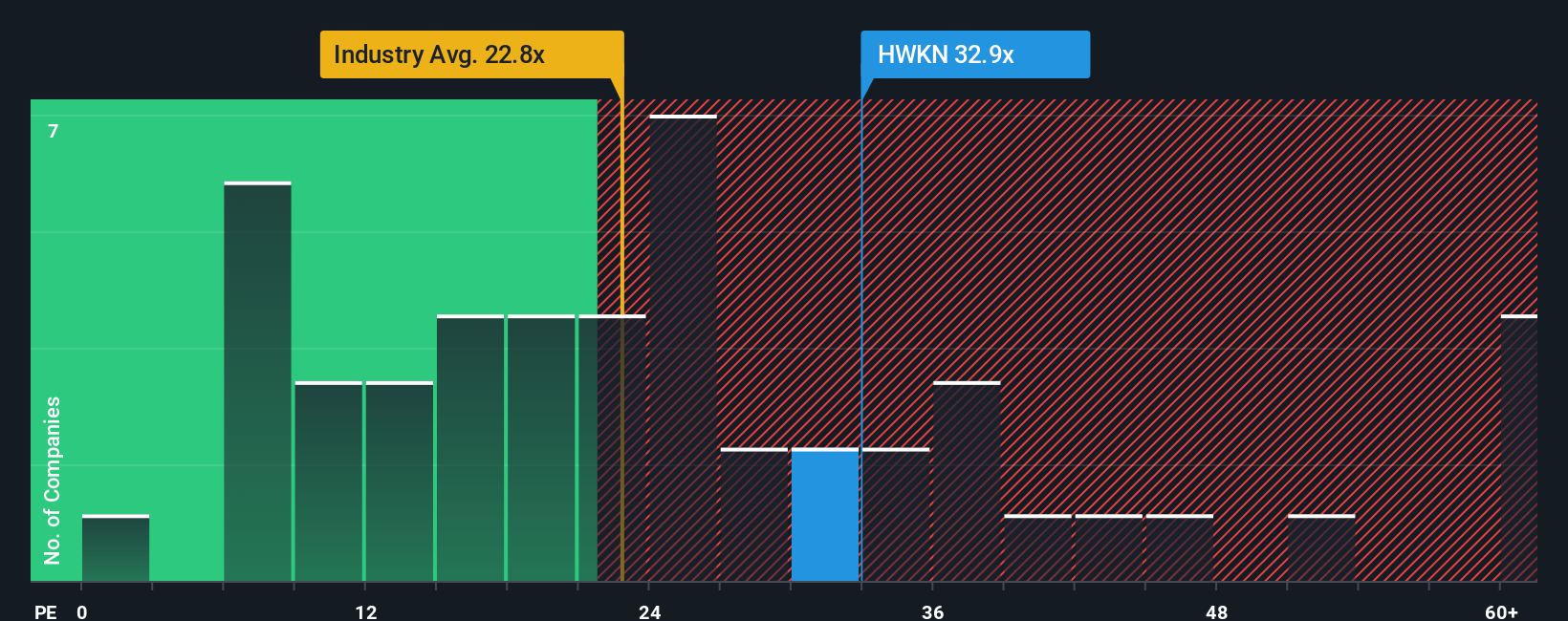

The level at which a PE ratio is considered “normal” or “fair” depends largely on growth expectations and the risks the company faces. Growing companies or those in stable industries can command higher multiples, while lagging growth or heightened risks often justify lower ratios. With Hawkins currently sporting a PE ratio of 32.93x, it stands noticeably above both the chemicals industry average of 22.76x and its peer average of 26.11x.

Simply Wall St's proprietary “Fair Ratio” concept enhances typical valuation benchmarking by considering Hawkins’ specific earnings growth rate, margins, industry category, market cap, and risk profile. In this case, Hawkins' Fair Ratio is 16.17x, which is a tailored figure that digs deeper than simple peer or industry comparisons. This metric enables investors to judge value relative to company-specific fundamentals rather than relying solely on broad averages.

With a current PE ratio of 32.93x compared to a Fair Ratio of 16.17x, Hawkins appears to be valued well above what its fundamentals would justify based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hawkins Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way to connect your perspective on Hawkins’ future with the numbers. It's your personalized story that ties together assumptions about fair value, future revenue, earnings, and profit margins.

Rather than relying solely on static metrics, Narratives connect the company’s evolving story to updated financial forecasts and a live fair value estimate. Narratives are easy to use and available right now on Simply Wall St’s Community page, where millions of investors build, share, and compare their views.

This approach helps investors decide if Hawkins aligns with their own fair value estimate by comparing it to the latest market price. Narratives dynamically update when fresh news, events, or earnings are released, so your view always reflects the most current information.

For example, one investor may see Hawkins’ growth potential and assign a high fair value. Another, more cautious user could form a much lower estimate based on different expectations about earnings or risks. Narratives make it easy to see and compare all these viewpoints at a glance.

Do you think there's more to the story for Hawkins? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hawkins might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HWKN

Hawkins

Operates as a water treatment and specialty ingredients company in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success