- United States

- /

- Metals and Mining

- /

- NasdaqGS:AUGO

Aura Minerals (NasdaqGS:AUGO) Losses Widen 56.9% Annually as Dividend Sustainability Questioned

Reviewed by Simply Wall St

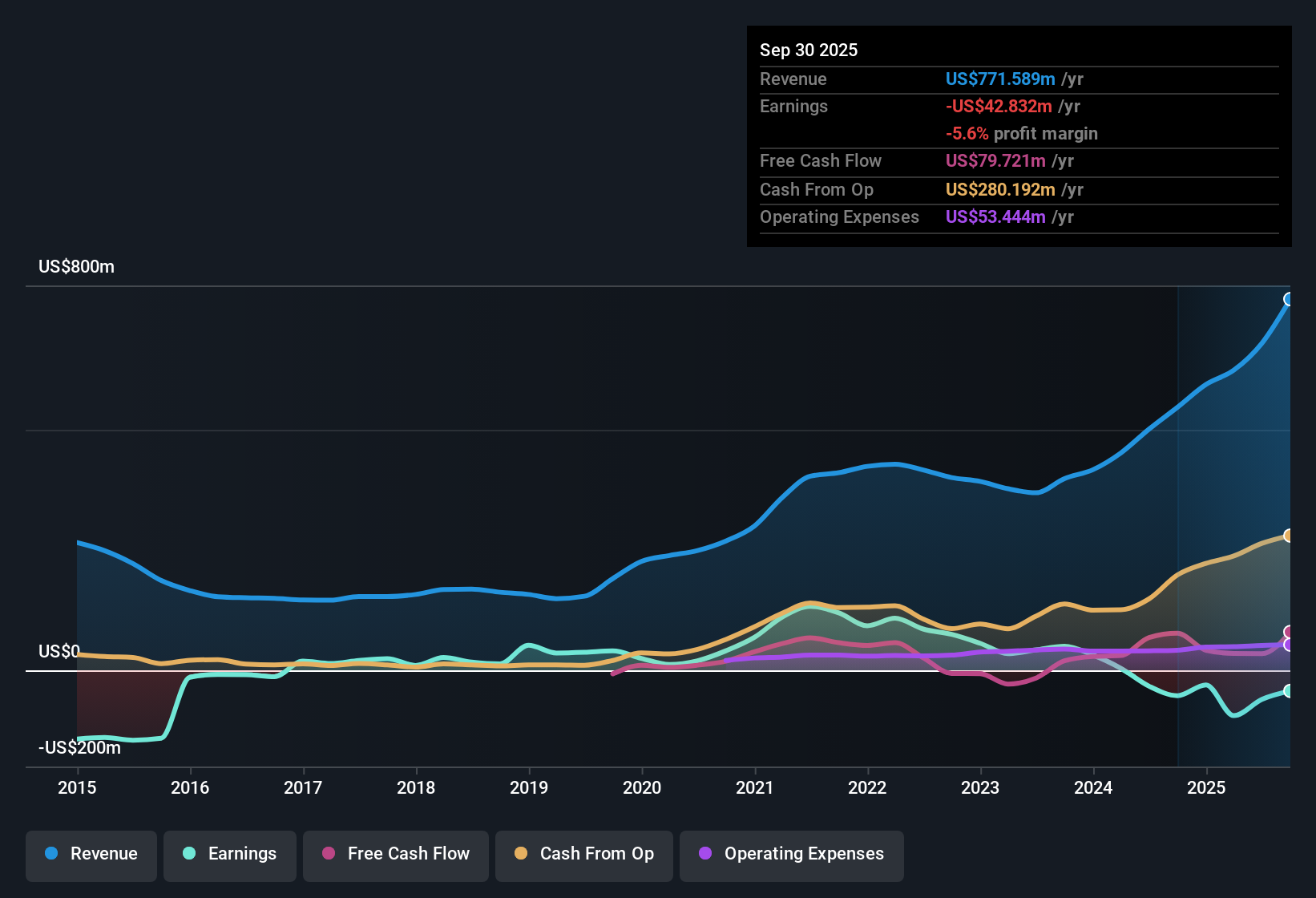

Aura Minerals (NasdaqGS:AUGO) remains unprofitable, with losses having widened at an annual rate of 56.9% over the past five years. The company’s revenue is forecast to grow at 5.4% per year, trailing the pace of the US market. Earnings are projected to climb by 19.67% per year, and a return to profitability is expected within the next three years. Despite a net profit margin that continues to lag due to ongoing losses, shares currently trade at $33.81, significantly below the estimated fair value of $117.31 as calculated using a discounted cash flow model.

See our full analysis for Aura Minerals.Now, let’s see how Aura Minerals’ results compare with the market’s prevailing stories and the expectations that shape investor sentiment.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Turnaround Expected by Year Three

- Despite ongoing unprofitability, Aura Minerals is forecast to transition to profitability within the next three years, outpacing the broader market’s timeline for similar recoveries.

- This supports the argument that this operational shift could reposition Aura as a turnaround story, especially as consensus projects annual earnings growth of 19.67%.

- This growth projection stands out compared to revenue growth of only 5.4% per year, highlighting efficiency improvements rather than just top-line expansion.

- With sector sentiment stabilized by steady company updates, the market is likely waiting to see consistent profit momentum as the main catalyst for a re-rating.

Dividend Appears Stretched Amid Ongoing Losses

- The company’s dividend may not be sustainable, given recurring net losses and a net profit margin that remains negative according to recent filings.

- Critics highlight that distributing cash while still posting annual losses puts pressure on financial flexibility, especially as equity dilution has occurred over the past year.

- This risk undermines the appeal of current dividend payouts since future reductions are more likely if profitability does not materialize as projected.

- With ongoing unprofitability, the debate continues around whether capital should be preserved to avoid further dilution or support business stability.

Shares Trade at Discounted Price-to-Sales

- Aura trades at a Price-To-Sales ratio of 4.2x, which sits below the peer average of 4.9x but above the US Metals and Mining industry standard of 2.7x.

- The prevailing market view points to shares trading at $33.81, well below the DCF fair value of $117.31, suggesting investors may be waiting for stronger profitability evidence before closing this valuation gap.

- This sizable discount reflects the market’s caution in pricing in the company’s anticipated operational improvements without visible follow-through.

- Compared to sector multiples, Aura’s current valuation offers potential upside, but underperformance on margins and past dilution keep sentiment measured.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aura Minerals's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Aura Minerals faces profitability challenges and pays a dividend despite recurring losses and recent dilution. This raises questions about future payout sustainability and financial flexibility.

If reliable income matters to you, search with these 1970 dividend stocks with yields > 3% to focus on companies offering dividends backed by steady profits and healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUGO

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

Reasonable growth potential and fair value.

Market Insights

Community Narratives