- United States

- /

- Insurance

- /

- NYSE:TRV

Travelers Rises 15% in 2025 as Digital Strategy Sparks Fresh Valuation Debate

Reviewed by Bailey Pemberton

- Wondering if Travelers Companies stock is offering real value right now? You are not alone, and unpacking the facts can reveal surprising opportunities for savvy investors.

- The stock has climbed 3.4% in the last week and remains up 15.1% so far this year. This hints at growing optimism but also raises the question of whether market enthusiasm is justified.

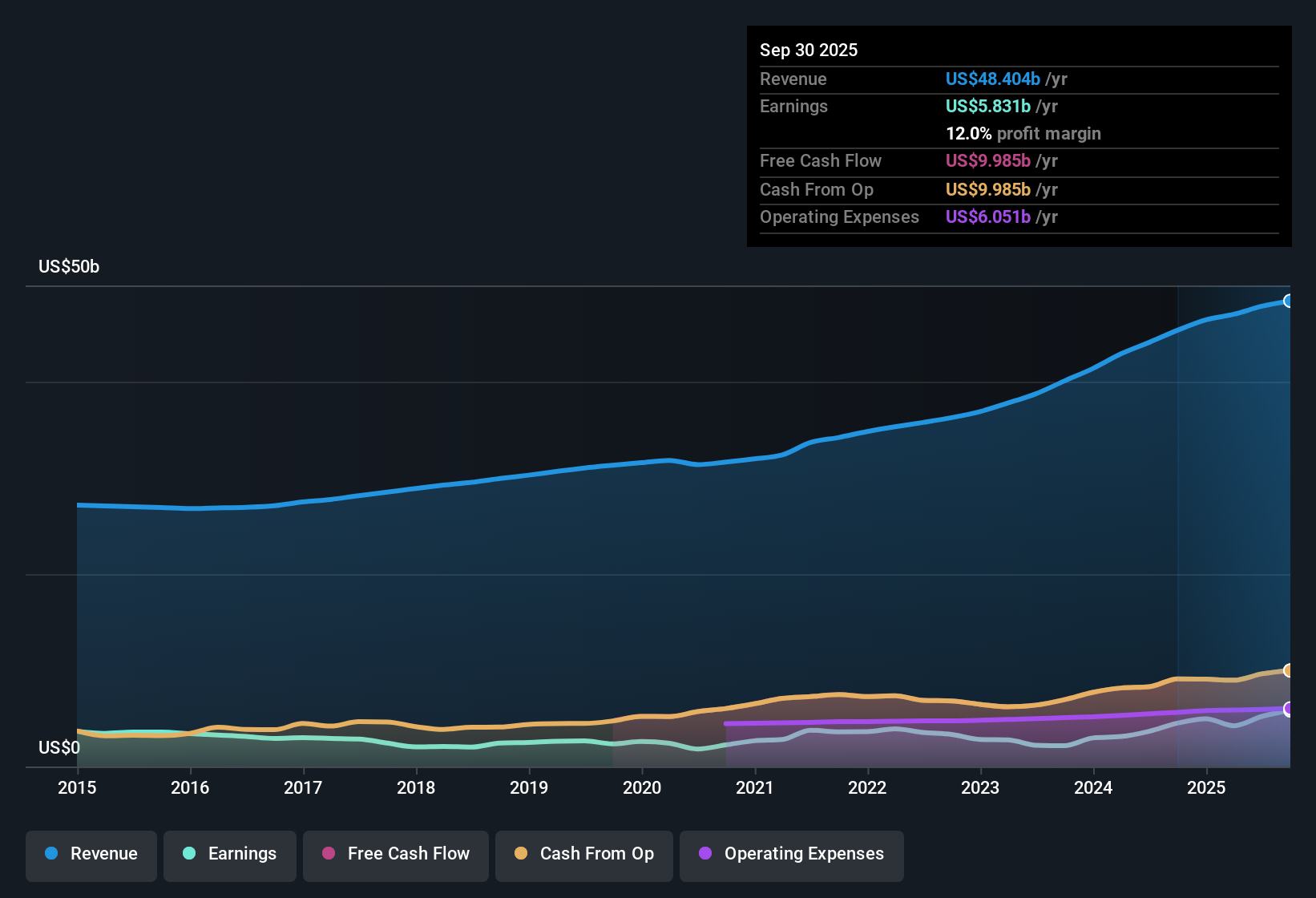

- Beyond the numbers, Travelers has recently been in the spotlight for expanding its specialty insurance offerings and investing in digital innovation. These moves are being closely watched as signals of its future trajectory. Headlines are focusing on how these strategies might impact competitiveness in the insurance sector and possibly the company’s risk profile moving forward.

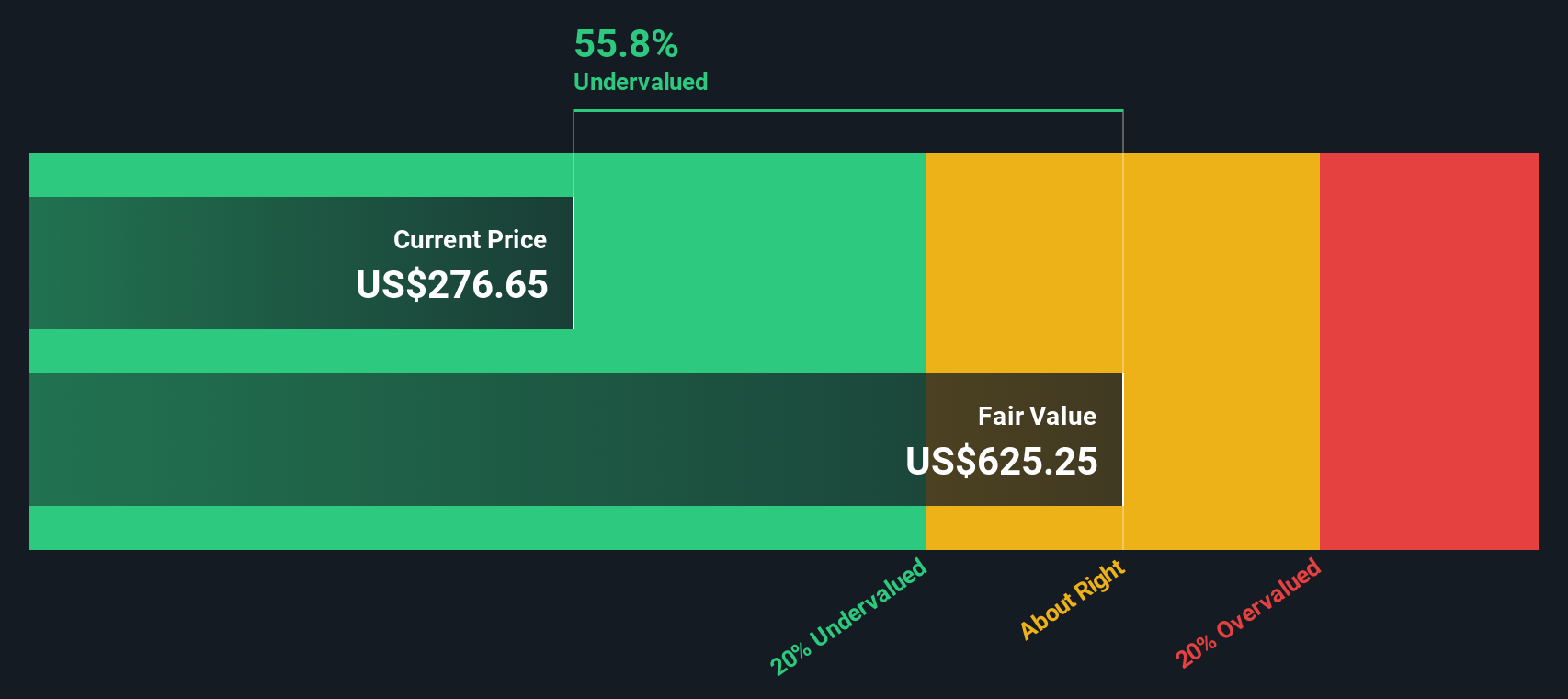

- On the valuation front, Travelers Companies scores a 5 out of 6 for being undervalued across our key checks, placing it well above most peers. Next, let’s break down how we reach that score using different valuation approaches. You may find that a better way to judge value is waiting at the end of this article.

Approach 1: Travelers Companies Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic value by evaluating how much profit it generates above its cost of equity. In short, this approach measures how well it creates value for shareholders beyond the minimum return required by investors. This method is particularly suitable for financial companies like Travelers Companies, as it focuses on the efficiency and profitability of the equity invested.

For Travelers Companies, analysts' consensus data highlights several key strengths:

- Book Value: $141.74 per share

- Stable EPS: $28.20 per share (Source: Weighted future Return on Equity estimates from 12 analysts.)

- Cost of Equity: $11.20 per share

- Excess Return: $17.00 per share

- Average Return on Equity: 17.06%

- Stable Book Value: $165.31 per share (Source: Weighted future Book Value estimates from 12 analysts.)

The model's calculation suggests Travelers is generating strong excess returns above what investors demand. This is a sign of healthy, value-creative growth. According to this method, the intrinsic value for Travelers is approximately 55.7% above the current share price, signaling a significant undervaluation in the market right now.

Result: UNDERVALUED

Our Excess Returns analysis suggests Travelers Companies is undervalued by 55.7%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Travelers Companies Price vs Earnings

For companies like Travelers that consistently generate profits, the price-to-earnings (PE) ratio is a reliable way to gauge valuation. The PE ratio provides a transparent look at how much investors are willing to pay for each dollar of earnings, which helps to quickly compare profitability, growth expectations, and perceived risk across the sector.

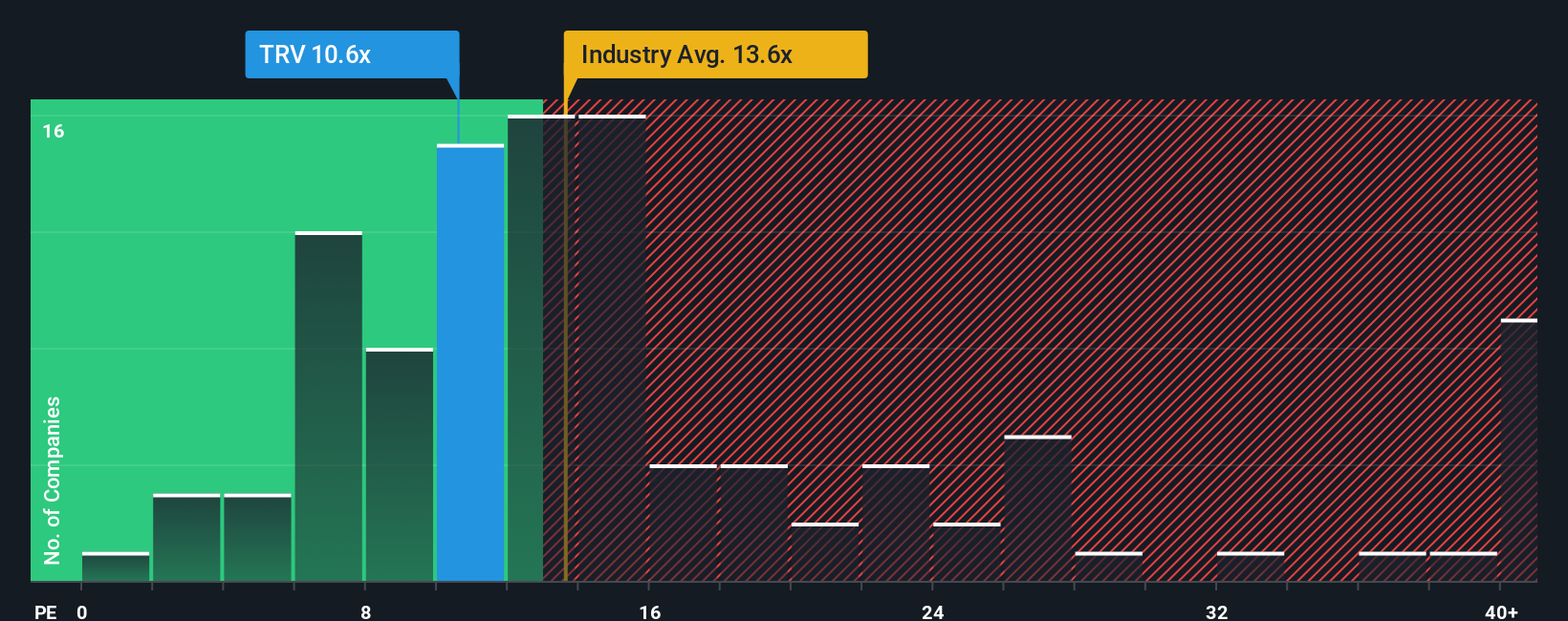

It's important to remember that a "fair" PE ratio is not one-size-fits-all. Faster growth and lower risk typically justify a higher PE, while slower growth or greater uncertainties call for a lower multiple. This puts Travelers Companies' current PE ratio of 10.6x in perspective when stacked against the insurance industry average of 13.7x and its peer average of 11.4x. At first glance, Travelers appears modestly valued relative to these benchmarks.

However, Simply Wall St's proprietary Fair Ratio offers a more complete picture. This metric, at 11.1x for Travelers, goes beyond basic peer comparisons. It weighs the company’s growth outlook, risk profile, profit margins, market capitalization, and specific industry dynamics to determine an individualized fair valuation multiple. This approach delivers a more tailored and insightful benchmark than broad industry or peer averages by factoring in real company-specific characteristics.

With Travelers’ actual PE ratio of 10.6x sitting just slightly below its Fair Ratio of 11.1x, the stock is trading at a level that is about right for its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Travelers Companies Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, interactive way to define your personal story and outlook for Travelers Companies by connecting your assumptions, such as fair value, expected revenue, or margin growth, to an actual financial forecast and a resulting fair value estimate.

Your Narrative brings the numbers to life by linking what you believe about a company’s future with what that outlook means for its share price. On Simply Wall St's Community page, millions of investors can easily create, share, or update their Narratives, tracking how changing news or earnings reports automatically refresh key calculations.

By building your own Narrative, you can compare your fair value against the current price to decide if it is the right time to buy, hold, or sell, bringing confidence and clarity to your investment choices. For example, with Travelers Companies, one investor might project a fair value as high as $320, expecting robust underwriting performance and effective share buybacks, while another might see just $233 due to concerns over weather risk and profit margins. This demonstrates how Narratives surface the full range of perspectives driving real-world decisions.

Do you think there's more to the story for Travelers Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travelers Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRV

Travelers Companies

Through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives