- United States

- /

- Insurance

- /

- NYSE:TRV

Will a Revenue and Earnings Beat Shift the Narrative for Travelers Companies (TRV)?

Reviewed by Sasha Jovanovic

- Earlier this week, Travelers Companies reported quarterly revenues of US$12.44 billion, representing a 4.5% increase year-over-year and exceeding analyst forecasts, while earnings per share also came in ahead of expectations.

- An interesting detail is that, despite this earnings and revenue beat, the company missed analysts’ book value per share estimates, reflecting a mixed but generally positive quarter.

- To understand the implications of this earnings beat, we’ll explore how outpacing revenue expectations may impact Travelers’ future earnings narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Travelers Companies Investment Narrative Recap

To be a shareholder in Travelers Companies, you need to believe that the firm's disciplined underwriting, investment in analytics, and capital management can offset industry headwinds like weather-related losses and social inflation. This recent earnings beat and revenue growth may support confidence in these strengths, but the book value per share miss suggests that key risks, specifically, volatility in claims costs, remain present and unchanged in the near term. Overall, the latest results do not materially change the most important short-term catalyst or the central risk for the business.

Among recent announcements, Travelers' ongoing share buybacks are particularly relevant in the context of the recent earnings, as the company repurchased roughly 2.3 million shares for US$625 million in Q3 2025. This capital return to shareholders aligns with management’s long-standing pattern, but investors should keep in mind that buybacks cannot fully insulate the business from sector risks or adverse loss trends.

In contrast, what investors should not lose sight of is the escalating impact of climate-related catastrophe losses and how...

Read the full narrative on Travelers Companies (it's free!)

Travelers Companies is projected to reach $49.1 billion in revenue and $5.0 billion in earnings by 2028. This outlook assumes a 0.9% annual decline in revenue and a decrease in earnings of $0.2 billion from current earnings of $5.2 billion.

Uncover how Travelers Companies' forecasts yield a $295.60 fair value, a 3% upside to its current price.

Exploring Other Perspectives

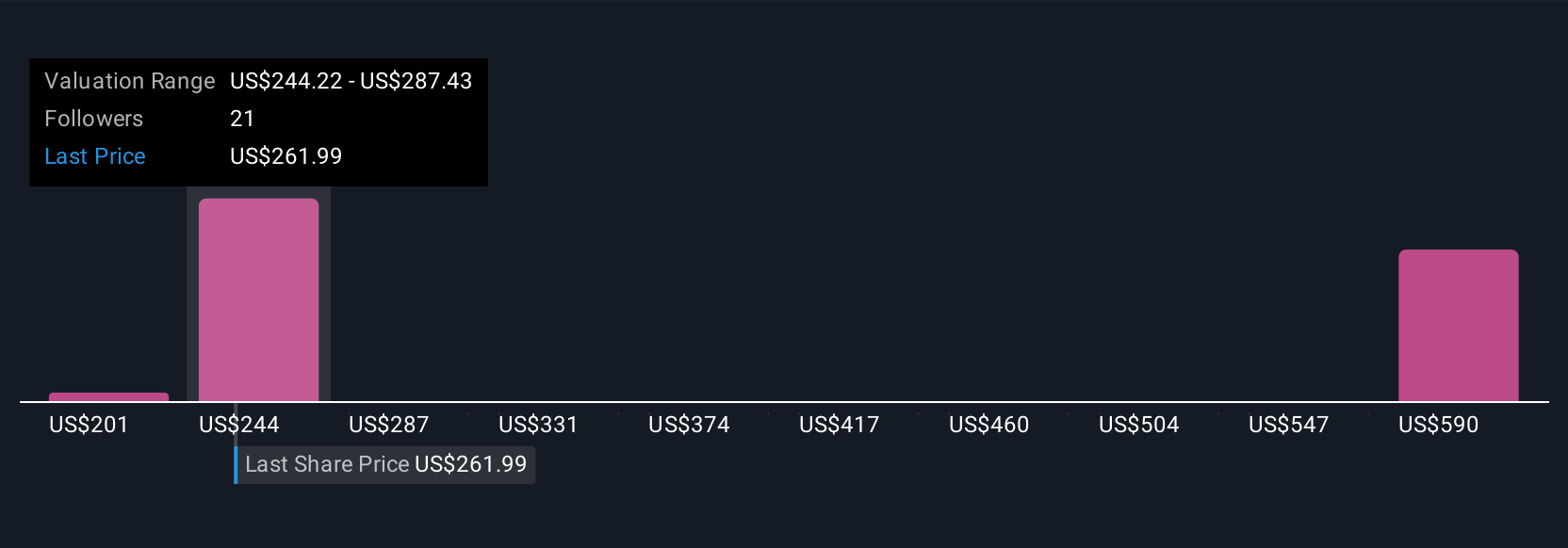

Simply Wall St Community members offered fair value estimates for Travelers ranging from US$228.84 to US$617.19 across four analyses. While some see significant undervaluation, others focus on risks like persistent weather volatility, reminding you that market outlooks can vary widely.

Explore 4 other fair value estimates on Travelers Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Travelers Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travelers Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Travelers Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travelers Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travelers Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRV

Travelers Companies

Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives