- United States

- /

- Metals and Mining

- /

- NasdaqGS:AUGO

How Aura Minerals’ (AUGO) Return to Profitability Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

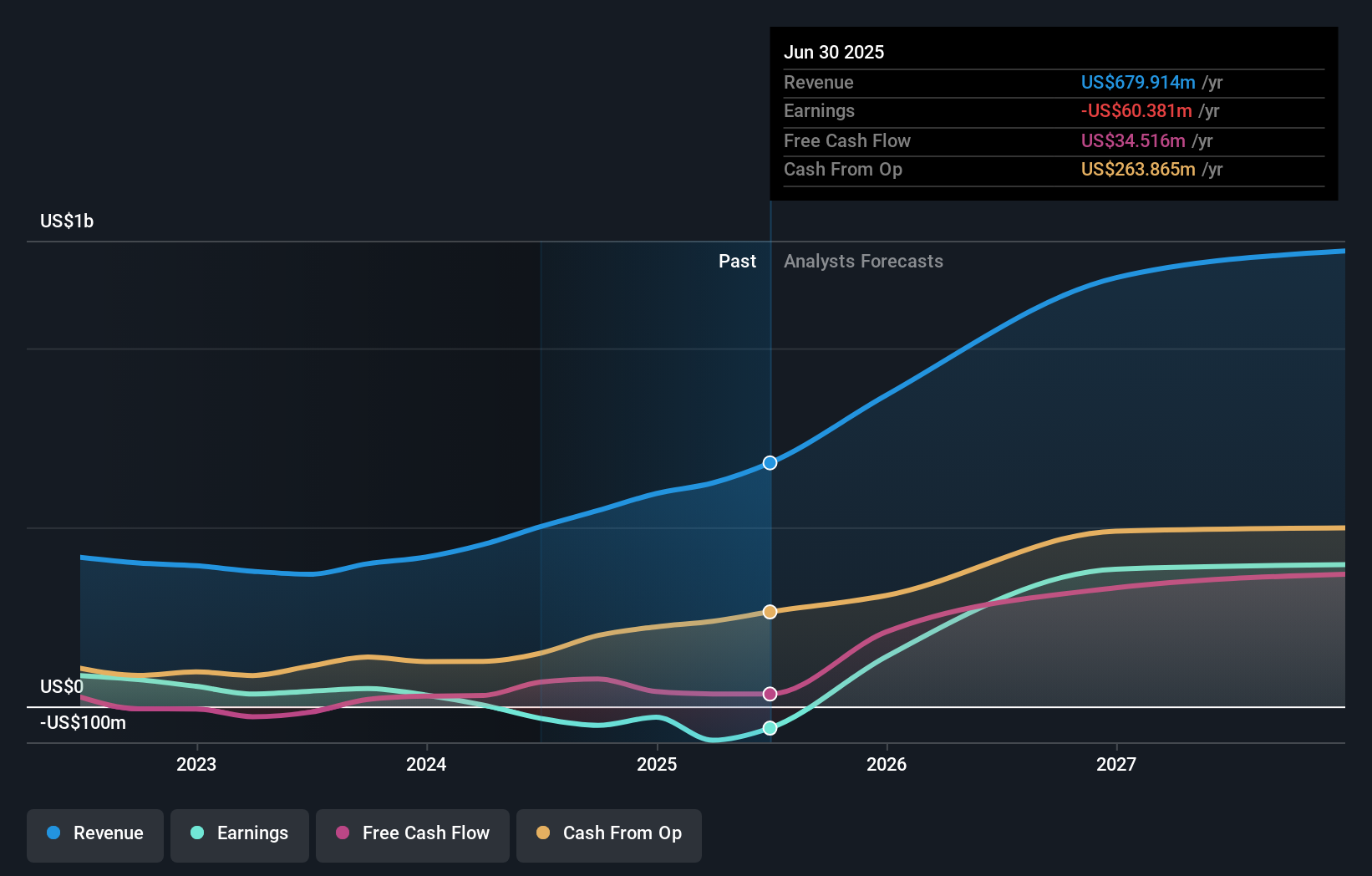

- Aura Minerals Inc. announced third quarter 2025 results, reporting sales of US$247.83 million and a net income of US$5.63 million, marking a shift from a net loss in the same period last year.

- This quarterly profit, driven by increased sales, stands out sharply against losses recorded for the nine-month period, highlighting a significant operational turnaround.

- We'll now examine how this return to quarterly profitability shapes Aura Minerals' investment narrative moving forward.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Aura Minerals' Investment Narrative?

Anyone considering Aura Minerals today needs to believe in the company’s ability to both deliver consistent profits and manage the swings of a cyclical, capital-intensive mining business. The latest quarterly results hint at a shift in momentum, with the first instance of net profitability after a period of mounting losses, thanks to strong sales and the ramp-up of the Borborema Gold Project. This return to positive earnings could reframe the short-term investment narrative by supporting analyst forecasts for a resolute turnaround and helping Aura maintain its inclusion in key mining indices. However, despite this progress, some risks remain, such as high leverage, limited board refreshment, and previous dilution of shareholders. The sustainability of recent gains and dividend payments will often come down to cost controls and commodity price volatility. If Aura sustains operational improvements, those watching for ongoing debt pressure or dividend safety might adjust their risk outlooks. But even with this profitable quarter, Aura’s high debt levels remain an important consideration investors need to keep in mind.

Aura Minerals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Aura Minerals - why the stock might be worth over 3x more than the current price!

Build Your Own Aura Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aura Minerals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aura Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aura Minerals' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUGO

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives