- United States

- /

- Insurance

- /

- NYSE:WRB

A Fresh Perspective on W. R. Berkley (WRB) Valuation After Strong Recent Returns

Reviewed by Simply Wall St

See our latest analysis for W. R. Berkley.

Momentum is clearly building for W. R. Berkley, with a 1.03% one-day share price gain and a robust 34.63% year-to-date price return showing renewed investor confidence. Over the long term, the insurance giant has delivered an impressive 203.11% total shareholder return over five years, making its outperformance tough to ignore.

If you’re interested in what other companies are demonstrating strong momentum, it could be the right moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares running ahead of analyst price targets and solid gains already delivered, the big question is whether W. R. Berkley remains undervalued, or if the market is already pricing in all future growth potential.

Most Popular Narrative: 5.3% Overvalued

According to the narrative’s fair value, W. R. Berkley’s recent close exceeds the analyst consensus price target, highlighting a premium in how the stock is currently trading. This points to tensions in expectations as investors weigh recent performance against forward-looking valuation frameworks.

“Prudent capital management, shown by a growing investment portfolio benefitting from higher new money yields and conservative reserving, is increasing investment income and book value per share. This lays a foundation for higher long-term earnings and the potential for resumed share buybacks.”

Want to know what’s fueling the company’s high valuation? The narrative’s fair value hinges on projected improvements in margins and profit multiples that challenge industry norms. Curious which bold assumptions and growth levers the analysts are betting on? Dive in to see what could push this stock even higher or spell a reversal.

Result: Fair Value of $74.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and rising competition could quickly alter the outlook and push analysts to reassess fair value for W. R. Berkley.

Find out about the key risks to this W. R. Berkley narrative.

Another View: Discounted Cash Flow Sheds New Light

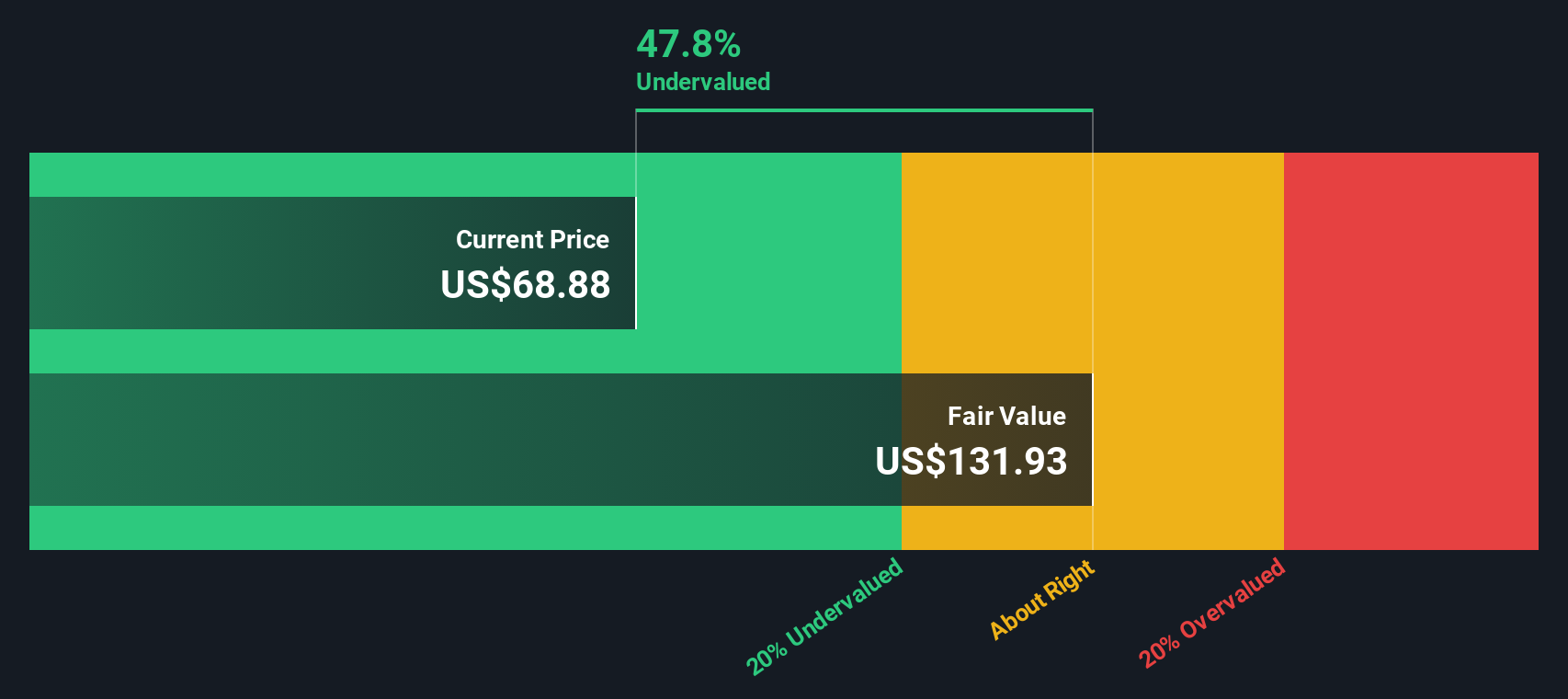

While the consensus price target values W. R. Berkley above fair value, our SWS DCF model offers a very different perspective, suggesting the stock is actually trading at a hefty 34% discount to its intrinsic value. Could the market be missing the company’s long-term cash generation story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out W. R. Berkley for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own W. R. Berkley Narrative

If you have your own perspective on W. R. Berkley’s story or want to dig into the numbers yourself, starting your own narrative takes just a few minutes. Do it your way

A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Why limit your potential to just one story? With Simply Wall Street’s Screener, you can pinpoint exciting stocks poised to outperform and unlock new possibilities for your portfolio.

- Tap into future-defining tech by scanning these 26 AI penny stocks, which are shaping advances in artificial intelligence and automation across industries.

- Capture steady income with these 16 dividend stocks with yields > 3%, which offer attractive yields above 3% and reward patient investors year after year.

- Catch tomorrow's breakthroughs early by targeting these 26 quantum computing stocks at the forefront of quantum computing innovation and disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives