- United States

- /

- Chemicals

- /

- NasdaqGS:BIOX

Bioceres Crop Solutions Corp.'s (NASDAQ:BIOX) Popularity With Investors Is Clear

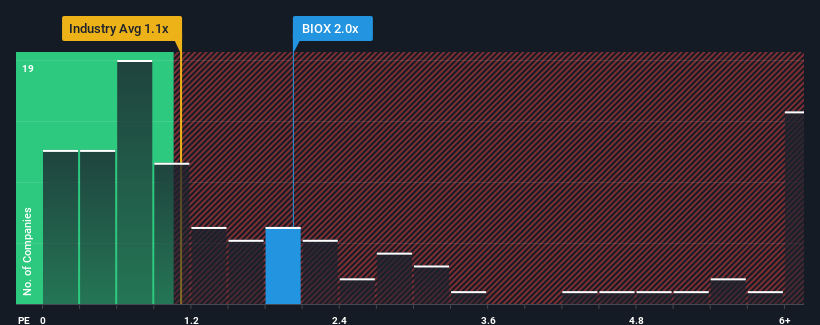

Bioceres Crop Solutions Corp.'s (NASDAQ:BIOX) price-to-sales (or "P/S") ratio of 2x may not look like an appealing investment opportunity when you consider close to half the companies in the Chemicals industry in the United States have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Bioceres Crop Solutions

How Has Bioceres Crop Solutions Performed Recently?

With revenue growth that's superior to most other companies of late, Bioceres Crop Solutions has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bioceres Crop Solutions.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Bioceres Crop Solutions would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 139% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 22% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 14% per year, which is noticeably less attractive.

In light of this, it's understandable that Bioceres Crop Solutions' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Bioceres Crop Solutions' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Bioceres Crop Solutions' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Bioceres Crop Solutions.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bioceres Crop Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BIOX

Bioceres Crop Solutions

Develops and commercializes crop productivity solutions.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026